Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Snapchat’s targeting direct-response advertisers with new dynamic ads product

With Snapchat’s new dynamic ads product, the company is targeting direct-response advertising spending from retailers and direct-to-consumer brands.

Dynamic ads, which have been in beta testing for more than a year, enable marketers to create ads on the fly. Because the ads connect directly to product catalogs, that means they’re always up-to-date, and they can also be automatically created and targeted based on a Snapchat user’s past behavior.

Previously, compared to its competitors such as Facebook, Instagram and Pinterest, Snapchat had some catching up to do with regard to targeting and campaign management. For the past two years, it’s had a self-serving Ads Manager, but that feature didn’t automatically create and target ads for marketers like the new dynamic ads product does.

Over time, Snapchat has increasingly added more features to also make the app more shoppable, engaging and effective for marketers. Last week, the first shoppable game from Adidas launched on Snapchat, for instance. In 2018, Snap Pixel allowed agencies to go their clients with better information about how many users take action on their websites after seeing their ads.

Snapchat also has shoppable AR ads and formed a partnership with Shopify to launch in-app stores for select accounts. Its collection ads make it easy to showcase multiple products in a single ad, and the platform can now support longer-form videos of up to three minutes in length.

DTC brands have also been heavily investing in Snapchat Discovery story ads, as previously reported by Business Insider. A March 2019 media buyer survey conducted by Digiday, however, found that Instagram beat out both Snapchat and Facebook in terms of ROI on story ads.

This new dynamic ad product gives direct-response marketers what they’ve been seeking for years now: “dynamic APIs and solutions that deliver scale and efficiency,” Gareth Jones, senior marketing director at eBay, said last year.

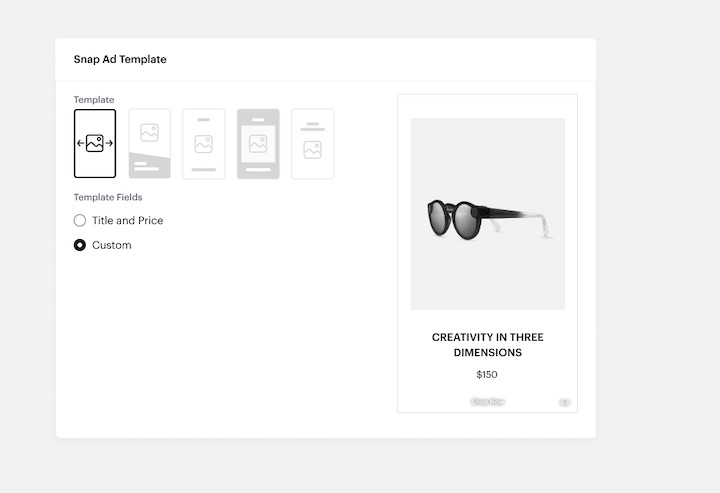

Another distinguishing feature about the new dynamic ad product is that it uses templates, said Noah Mallin, head of content and experience at Wavemaker.

“Having that step built into their system will be very helpful for a lot of brands, especially ones that are new to their platform — they might feel like they don’t have the assets to do so,” Mallin said. “But the templates are making it as turnkey as possible.”

Snapchat is starting with a test phase. For now, campaigns will only reach U.S.-based Snapchat users but will roll out to global markets over the next few months. Some companies have already seen significant returns in beta testing.

David Herrmann, president of Herrmann Digital and a media buyer who specializes in buying for DTC brands, tested the new ad product for one of his clients recently. With a September $3,200 campaign, he saw a 14X return on ad spending.

“I’ve had tremendous success utilizing it because not that many people are using it,” he said. “It’s performing really well, and actually in line with what we’re putting on Facebook. Normally, Snap performs a little less than what we get on Facebook, but that campaign was performing at par with what we’re doing on there.”

Snapchat’s user base, while appearing flat earlier this year, is growing slightly. According to Snap’s most recent quarterly earnings report, it saw nearly 8% more daily active users in the second quarter of 2019 compared to the same period last year for a record total of 203 million. By comparison, Pinterest counts 300 million users per month, and Facebook’s total audience, including Instagram, is 1.3 billion.

Prior to the launch of dynamic ads, however, Snapchat has been hit or miss with some DTC brands. Digigirlship Media, whose clients include Noom and Away, told Modern Retail some of its brands aren’t seeing high-enough click-through rates to convince them to spend more on Snapchat than on others like Facebook and Instagram.

“Because there’s a huge influx of e-commerce and DTC brands that have flooded onto Facebook, that’s driven up costs for a number of marketers so, for now, that could benefit Snap,” said Mike Dossett, vp and director of digital strategy for RPA. “Less density in the options environment might mean better pricing for advertisers looking to test out the product.”

Herrmann said it’s not fair to make direct comparisons between Facebook and Snapchat simply because Facebook is so large, but Snapchat makes a solid “secondary” platform for ads.

“We all need to diversify our ad spends,” he said, noting the Facebook Ads Manager is so prone to breaking down, and only adding to buyers’ frustrations.

When it comes to newer platforms also courting younger audiences, such as TikTok, Herrman said he thinks both Snapchat and TikTok can co-exist. He’s been running ads on TikTok that “perform very differently” but are complementary to the ads he runs on other apps. “TikTok is an awareness play. Snap is more of a conversion play. I think TikTok is definitely a player, but they still have a long way to grow.”

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.