Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Media Briefing: Publishers’ H1 pulse check on ad spend in digital media

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

Market check

About a year ago, advertiser categories like technology, finance, insurance and retail were decidedly not spending very much with digital publishers. In the first half of this year, however, publishers say there’s been a rebound – though not quite a full blown return.

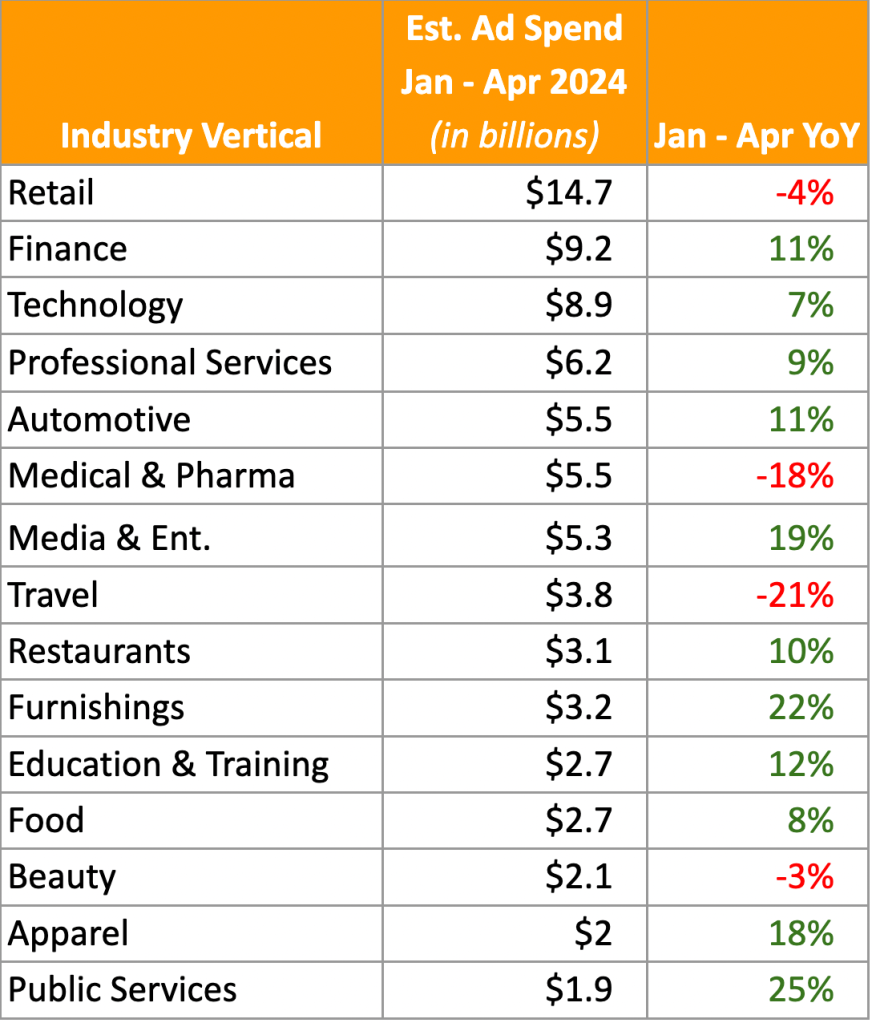

In general, publishers reported an uptick in digital advertising revenue during the first quarter of the year — a good sign considering how tumultuous the ad market was in 2023. They also reported that this growth is expected to persist into the second quarter. According to data from MediaRadar shared with Digiday, digital ad spend in the U.S. exceeded $52.8 million in the first four months of 2024, up 7% year over year.

But while tech seems to have made a recovery as an ad category, finance is more so par for the course for this time of year. Meanwhile, publishers are reporting promising signs from retail and healthcare and pharma.

Here’s a breakdown of which advertising categories are spending, or are semi-spending, with publishers so far in 2024.

Back in action

- Technology

The purging of excess that the tech category underwent at the beginning of 2023 seemed to include the ad budgets typically allocated to digital publishers, but a year or so later, those dollars seem to be returning to digital media.

The Atlantic’s publisher and CRO, Alice McKown, attributed this category’s interest in branded content as part of its growth in ad revenue in the first half of this year. One news publishing exec, who spoke on the condition of anonymity, also called out tech as having a comeback moment in the beginning of 2024.

Shae Carroll, vp of social sales at Forbes, said big tech advertisers and software-as-a-service clients are pacing up their interest in social video offerings this year.

But a notable trend within this category, according to a few publishers, is professional leadership around AI advancement, which is steering a significant amount of conversations with tech clients.

“The biggest tech partners out there are coming to us to tell their stories both about the impacts of AI and society or telling their story of how their AI product is unique … And that’s been a real driver of growth from a branded content standpoint,” said McKown.

