Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Adidas is using apps to meet its goals for e-commerce sales.

A focus on Amazon and online retailers drove €1.5 billion ($1.9 billion) in online sales in 2017 for Adidas, a 57 percent increase on what it made in 2016, according to Adidas’ latest earnings report. Speaking to investors on March 14, Adidas CEO Kasper Rorsted said it is on track to hit €4 billion ($4.9 billion) by 2020. Hitting that target, however, will be as dependent on the likes of Amazon and Foot Locker as on Adidas’ owned channels, particularly its apps.

Apps, according to Adidas, are a way to strike a direct relationship with consumers. In other words, they establish an online business that doesn’t require the company to pay a tax to Amazon to sell its products. Rather, Adidas can use its ever-widening portfolio of apps to push rarer — and therefore more expensive — products, while using Amazon and other online retailers to sell its cheaper products. Adidas and rival Nike are in a race to evolve their distribution channels and manufacturing technologies in order to get their products to market faster, which could also safeguard their businesses from brick-and-mortar killer Amazon.

In November, Adidas launched its first shopping app, which has been downloaded more than 1 million times, according to the company. The app’s news feed, which features content such as new product updates and events, prioritizes content the user has told Adidas they are interested in. The app mirrors the efforts of Nike, which has a similar app that launched in 2015 and started selling its products on Amazon last year. For both Adidas and Nike, selling on both owned and third-party channels equates to a pricing strategy spread across premium, mid-tier and lower-tier customers. Both brands stand to generate higher profit margins from online sales compared to those made via traditional channels. Last year, Adidas said e-commerce had become its most profitable point of sale channel.

Rorsted said e-commerce is helping the business improve its profitability. “We’re finding the right balance to focus on revenue when it delivers margin,” he said, “but we’re not focusing on margin if we don’t get any revenue on it.”

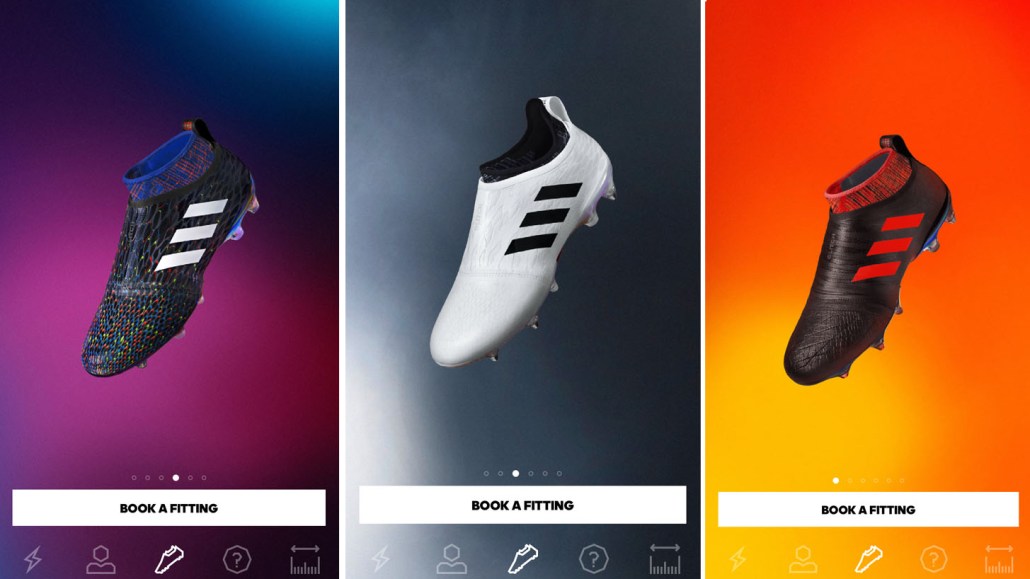

The arrival of Adidas’ shopping app ended a two-year period in which it didn’t launch any major apps. Although it launched the Glitch app in 2016, it deemed the app a low-key test for micro-influencers rather than e-commerce. Prior to Adidas’ hiatus from apps, there were launches “coming from everywhere in terms of markets and categories,” said one agency executive, who shared details of the advertiser’s mobile strategy on condition of anonymity. Adidas has assessed all of its apps, scrapping those it no longer needs. Now, according to another agency source, Adidas wants its newest app to kick-start its customer relationship management plans. The business spent part of 2017 outlining a strategy that could link all future apps together.

The executive said the intention is that whenever people sign into an Adidas platform, they use the same profile, allowing the brand to get a clearer picture of its more lucrative customers. In turn, that system will eventually start serving content to customers based on what they’ve previously viewed or bought.

Subscribe to the Digiday Retail Briefing: A weekly email with news, analysis, interviews and more covering the modernization of retail and e-commerce.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.