Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Editorial teams are being forced to adapt as publishers cut staff and pivot between emerging revenue streams. In order to assess the ongoing change within editorial departments at media organizations, Digiday surveyed 200 publisher executives from its proprietary research panel in February 2019. Digiday’s research found that editorial staff are increasingly asked to create more content with fewer resources, produce more evergreen and video content that is easier to monetize, and find ways to personalize reading experiences for consumers.

Table of Contents

- Many publishers expect to boost content production despite cutbacks

- 62 percent of publishers plan to spend more on video production

- Marketers and publishers boost podcast investment

- Chasing revenue, news publishers are producing more evergreen content

- 70 percent of publishers say they personalize content

- Publishers look to technology to help keep down editorial costs

- 44 percent of publishers plan to work with fewer ad-tech vendors

- 52 percent of publishers haven’t started preparing for the California Consumer Privacy Act

![]() 1. Many publishers expect to boost content production despite cutbacks

1. Many publishers expect to boost content production despite cutbacks

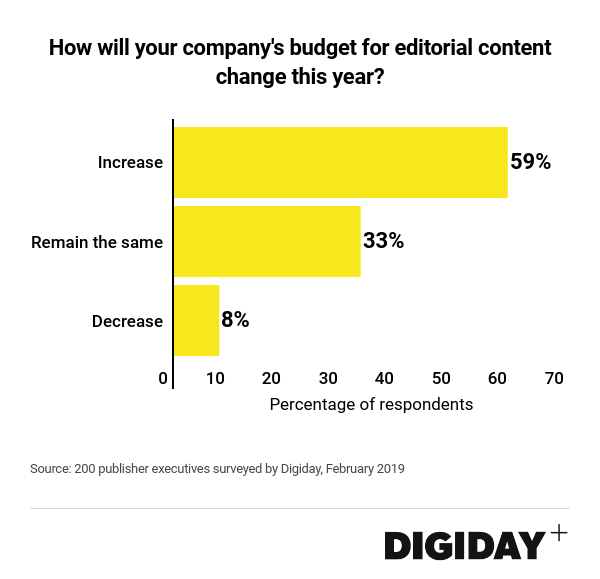

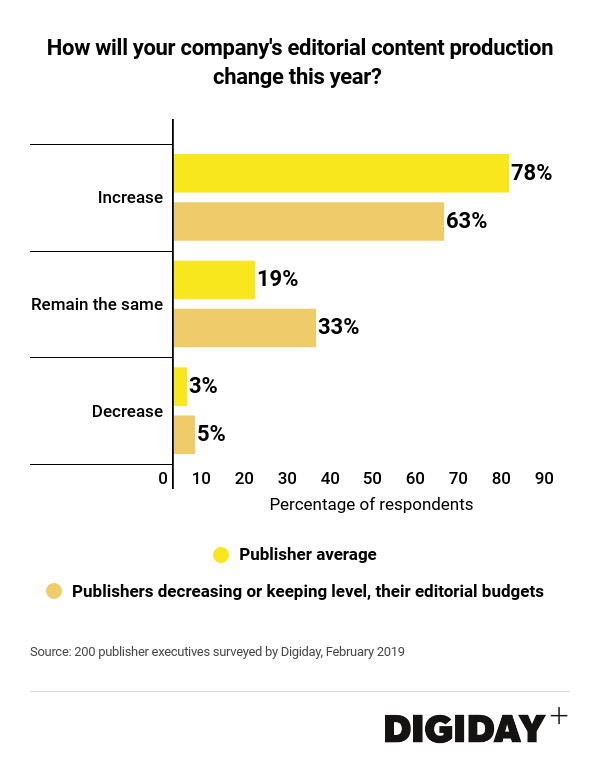

Publishers are tightening their purse strings as challenges to their businesses continue to mount, and many editorial departments are being asked to do more with less as a result, according to Digiday research.In a survey of 200 publishing executives conducted this month by Digiday, 41 percent of respondents said their content budgets would remain the same or decrease this year. Nevertheless, 63 percent of those respondents also said their companies expect to increase the volume of content they produce in 2019 despite no plans for additional funding.

It’s been a rough year so far for many publishers, with high-profile companies laying of hundreds of editorial staffers in some instances. But that doesn’t change the economics of their businesses, and many will have little choice but to continue producing content at a similar rate despite their cutbacks.