IAC’s first quarter earnings, published earlier this month, reported that Dotdash Meredith’s 19% year over year increase in digital ad revenue came from higher premium sold ads driven primarily in the tech, beauty and health and pharma categories.

MediaRadar data showed that U.S. ad spend in the tech category was up 7% in the period of January to April 2024 compared to the same period in 2023. This category spent approximately $8.9 billion on ads in the first four months of the year.

- Healthcare and pharma

As stated above, Dotdash Meredith called out this category as a growth contributor in the first quarter of 2024 and the publisher is not alone.

McKown said that The Atlantic’s custom bespoke events business — a renewed offering from 2023 — has been bolstered by interests from healthcare clients this year.

Forbes’ Carroll said that healthcare advertisers are increasingly interested in partnering with the publisher on social video ads, particularly when adjacent to one of Forbes’ franchises like its Healthcare Summit.

MediaRadar’s data tells a different story, however. In the period of January to April 2024, U.S. ad spend within the medical and pharma category decreased 18% year over year, totaling $5.5 billion.

Staying the course

- Finance

Similar to tech, the financial category took a spending hiatus following the crash of the Silicon Valley Bank. And while there’s been a bounce back in tech, publishers say finance is more so even with where they expect it to be this time of year.

“We’ve actually seen relatively even levels … in financial services. It certainly isn’t down the way it was [last year] right. But … we’ve seen fairly even levels across the board,” said Katy Lawrence, Yahoo Finance’s vp of revenue partnerships.

That said, the news publisher remarked that “tax was big for us this year.”

Finance ad spend during the first four months of 2024 was up 11% year over year, totaling approximately $9.2 billion, per MediaRadar data. But it makes sense why publishers aren’t necessarily impressed by the rebound, given how steep of a drop off the category experienced in January 2023 (16% year over year).

- Retail and apparel

While not necessarily down in 2023, retail and apparel is showing positive growth indicators in 2024.

One publishing exec from a digital lifestyle media company said anecdotally that retail has been pacing up year over year, though they declined to share by how much.

Measured separately by MediaRadar, the apparel category (representing about $2 billion in ad spend) was up 18% year over year during the first four months of 2024, while retail (representing $14.7 billion in ad spend) was down 4% in the same period.

- Travel

Travel was a strong category last year and seems to be maintaining that status, according to publishers. MediaRadar data, however, indicates a steep decline after last year’s boom.

McKown said that travel has been a particularly strong client for branded video, and named Visit Seattle as a new client this year.

The digital publisher also said travel remained a strong category this year, coming off of the boom it experienced in 2023, but it was on par with this time of year as people are in the midst of planning their summer travel.

Forbes’ Carroll said that luxury and hospitality were “coming back a bit,” but agreed it was more in line with the regular upticks for this time of year.

MediaRadar data reported a 21% decline in travel ad spend year over year, bringing it to a total of $3.8 billion spent on ads in this category during the first four months of 2024.

What we’ve heard

“The TikTok ban itself is very scary … but that’s why we cross post … Another way that we have really been talking about is just creating an email chain, telling them ‘Hey, we have an email. Subscribe here. Put your email in and anywhere that we go anywhere that we post, you will be notified, whether that’s by email or phone.’”

– Lazara Martin, content creator, on the latest episode of the Digiday Podcast’s creator series.

Penske Media ‘temporarily’ shuts down commerce site Spy

Penske Media “paused operations temporarily” at its product recommendation and men’s lifestyle site, Spy, citing a “strategy reorganization,” according to a company spokesperson.

However, three sources with knowledge of the situation told Digiday that all five full-time staff were let go by the end of last month. Staff were informed that the site was shutting down in mid-April and given until the end of the month to wind down operations. They said this decision was made amid an editorial and business revamp at Spy with the goal to diversify the site’s revenue this year beyond affiliate commerce revenue. For example, they said Spy hired its first art director in February and was rolling out a newsletter-focused strategy.

The Penske Media spokesperson said the company will “continue to ramp [sic] our commerce operations within our core brands.” When asked to confirm how many people were let go and if the reason for the pause was difficulties with Spy’s affiliate business, the spokesperson declined to comment “on personnel matters or business strategy.”

Spy.com had 1 million total U.S. unique visitors in January 2023, compared to 336,000 uniques in January 2024, according to Comscore data. In April 2024 — Comscore’s latest traffic data — Spy.com had just 62,000 uniques, down from 527,000 in April 2023.

One source told Digiday that Spy was dealing with “significant traffic challenges” and stiff competition to grow affiliate revenue. It’s unclear how freelancers were impacted by these changes. As of Wednesday afternoon, Digiday could not identify any stories on the site published since April, though the main story on the homepage shows it was updated on May 21.

Some publishers have been facing affiliate commerce challenges.

