Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: For most publishers, video is less than 25 percent of total content

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Digiday’s “Research in brief” is our newest research installment designed to give you quick, easy and digestible facts to make better decisions and win arguments around the office. They are based on Digiday’s proprietary surveys of industry leaders, executives and doers.

“Pivoting to video” has been the talk of the digital media industry recently, with Mashable, Vocativ, Mic, MTV News, Fox Sports, LittleThings, Bleacher Report and Vice all making the shift to video.

But Mashable, an early proponent of the move, was reportedly sold for $50 million to Ziff Davis after being valued north of $300 million just two years ago. Soon after that news broke, BuzzFeed and Vice, both heavily invested in video, announced they would miss their upcoming revenue targets.

So much for the pivot to video, right?

Shifting to video-heavy strategies has had noticeable drawbacks, including plummeting audience views. Mashable’s decline lays bare the danger of relying heavily on video ad revenue.

Digiday’s prior research found that 82 percent of U.S. publishers and 94 percent of European publishers were planning on increasing their video output in the next year.

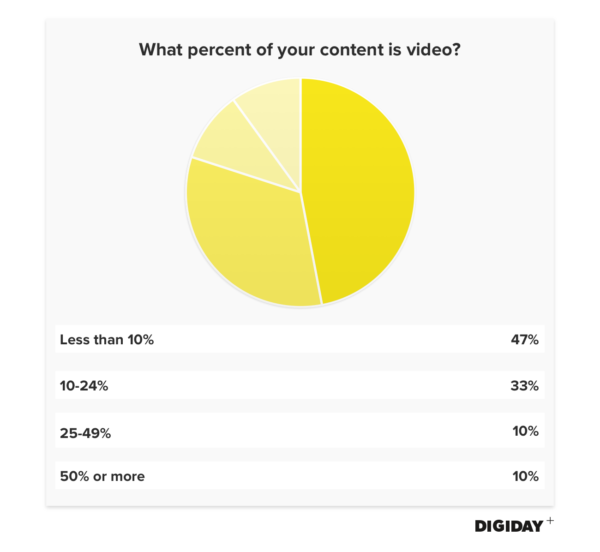

Despite this, the majority of U.S. publishers produce video sparingly. At the Digiday Publishing Summit in September, we surveyed over 50 leading executives about what percentage of their content was video.

Eighty percent said video represented less than 25 percent of the total content they produced. Due to the amount of publishers aiming to boost their video output, we expect the number of publishers producing less than 25 percent video content to decrease.

However, the pivot to video will surely be slow. The struggles of Mashable, Vice and BuzzFeed serve as a warning for any publisher chasing video ad dollars.

In-house video production remains a challenge, with publishers previously noting it as their greatest weakness, with cost being the most prohibitive issue. And unfortunately for publishers, the price associated with producing digital videos has actually gone up in recent years with technological advancements, not down. Meanwhile, publishers are struggling to monetize their video views through Facebook’s mid-roll ad format.

Pivoting to video might be the latest fad, but it appears unsustainable.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.