Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘Get while the getting’s good’: Publishers look to cheap Facebook ads to increase subscriptions

Over the past seven weeks, many publishers have welcomed a coronavirus bump in subscribers as news consumption rises. That bump has been helped along by a significant acceleration in Facebook ad spending.

For example, subscriber growth across Condé Nast’s portfolio is up 100% from the start of March compared to the same period year over year. And 50% of the new subscriptions its titles have accumulated are coming from paid efforts, a spokesperson said.

This month, a publisher that uses Keywee to drive subscription growth using Facebook is on pace to spend more this month on Facebook ads to drive subs than they did in November and December, combined.

Thanks to a combination of soft advertiser demand on those platforms, strong engagement from readers there and conversion on their own sites, the cost of acquiring a digital subscriber has slid in the past month. An executive at one publisher said that their subscriber acquisition costs have fallen by to as little as one third of what they had been at the beginning of March.

Those same factors have made Facebook an attractive place for publishers to gather newsletter subscribers too. In the first half of April, the cost of acquiring a newsletter subscriber through Facebook fell from 75 cents to 25 cents, thanks to a combination of lower CPMs and significantly higher clickthrough rates, an executive at a second news publisher said.

Thanks to significant drops in cost per acquisition, Condé Nast expects to accelerate spend on Facebook and increase its titles’ ad spending budgets, its spokesperson said.

While publishers would love to pour as much gas on the fire as possible, in most cases, they do not have the option of raising the amount of money they are spending on the platforms because of budget cuts and austerity measures.

“We told people to lean into their spend early in the month, get while the getting’s good,” an executive at the first publisher said.

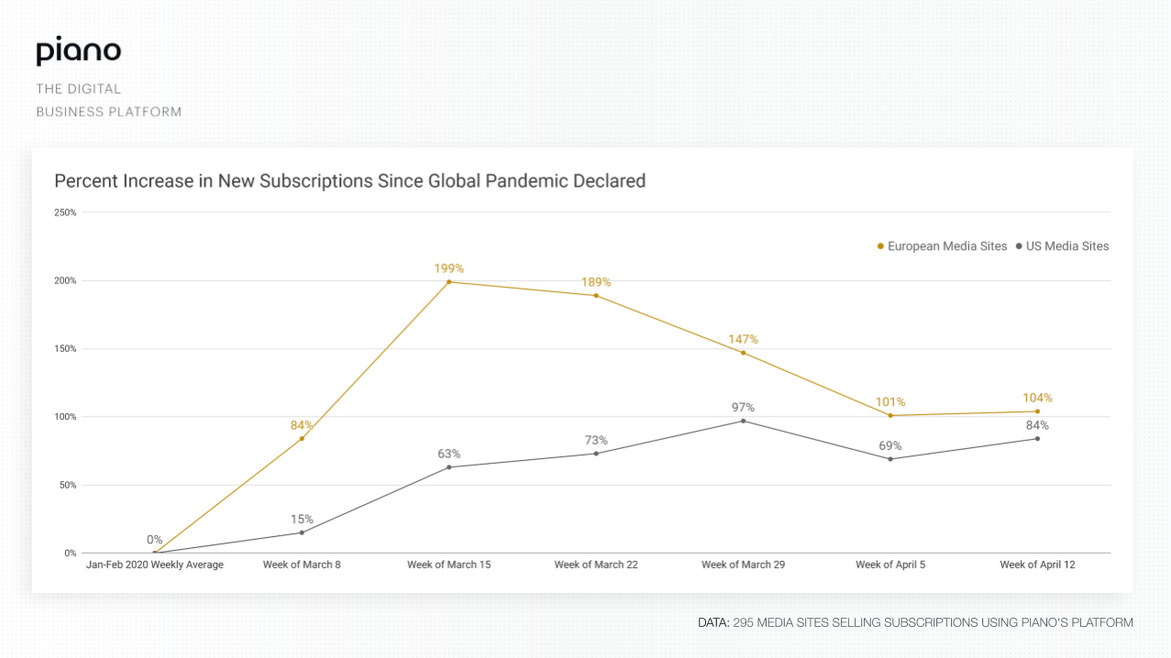

Though publishers have spent the past seven weeks getting battered by declining programmatic ad rates, advertisers pausing or cancelling campaigns, vendors and agencies lengthening their payment terms, and events businesses being thrown into limbo, subscription growth has been an unquestionable bright spot, according to Piano data.

Historically, heightened uncertainty and emotion tend to be great drivers of short-term subscription growth. The widespread use of messages asking readers for monetary support — see The New York Times, BuzzFeed News, or The Daily Beast — helps too.

“Typically what motivates people to subscribe is an emotional event,” said Matt Lindsay, the CEO of Mather Economics; Mather found in its own research that subscriber conversion rates among its clients were up 190% over the past 60 day. “It gets them over their inertia.”

While the strong organic growth could make the case that spending to acquire subscribers would be unnecessary, the short-term revenue pinch many publishers are feeling makes the prospect of adding new revenue quickly more attractive.

“If I can stretch the return of the dollar in April and May, then it probably behooves me to spend it now, rather than later in the year,” a source at the second publisher said. “Not only do I get more value, but I also drive more revenue in 2020.”

But finding the budget is tough, particularly in news, which has faced some of the steepest declines in ad revenue in media. One source noted that it is tough to ask for extra budget at a moment when colleagues are being furloughed or even laid off.

Lindsay expects that, as coronavirus subsides, publishers may find that they have a lower take rate, as they have depleted the ranks of people that might have become subscribers over a longer period of time. Those same publishers will also have to quickly segment the subscribers that signed on during coronavirus and try to find some other part of their reporting for them to read.

“What retains people is habitual consumption,” Lindsay added. “You need to introduce them to something they’re going to get used to doing every day.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.