Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Media Briefing: How The Athletic used the World Cup as a kick off for its advertising business

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

This week’s Media Briefing includes a conversation with The Athletic’s chief commercial officer Sebastian Tomich about how his sales team is pitching advertisers on campaigns amidst a busy sports season.

- Q&A with The Athletic’s Sebastian Tomich

- Twitter referrals trend down

- The Washington Post braces for layoffs, crypto publishers are feeling the squeeze and more

Tomich talks ads

The Athletic launched its advertising business right in time for many sporting tentpoles, including the World Cup, posing a real opportunity for The New York Times-owned sports brand to compete for ad dollars.

But what Sebastian Tomich, chief commercial officer of The Athletic, found was that many top spenders around marquee events like the World Cup had already pre-planned those budgets years before the Times even made a motion to purchase the sports brand. While there were some remaining dollars to campaign for, he said the real benefit to his sales team was being able to get the ball rolling on large campaigns tied to tentpoles next year, like the Super Bowl and Women’s World Cup, and even the World Cup in 2026.

The Athletic’s ad revenue is not relying solely on future campaigns, however, especially during an economic downturn. Instead, Tomich’s team is continuing to pursue as many prospective advertisers as possible, while also turning on the programmatic spigot — something he was hesitant to use back when advertising first appeared on The Athletic’s website.

“Never say never, particularly when it comes to open market programmatic. It’s not on the cards now, but if we do make that move to open market programmatic it will be because we need to,” Tomich told Digiday in September.

Now with a 12-person-strong sales team, programmatic revenue trickling in and the Times’ advertising division behind him, Tomich said The Athletic is still on track to achieve profitability by 2025.

As the France-Morocco World Cup match played out on Wednesday, Tomich agreed to miss the first 20 minutes of the game to sit down with Digiday to discuss how the brand’s advertising business is faring after nearly a full quarter of experience. “Good for business if France wins. [A head-to-head of] Mbappé and Messi is a good final for any newsroom covering the World Cup,” said Tomich.

The following conversation has been lightly edited and condensed for clarity and readability.

How has the timing of the World Cup helped with the launch of your advertising business?

We launched advertising at the end of September [and] the World Cup is such a great beacon to hitch your launch to, so it was kind of two-fold. We’re launching advertising and we have this giant [amount of] World Cup cover[age]. It’s a good pitch [and] it helped us a lot in conversations with clients. In some cases, the conversation started with the World Cup and ended up in other places à la our big partnership with Google that we announced around women’s sports.

We had very directly relevant World Cup sponsors come in like Emirates and Paramount+, and then because [it’s a] big moment that everybody’s paying attention to all at once, we had other big brands join us like Chanel, who was our launch partner, join us again for the World Cup, as well as Applebee’s.

Which types of advertisers have you been targeting with your ad business? From the few you mentioned, they don’t appear to be very endemic to sports.

I segment it in three ways. We look for brands that already have pre-existing sports relationships. So team and league [sponsors and] official sponsors of the World Cup, like Visa Hyundai, McDonald’s, Coke — we will 100% go after all of them.

Then you have brands that are interested in reaching affluent audiences, predominantly males. That leads you to all the golf tournaments, all the men’s lifestyle publishers, all the brands that show up there like big watches, cars and apparel. They might not sponsor a team, but they want to be around it.

And then third is advertisers who just want to be around sports. Their number-one target might not necessarily be affluent males, but they love the sports environment. A good example of that is Paramount+, right? They’re not an official team sponsor. They target everybody, but they love being around sports.

How has it been pitching The Athletic to advertisers right around the same time that a lot of tentpole sporting events are happening?

It’s 100% outbounds now because you’ve got to remember that The Athletic didn’t have advertising before. We’re not on any RFP lists. We have to go build our own awareness in the market. And it [goes] back to those three guideposts. We have all of those broken out and then we have research behind them that shows all of the top spenders in those spaces. And we’re holding ourselves accountable to making sure we get to every one of them. It’s a long list. There’s so many people to call on but we’ve been fortunate enough to have the resources to do that.

How large is your sales team?

We will try to finish the year with 12 [salespeople]. And then, of course, we have the Times sales team that we’re still working through how the two teams work together. [There’s] a lot of partnership there.

The goal is by the end of next year, [we] won’t be 100% outbound [dependent]. We’ll be on those RFP lists.

How has this set you up for next year in conversations with advertisers, particularly around the several marquee sporting events that are happening all within the first half of 2023?

One interesting thing is just how far in advance brands plan for these things. I mean, some of the mega sponsors of the World Cup will have their plans baked two to three years prior to the tournament. In many cases, we were going to brands and they were like, “Well we can talk about things that are leftover, but we’ve been planning [for the World Cup]. Let’s talk about the Women’s World Cup next year or [the World Cup in] 2026.”