Despite the challenges faced by some publishers, the majority say they’re continuing to grow their investment in their editorial output. Fifty-nine percent of respondents surveyed said they are expanding their editorial budgets overall, and only eight percent plan to cut back on funding.

Part of the problem for publishers is that readers’ expectations have changed, as have the demands of social networks and other distribution channels which have offered up bottomless feeds of content for readers to consume. Some publishers have become bloated trying to meet those demands in attempts to stay top of users’ minds.

For editorial staff at publishers expecting more content without additional resources, that often simply means more work and shorter deadlines. One member of Study Hall, an organization of media freelancers, shared in an open statement by the organization, that Elite Daily doubled the word count required for each story while giving staffers less time to write.

Other publishers might simply opt to produce less content. BuzzFeed, Vice, Gannett, HuffPost, and The Players’ Tribune all laid off editorial staff this year. Fewer staffers either means less content overall, or more content per head, unless or publishers have other strategies for introducing new efficiencies to their editorial departments and newsrooms.

Maribel Wadsworth, USA Today Network President and USA Today Publisher, confirmed to Digiday in a statement that following the layoffs at Gannett, “we have reduced the amount of content our local markets produce by 40 percent on average.” However, she said that USA Today still grew its audience by refocusing on national topics that drive higher engagement, and diverting resources to areas such as investigative reporting.

For some of these companies, layoffs meant slimming teams and products to focus more intensely on areas performing well. BuzzFeed’s layoffs impacted 200 people and were done to focus resources on teams producing shows that can be licensed out to platforms, for example. BuzzFeed will also rely more heavily on unpaid contributors to generate quizzes to help offset staff reductions, Digiday previously reported.

However, a spokesperson from Vice said that despite the layoffs, it will not be producing less content. Even after letting go 250 employees and cutting its weekly documentary series for HBO, the spokesperson added that Vice will continue “diversify its content,” through the creation of feature films from Vice Studios, a new Vice Live show and expanding its digital news capabilities.

HuffPost did not return requests for comment on their post-layoff plans. BuzzFeed declined to comment.

Publishers looking to increase the amount of content they create have several strategies they can pursue. Staffing up is an obvious one. A spokeswoman for The Atlantic confirmed it had already hired 30 of the roughly 50 journalists it planned to add and was producing more editorial content as a result.

Technology can also play a role. Forbes invested in artificial-intelligence tools to help its reporters increase their output by giving article suggestions and even writing rough drafts for contributors to finish. Elsewhere Bloomberg is using bots to help draft article summaries for users.

In general, publishers navigating the changing media landscape must become streamlined and fund sustainable products. Even if that means creating fewer pieces of higher-quality content.

![]() 2. 62 percent of publishers plan to spend more on video production

2. 62 percent of publishers plan to spend more on video production

The pivot to video might be over, but publishers are still prioritizing short-form video.

