Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday Video Summit last month in Scottsdale, Arizona, we sat down with 51 publisher executives to learn about social platforms’ contributions to their video revenues. Check out our research on publishers’ growing concerns about their ability to monetize content for over-the-top services here. Learn more about our upcoming events here.

Quick takeaways:

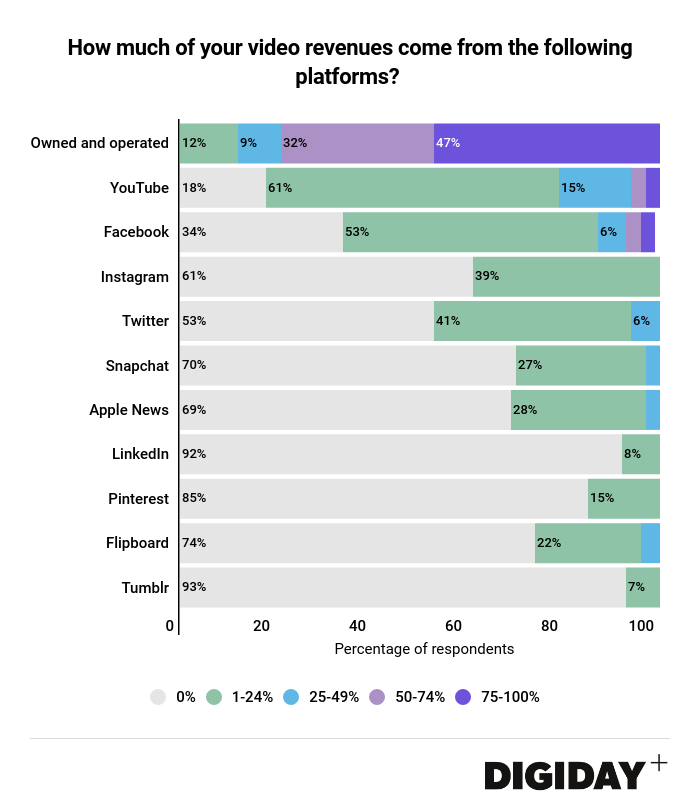

- Nearly half of publishers in Digiday’s survey make at least 75 percent of their video revenues from owned sites.

- Forty-seven percent of respondents rely on Twitter for part of their video revenue.

The pivot to video has seemingly failed for many publishers. Despite this, 86 percent of the publishers surveyed at the Digiday Publishing Summit in March said they plan to increase the amount of video they produce. Additionally, 75 percent of publishers in a separate Digiday survey indicated that part of their revenue comes from video advertising. C-suite publisher executives also view video advertising as one of the biggest revenue opportunities in 2018.

That led us to question the source of publishers’ existing video revenues. In a survey of 51 publishers at the Digiday Video Summit, the vast majority said they make most of their video revenues from their owned and operated sites, but almost half reported revenues from Twitter.

Owned and operated sites are publishers’ second most-used platform for video distribution, behind YouTube. But these sites contribute significantly more than YouTube to publishers’ revenues. While 82 percent of publishers make money off YouTube, just 6 percent of that group makes at least half of their video revenues there. In contrast, 79 percent of publishers attributed at least half of their video revenues to their owned and operated sites.

For the foreseeable future, owned and operated sites will continue to be publishers’ preference for hosting video, as companies like Refinery29 redesign their sites to emphasize video viewership. But as publishers seek scale via platforms, they are increasingly prioritizing YouTube over former video view goldmine Facebook. Genius now has a YouTube-first video strategy, for example, calling YouTube its “most important platform.” Other publishers favor YouTube because the platform offers a more predictable revenue stream than Facebook.

Fewer publishers earn revenue from Twitter than from Facebook, according to the survey from Digiday’s video summit. But that could change if more publishers, like The Weather Channel, stop distributing videos on Facebook. Since Facebook de-emphasized publishers’ posts in its news feed, publishers have seen a boost in video views coming from Twitter. As Twitter tries to capitalize on Facebook’s retreat from publishers’ video, Twitter’s Amplify program has increased the ways publishers can monetize videos on the platform to include sponsorships with standard pre-roll ads.

Other platforms, including Apple News and Tumblr, offer ways for publishers to make money, but those efforts are still in the development stage. Apple News, which started selling ads on video content last year, has yet to become a significant revenue source for publishers. Verizon is attempting to turn Tumblr into a home for original video series, but the platform lacks a clear video distribution and monetization strategy.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.