Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

This week’s Media Briefing will explore how a strong Q4 of 2025 gave publishers’ advertising businesses momentum, even as AI and traffic shifts force them to rethink where they can unlock future growth.

- Publishers see Q4 gains, but pressure remains

- The Washington Post’s workforce decimated, IAB proposes law to stop AI scraping without compensation, and more.

- Bloomberg wants its video content to be easier to find and harder to leave. Instead of betting on vertical video feeds to keep audiences engaged, it launched a centralized video hub on Feb. 4 across its website and app as a home for all its video content.

- Bloomberg is using its video archive as an audience engagement and subscriber retention channel. While most of the videos are free to watch, some will be available only to paying Bloomberg subscribers, as the publisher tests video as an added value.

- Microsoft is moving its publisher AI content marketplace pilot beyond the initial pilot phase, laying the groundwork for a broader ecosystem to connect publishers with a growing set of AI builders looking to license premium content.

- Business Insider Inc, Vox Media Inc, USA Today Co., People Inc, The Associated Press, Hearst Magazines and Condé Nast are the first wave of publisher pilot partners.

- The U.S. Justice Department’s ruling against Google for monopolizing digital advertising markets has opened the door for publishers to seek compensation for claimed lost revenue.

- Digiday has compiled a running list of publishers’ lawsuits against Google for its ad tech practices, with dates and their main claims.

- Vibe coding is a new way for creators to build advanced computer programs without knowing how to code.

- Vibe coding has leapt from developer forums into mainstream buzz, making it one of the fastest-growing AI tools for creators today. But what are the benefits, compared to traditional coding?

- The U.K’.s Competition Markets Authority (CMA) has proposed new rules to give publishers more control over how Google uses their content in AI features like its AI Overviews.

- Publishers should be able to opt out of having their material included, and see clearer attribution when their content does appear. Google says it plans to play ball.

Publishers see Q4 gains, but pressure remains

After a long stretch of belt-tightening, Q4, 2025 gave publishers something they haven’t had in a while: a win.

Digital advertising revenue was up for many, buoyed by a more stable economy and advertisers feeling more confident to spend again after months of hesitation. The late-year momentum is carrying over into early-year forecasts, fueling cautious optimism about what 2026 could bring.

But the rebound comes with some notable caveats.

Traffic erosion, a volatile open-web programmatic advertising market, and AI-driven shifts in content discovery mean growth now has to be earned differently. The challenge for publishers is no longer proving reach. As AI reshapes discovery and dollars get harder to win, the pitch to advertisers is shifting from scale to relevance, with a need to show advertisers what makes their content discoverable and worth buying against — and from programmatic dependence to diversified, defensible businesses.

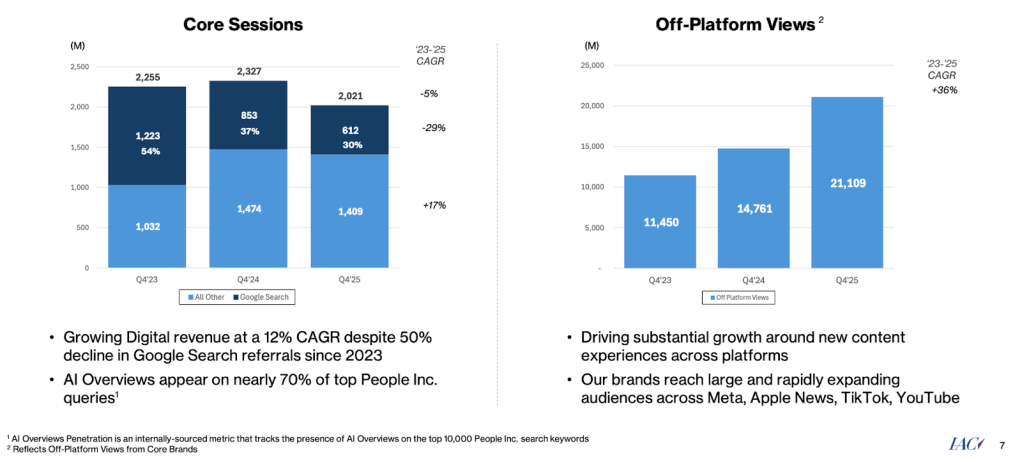

In its earnings call yesterday, People Inc. focused on the growth in revenue not tied directly to web sessions, which are search-reliant. Non-session-based revenue grew 37 percent in Q4 year over year, accounting for 38 percent of total digital revenue. The publisher attributed that growth to its events business, creator and social revenue models, and its partnership with Apple News, along with AI licensing deals (which it has with OpenAI, Microsoft and Meta). Meanwhile, session-based revenue grew only 4% year over year, although it still accounts for 62 percent of total digital revenue.