[Now] it’s all hands on deck for the entire sports calendar for next year. We’ve got a dual strategy right now. We’ve got those three buckets of partners we’re chasing, and then second, we’ve got a really exciting sports calendar [that we’re using] to launch new editorial products that can stand out [to advertisers].

We want to end the year with three to five multi-year, very integrated partnerships [with] many millions attached and want to be able to have a roster by sport of the top sports sponsors all working with us in ways that are similar to stadium rights, where they can own a piece of coverage or be the official partner of our Major League Baseball coverage or NHL coverage, things like that.

Some publishers have said the fourth quarter this year was particularly strong for programmatic advertising because it allowed advertisers to act quickly on any remaining budgets they had this year. You told Digiday this September that open market programmatic advertising wasn’t a part of the launch plans. Have you since added it into the fold?

We definitely focused on direct-sold ads at launch, particularly because we were introducing ads to a platform that was ad-free since its inception. So we wanted to be deliberate [because] ad quality is something [that is] super important to us. We’re testing some stuff in programmatic with some pretty tight quality controls. I don’t see it becoming a big part of our strategy, but I see it becoming a component of the way we make money.

The Times provides a good framework for this, like how to balance the high quality, direct-sold ads with programmatic. I see us more closely mirroring the Times’ strategy and then [if] we do a really good job and we sell out everything from the direct side, we won’t be doing a lot of programmatic. And I’m hoping that’s the case.

Are you testing both open marketplace and private marketplaces?

All the above. We do some open market stuff, but [with] some really tight controls. Obviously it makes it harder to do stuff at scale there. [I’m also] super interested in PMP as well.

What we’ve heard

“The Google outage that happened a couple of days ago hurt some publishers. That wasn’t ideal, but I do think they fixed it quickly and they were communicative about it.”

— a media executive who spoke to Digiday on the condition of anonymity

Twitter referrals trend down

All the hoopla going on at Twitter since Elon Musk took over at the end of October begs the question: How have these changes impacted the traffic referred to publishers’ sites from the social media platform?

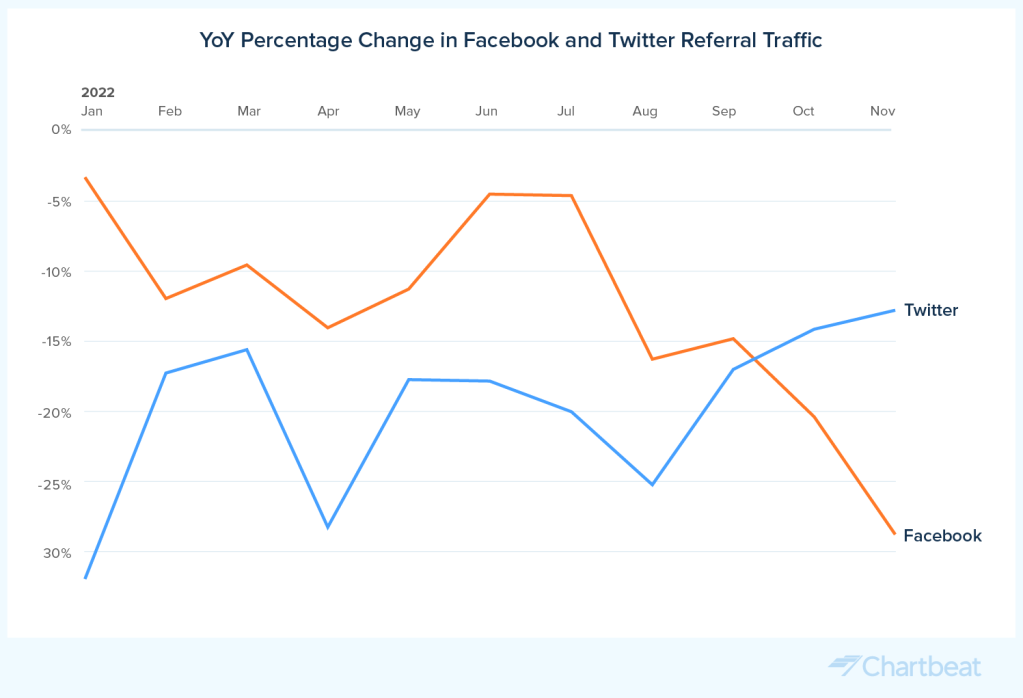

Not as much as you might think. According to Chartbeat data shared with Digiday, Twitter’s referral traffic to publishers has fallen since Musk’s takeover — down 12.8% year-over-year in November — but not to the extent that it has been dropping since the start of the year.