In Q1 2024, less than half (45%) of a survey of more than 150 publisher professionals reported that affiliate commerce accounted for at least a very small portion of their revenue. A year before in Q1 2023, that portion was nearly two-thirds (62%), according to a Digiday+ Research survey. And while 70% of publishers said last year that they would put at least a very small focus on growing their affiliate commerce business, 58% said the same this year.

Looking at recent earnings reports from large digital publishers, commerce revenue performance was mixed in the first quarter of this year. While commerce and other revenue was down for BuzzFeed by 9% year over year, it was up 18% year over year for Dotdash Meredith. While The New York Times doesn’t break out affiliate commerce revenue in its earnings report, the company referred to higher affiliate referral revenues from its product recommendation site Wirecutter. – Sara Guaglione

Numbers to know

5: The number of local, nonprofit news outlets that the Associated Press signed new content-sharing deals with ahead of the 2024 election.

$1.5 million: The amount of money that the Daily Beast is hoping to cut from its operating budget via voluntary staff buyouts.

£84.5 million: The amount of money that the London Evening Standard has lost over the past 6 years, leading to the decision to cease its daily print publication and replace it with a weekly.

What we’ve covered

The Trade Desk’s ‘premium internet’ shift stirs concerns among publishers over ad dollar allocation:

- The Trade Desk’s CEO Jeff Green drew a figurative line down the open web and what he calls the “premium internet.”

- Publishers fear that The Trade Desk is preparing to withdraw ad dollars from many of them, interpreting Green’s “premium internet” claim as a signal of this shift.

Read more about why publishers are worried about what this distinction means for their businesses here.

How Time’s collectible covers make the case for a print comeback:

- Time is ramping up its special edition “bookazine” business and collectible covers in order to earn more reader revenue generated from newsstand, retail and direct-to-consumer sales.

- While not a special edition, Time’s recent Person of the Year cover, featuring Taylor Swift, epitomized the power of collectibility with 365% more copies being distributed at retailers than other single issue copies.

See why Time is leaning further into special issue publications here.

Inside The New York Times’ plans to correlate attention levels to other metrics:

- There’s a lot of buzz around attention advertising right now, but The New York Times is trying to stay grounded even as it develops its own plans.

- Those plans include its proprietary attention metric, launched last year, and a recent partnership with measurement firm Adelaide announced last month.

Learn more about the publisher’s plans for measuring attention levels here.

Why publishers are preparing to federate their sites:

- At least two digital media companies are exploring the fediverse as a way to take more control over their referral traffic and onsite audience engagement.

- This comes at a time when walled gardens like Facebook and X are becoming less reliable for driving readers to publishers’ sites.

Read more about The Verge’s and 404 Media’s plans for the fediverse here.

Why publishers fear traffic, ad declines from Google’s AI-generated search results:

- As Google expands its new “AI Overview” feature, publishers are wondering to what degree AI-generated search results will negatively impact referral traffic.

- Following AI Overview’s rollout last week, some think the impact could be even worse than feared.

See why publishers are concerned about further impact to search referral traffic here.

What we’re reading

BuzzFeed’s new activist investor, Vivek Ramaswamy, goes head to head with CEO:

Vivek Ramaswamy, a former GOP presidential candidate, has been buying up shares in BuzzFeed, now equal to a 8.3% stake in the digital media company. But The New York Times reported that the activist investor is hoping to convince BuzzFeed’s Board of Directors and founder and CEO, Jonah Peretti, to change its business practices and journalistic standards — something Peretti rejects.

Sports Illustrated’s new license holder is planning the magazine’s return to print:

Adweek reported that Minute Media — the media company that acquired SI’s licensing rights in March — is planning to bring back the print product in June. The company, which also owns The Players’ Tribune, FanSided and 90min, is also planning to streamline its portfolio to be more centrally focused on Sports Illustrated.

Google’s AI Overview feature is highlighting some questionable answers:

Google launched its AI Overview feature on its search results earlier this month, but users are finding that the tool is generating some interesting — and factually incorrect — answers, including adding glue to pizza sauce to thicken it. According to a report by AV Club, answers also seem to be generated based on headlines from satirical sites like The Onion, rather than credible journalistic content.

Vox Media and The Atlantic are the latest pubs to ink deals with OpenAI:

OpenAI has signed two separate, multi-year deals with Vox Media and The Atlantic, enabling the generative AI technology company to license and use the publishers’ content archives to train its large language models, Axios reported. The terms of the deals were not disclosed.

More in Media

WTF is a creator capital market?

What is a creator capital market, what does it mean for creators looking to diversify revenue, and why is it so closely tied to crypto?

Media Briefing: Publishers explore selling AI visibility know-how to brands

Publishers are seeing an opportunity to sell their AI citation playbooks as a product to brand clients, to monetize their GEO insights.

Creators eye Snapchat as a reliable income alternative to TikTok and YouTube

Figuring out the Snapchat formula has been very lucrative for creators looking for more consistent revenue on a less-saturated platform.