Amid a flood of fiscal data for the quarter, one figure quietly stood out: Google AI Overviews appear on 70 percent of top People Inc. queries.

However, People Inc. remains bullish on its longstanding strategy to wean itself off dependency on Google search – a plan that’s at least two years in the making. CEO Neil Vogel singled out People Inc’s fashion title InStyle’s breakout social video franchise “The Intern,” – launched last February and now in its seventh season – as a major growth driver, with advertisers willing to pay between $500,000 and $700,000 to sponsor the show, which costs next to nothing to produce.

“This is the model for our future, strong growth from non-session-based revenue streams led by our growth on all platform audiences and [in-house contextual ad tech platform] D/Cipher and executing against our session-based businesses, while absorbing continued declines in referral traffic from Google and other platforms,” said Vogel in the earnings call. “We’re super proud of this quarter.”

Display ad growth is a mixed bag

Last quarter, digital ad revenue performed surprisingly well for some publishers, given the industry consensus that open-web display advertising is shrinking. That was reflected in conversations Digiday had with eight publishers over the last few weeks, including Axios, Forbes, Recurrent, Vox Media and The Wall Street Journal — and mirrored in this week’s earnings calls from some of the biggest publishers.

Even subscriptions juggernaut The New York Times touted its digital ad growth, which spiked 25 percent in Q4 to $147.2 million (and 20 percent in 2025 overall, to $410.6 million), crossing $2 billion in total digital revenue for the first time. In its earnings call yesterday, the publisher cited increased marketer demand, new ad supply and improved monetization of its existing ad inventory, due to better ad performance and targeting as the drivers. A recent push to increase video production is a prime example, providing fresh ad inventory and new channels to monetize audience engagement.

“We can do bigger deals with the marketers we already work with, because there’s more to offer … We appeal to more marketers because we’re now at scale in multiple spaces that are very appealing to marketers,” such as games, sports, cooking and shopping, said The Times’ CEO Meredith Kopit-Levien in the earnings call.

Meanwhile, Forbes grew total revenue by double digit percentages, which it attributed to increases in its direct digital ad sales, live events and content businesses, according to Leann Bonanno, chief sales and marketing officer. Bonanno told Digiday the company is pacing to achieve over 150 percent of its goal for its direct digital and content businesses, but declined to provide specifics.

Axios CRO Jacquleyn Cameron said it was the “strongest” Q4 revenue performance for the company (Axios only sells direct sponsorship advertising). The digital publisher’s live events revenue grew 26 percent year over year in 2025, according to Cameron, who declined to provide revenue figures.

While execs at Forbes, Recurrent and Vox Media touted growth in events sponsorships, direct deals and video, the programmatic ad business suffered in 2025, due largely to the challenging search referral environment. Q4 was a soft quarter compared to the prior year’s quarter, due to supply and pricing lacking the boost that came from major events like the U.S. presidential election, which drove up programmatic ad demand, per data shared exclusively with Digiday by agentic media platform MediaMint, which tracks billions of impressions across the web. The number of ad requests fell 12 percent, and CPMs were lower across the board during the quarter.

“The traffic decline – obviously that hurts our programmatic business,” said Bonanno. “That’s really why we are focused on, what are the tools on Forbes that create that loyalty and that engagement? And that way to kind of bring audiences back.” She noted that the company’s growth is being supported by multiple strong business lines beyond digital, whose results are already tracking ahead for Q1 ’26 forecast.

Naturally, those more reliant on Google search for traffic were bitten hard by the decline in referrals, which occurred last year. The Daily Mail and General TRUST (DMGT) revealed that digital advertising revenue dropped 15 percent throughout 2025, in its annual report released this week (whose fiscal year goes through September 2025). While the company blamed the impact of Google AI Overviews on its traffic for the hit, it pointed to a 10 percent bump in subscription revenue for the Mail+, taking the total to £133.6 million ($182.31 million.)

“Programmatic demand was uneven across categories and buyers due to macro pressures and general uncertainty around things like tariffs,” said Andrew Perlman, CEO of digital media company Recurrent. “Softness across the open web was definitely present … We continue to focus on first-party data and direct audience and continue to move away from legacy SEO as a primary growth lever, and have begun to turn our sights to GEO.”

