Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Marketing Briefing: ‘Success is tied to its creators’: As TikTok offers ad rev sharing, it courts creators and recognizes its shift to entertainment platform

This Future of Marketing Briefing covers the latest in marketing for Digiday+ members and is distributed over email every Friday at 10 a.m. ET. More from the series →

As consumer viewing habits are increasingly focused on creators, the revenue plays associated with the trend have taken on considerably more urgency, sophistication and scale.

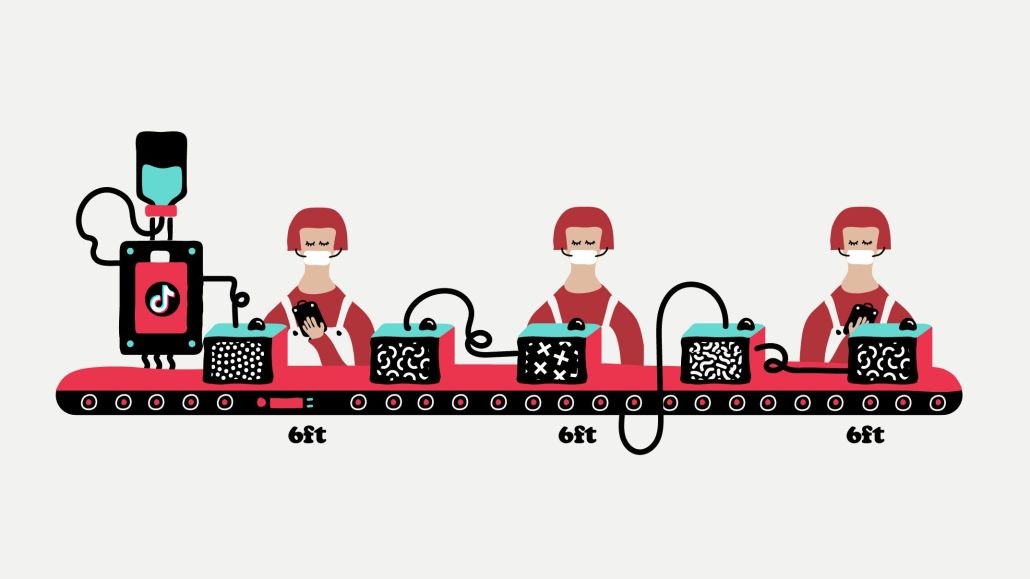

With TikTok’s announcement last week of its new ad product, TikTok Pulse, it’s clear that it is looking to further court creators and recognize its position as an entertainment platform versus a social media app. And with Pulse, TikTok announced it was exploring its first advertising revenue sharing program available to creators and publishers with over 100,000 followers.

“So much of TikTok’s success is tied to its creators,” said Swap Patel, executive director of media at McKinney. “Larger, more established players like Google/YouTube have, for years, not only helped creators make a name for themselves but also incentivized them with a cut of the revenue amassed via the YouTube Partner Program. So it’s only natural that TikTok now offers this as well.”

With the announcement of the Pulse ad product, agency execs believe this is part of a larger shift for TikTok to more fully embrace the fact that users turn to the platform for entertainment more than social media. “This change will reinforce TikTok’s position as an entertainment platform, closer to YouTube and further from Instagram,” said Danielle Kim, associate director of strategy at Stink Studios.

Agency execs noted that while TikTok had been garnering roughly 10% of the social media ad budget in previous years, they expect that percentage to increase to between 10-20% of the spend. At the same time, some agency execs wondered if the shift to be more of an entertainment platform could have brands move ad dollars from other entertainment sources like linear TV rather than simply getting more of the social media budget.

Given that TikTok’s entertainment comes from creators, courting them to continue to build on the platform with an ad revenue share makes sense to agency execs. “This is one big step on a path of much more needed steps,” said Alexis Madison, associate director of digital strategy at Deutsch NY. “Creators give TikTok their power.”

However some questioned the platform’s cap of 100,000 followers for the program, noting the power of smaller creators. “[Marketers shouldn’t] just stop at creators with 100k followers,” said Chelsea Smith, associate director of influencer marketing at Campbell Ewald. “Micro influencers have a wealth of knowledge and influence that enable brands to go beyond mass reach to engage with more specific audiences.”

Others question TikTok Pulse’s focus on the top 4% of content and whether or not that would differ from where brand content is already showing up. “All advertisers want more control of placement, adjacency, etc., so this is certainly a benefit,” said Jason Dille, evp, media at Chemistry. “However, with the top 4% of videos already taking a large portion of user’s consumption, many brands were probably already there.”

3 Questions with Cariuma’s chief digital officer Felipe Araujo

Shoemaker Cariuma doesn’t have a so-called marketing playbook. Why is that?

It’s more about the process than the playbook on what we should do. It’s more about putting that customer first, understanding where she is, what she’s looking for and building the ecosystem around her versus the other way around.

What does that look like in practice when it comes to building a media mix?

It changes throughout the year. There’s seasonality of the platforms as well and we’re learning that. That’s why it’s so important for you to have a diversified channel mix. At different times of the quarter or the year, you’re seeing this channel is working really well.

Last year, we saw a lot of success on channels like LiveIntent and channels like Google, outside of text ads, going more into shopping, smart shopping, discovery units, YouTube, etc. We saw that display grew its share in terms of efficiency. We still have success on Facebook and Instagram, it’s just that the mix has changed in terms of how reliant you are on [them] and what [they] represents in your media mix.

What has been the result of the flexible media mix approach?

We have created this culture of iterating, learning, testing and not being scared of failing. Not every test needs to be successful. The failures are as important as successes. — Kimeko McCoy

By the Numbers

After two years of the pandemic, the ways in which marketers are getting in front of shoppers has changed over the last two years. Budgets that were once tight have since recovered and new marketing channels have emerged. This year, marketing budgets across the globe have gotten a major bump, according to a new report from social listening company, Mention. Find details from the report below:

- 59% of marketing managers who responded to the survey say their budget increased in 2022.

- 72.5% of survey respondents said brand awareness is the key goal of social media marketing efforts.

- 41% of respondents reported that the main difference in their marketing strategy post-pandemic was investing in new marketing channels. — Kimeko McCoy

Quote of the Week

“The office just needs to have a different purpose. Coming together face-to-face is nice. I don’t think it’s critical for building relationships.”

— Emma Sexton, founder and CEO of Hands Down Agency on remote work and the future of the office.

What We’ve Covered

- How Omnicom Media Group is making sense of clean room complexities

- Marketers are adapting to new ways of working with creators

- Overheard at the Digiday Programmatic Media Summit

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.