Twitter’s November referral traffic drop happens to be its smallest fall all year. The largest difference was in January, when Twitter referral traffic was down 31.9%. Referral traffic from Twitter has been down in the double digits every month this year, with an overall decrease of 20.4% year-over-year. For comparison, Facebook’s referral traffic to publishers’ sites was down 28.8% in November year-over-year, the largest dip this year and a smaller change than what Chartbeat has tracked at Twitter. The data comes from 1,200 sites, all of which are Chartbeat customers that fall in the category of news and media.

For the most part, traffic coming from Twitter to publishers’ websites hasn’t been substantial enough to make a lasting mark on business so far. This referral channel has hovered around an average of 2% for years. Spokespeople from NPR and another large news organization that asked not to be named in this story told Digiday this week that they have not experienced significant changes to their respective Twitter referral traffic.

Five news publishers Digiday contacted said they had not updated their social media policies or strategies since the changes to the Twitter platform. (Quite different from the way advertisers are treating the platform. Many have pulled back spending.)

However, one head of audience at a large regional news publisher that spoke on the condition of anonymity said that while they have seen traffic from Twitter decline all year, that traffic halved in the past two months, from about 5% to now about 3% of overall traffic. This was mostly due to a decline in the publisher’s Twitter followers and in organic referrals from users sharing their content, as well as the removal of the Moments feature last week, which allowed publishers to curate and highlight news events, they said. – Sara Guaglione

Numbers to know

30%: The amount that Semafor’s events business will contribute to the company’s total revenue in its first year.

$1.6 billion: The amount of money Dominion Voting Systems is suing the Murdoch-owned Fox Corp for after the cable news station repeatedly claimed the company rigged its voting machines during the 2020 presidential election.

533: The number of journalists who are currently being detained worldwide, according to a new report from Reporters Without Borders (RSF). This is a new record.

What we’ve covered

iHeartMedia to cut U.S. real estate footprint in half:

- iHeartMedia is cutting its office square footage by half across the U.S.

- The company does not plan to close offices in any of the 160 markets where it has a presence.

Read more about iHeartMedia’s cost-cutting strategy here.

Here are the 2022 global media rankings by ad spend:

- The winds of the global economic slowdown have started to chill even the buoyant digital advertising market, albeit digital spending is on course to hit $567.49 billion this year, up from $522.5 billion in 2021, according to Insider Intelligence.

- Google and Facebook remain dominant while Alibaba and ByteDance are in the mix.

Read more about 2022’s media ad spending here.

How The Wall Street Journal hopes to reach young news consumers on TikTok:

- With its recently introduced TikTok channel, The Wall Street Journal has joined a number of other legacy publishers working to reach Gen Z and young millennial audiences on the platform.

- Since launching its TikTok channel on Oct. 3, it has accrued over 37,000 followers and 600,000 likes.

Learn more about the publisher’s TikTok strategy here.

Publishers prime their YouTube Shorts strategies ahead of next year’s revenue-sharing program:

- YouTube Shorts has yet to turn on the revenue spigot for creators and publishers to directly profit from the short-form vertical videos they post to the platform, but some publishers are preparing for the ad revenue-sharing program’s debut next February by building up their audiences now.

- As the revenue-share model will be based on viewership, building up stamina on the platform will be critical once the revenue tap is turned on next year.

Read more about publishers’ YouTube Shorts strategy here.

What we’re reading

Layoffs loom for The Washington Post:

The Washington Post will conduct layoffs in the new year in an effort to reorient itself for the future and reinvest in other areas, publisher Fred Ryan said during a town hall on Wednesday, CNN reported.

Outage of Google Ad Manager costs publishers’ ad sales:

Google Ad Manager, which is used by many websites to sell and display ads, was down for about three hours last Thursday, preventing publishers from earning revenue during the crucial holiday period, reported Reuters.

News publishers are up against a political lobbyists after JCPA is killed:

The Journalism Competition and Preservation Act was a bill designed to provide a safe harbor for some news organizations to collectively bargain with platforms for payments. Targeting behemoths like Google and Meta, the bill was dead within 48-hours, indicating that strong bi-partisan and well-funded lobbying will be up against local news publishers for the foreseeable future, writes The Columbia Journalism Review.

Crypto publishers are feeling the boom and bust of crypto more than most:

The declining adoption and waning trust in crypto has led to a steep downturn in marketing spend, causing endemic publishers like CoinDesk, Decrypt and The Block to adapt to a far less hospitable economic landscape, reports Adweek. The third quarter 2022 saw an 80% decline in ad spend from the top cryptocurrency advertisers compared to the first quarter, according to MediaRadar.

Spotify is cutting back on live audio show programming:

The company is ending the production of several live audio shows including “Deux Me After Dark” and “Doughboys: Snack Pack,” reported Bloomberg.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.