Bidding farewell to the ‘stop-and-start’ media planning of 2025

Vox Media CRO Geoff Schiller said he’s seeing signs that the stop-and-start media planning process he experienced from advertisers last year has now settled into a more predictable routine, thanks to key events like the Winter Olympics and the FIFA World Cup that required upfront marketing commitments.

“The frenetic sort of planning that was persistent for most of [last] year started to really ease up, and brands started to plan further out with less unpredictability,” Schiller said.

Another revenue exec at a publisher – who traded anonymity for candor – said they were also seeing more upfront planning. “Entering the year, we’re seeing advertisers move forward with more confidence than this time last year, with less of a ‘wait-and-see’ mindset in early Q1,” they said.

Schiller believes that the key to a publisher’s business success this year will be how to differentiate oneself and pitch original content to advertisers, at a time when it’s easier than ever for people to get information from AI search.

“The market has continued to raise the bar for what it expects,” Schiller said. “As content consumption has become more commoditized through technology, our value to the consumer has risen. Our ability to [tell that story] is the difference between us leading, us fast following, or us in the middle of the pack … If we can prove differentiation, then we can be successful.”

Others were eagle-eyed on continuing to diversify their businesses to insulate themselves from search-driven impressions. Perlman said Recurrent was focused on partnership deals, paid memberships and fostering direct audience relationships through channels like email and events.

“Broader search behavior continues shifting, which reinforces the need to diversify audience and revenue strategies,” he said.

What we’ve heard

“Finding the time … that’s always the challenge. It’s exciting when things are going well, there’s a lot to do – but it’s a lot. It’s a lot for the sales people. It’s a lot for the teams that are delivering the campaigns. It’s a lot for the events teams. And so we have to be very mindful of burnout.”

– Josh Stinchcomb, The Wall Street Journal’s chief revenue officer.

Numbers to know

70%: The percentage of People Inc. queries where Google’s AI Overviews summaries appear.

1.4 million: The number of digital subscribers The New York Times added in 2025, ending the year with 12.78 million total subs.

20%: The increase in AI bots scraping publishers’ sites for content from Q3 2025 to Q4, according to the latest “State of the Bots” report from Tollbit.

15%: The decline in AI training bot traffic to sites from Q2 to Q4, according to Tollbit. RAG bot traffic grew 33% in the same period.

What we’ve covered

Bloomberg’s new video hub aims to keep audiences – and subscribers – on its own turf

Read more here.

Microsoft AI scales its ‘click-to-sign’ publisher AI content marketplace

Read the Q&A with Nikhil Kolar, vp at Microsoft AI, here.

A running list of publisher lawsuits targeting Google’s ad tech practices

Read the tracker here.

WTF is vibe coding?

Read more here.

Google’s forced AI opt out: what changes — and what doesn’t — for publishers

Read more here.

What we’re reading

The Washington Post cuts 30% of its workforce in massive overhaul

The Washington Post is enacting a round of layoffs expected to decimate the organization’s sports, local news and international coverage, laying off about 30 percent of all its employees – including more than 300 of its roughly 800 journalists, The New York Times reported.

IAB proposes law to protect publishers from AI scraping

The IAB proposed draft legislation to protect publishers from AI companies using their content to train models and generate summaries without compensation, called the AI Accountability for Publishers Act, Axios reported.

Should news publishers be on Apple News?

The U.K.-based subscription research company Enders Analysis looked at whether or not news publishers should share their content on Apple News (and get a cut of revenue) or focus on growing their own direct subscription businesses – and found it’s a mixed bag, A Media Operator reported.

CNN CEO Mark Thompson holds meeting to calm staff

CNN CEO Mark Thompson sought to reassure anxious staff during a recent company-wide meeting about the network’s future, as they await more updates on a major digital transformation to come, and speculation over potential acquisition outcomes, according to Status.

News publishers limit Internet Archive access due to AI scraping concerns

The Internet Archive’s crawlers capture webpage snapshots, but publishers like The Guardian and The New York Times are limiting those bots’ access to its sites, worried that AI companies might scrape content from the nonprofit org, Nieman Lab reported.

More in Media

In Graphic Detail: Publishers chase video podcast growth, but audio still leads

Podcasting may be racing into video, but more listeners still prefer audio — leaving publishers caught between hype and habit.

WTF is a creator capital market?

What is a creator capital market, what does it mean for creators looking to diversify revenue, and why is it so closely tied to crypto?

Media Briefing: Publishers explore selling AI visibility know-how to brands

Publishers are seeing an opportunity to sell their AI citation playbooks as a product to brand clients, to monetize their GEO insights.