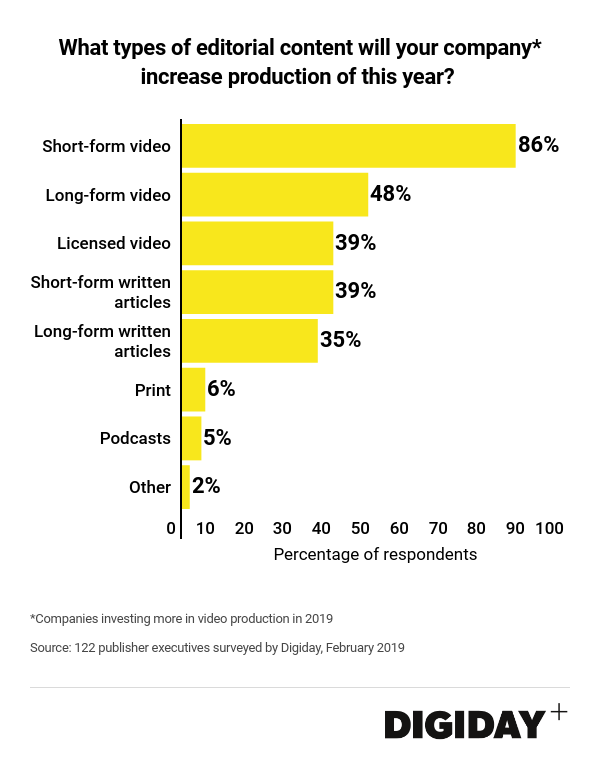

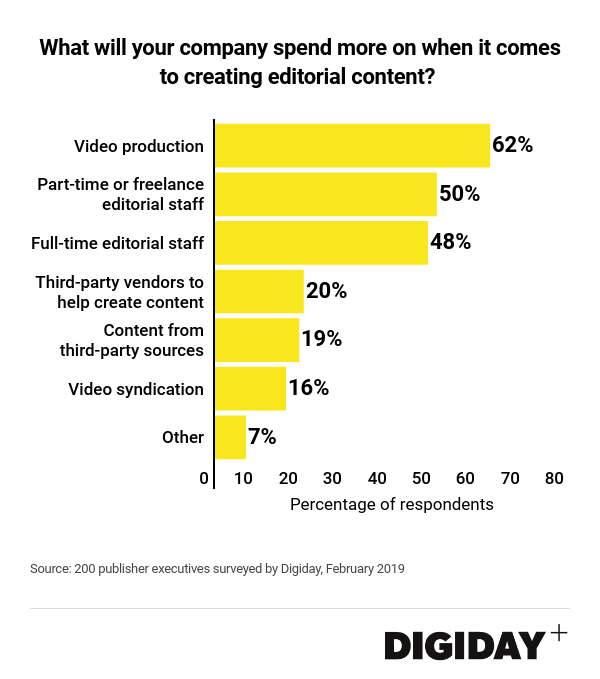

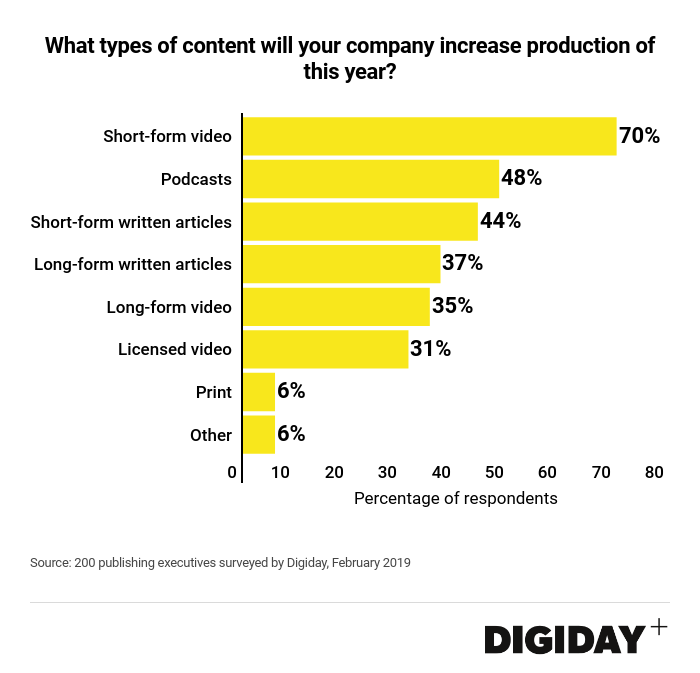

Earlier this month, Digiday polled 200 publishers and found that 86 percent of publishers increasing their video production budgets said they will produce more short-form video content compared to just 48 percent of publishers who said they would make more long-form videos and 39 percent who said they would make more videos to license out to OTT and TV platforms.

Short-form video content, which can still perform well on platforms like Instagram or YouTube, appeals to publishers for its ability to generate awareness for new products and build audiences. It is also vastly cheaper too.

Overall, 62 percent are increasing spending on video, 50 percent said they will fund more freelance and part-time editorial staff and 47 percent will increase budgets for full-time editorial staff.

Meanwhile hiring part-time or freelance editorial employees might be a cheaper way for publishers to meet growing content demands. Companies like BuzzFeed, Fortune and Forbes have long relied on freelance contributors to help meet those demands. But it also leads to unrest among full-time staff worried about being replaced and a growing push to unionize. Bustle Digital Group found itself under pressure after unionized staffers, laid off after the sale of Mic to BDG, claimed that their unfinished work was completed without their consent by Bustle employees.

However, the small likelihood that publishes will hire for part-time or freelance editorial staff over full-time staff could just be the result of current market forces. With low unemployment rates, research from Edelman Intelligence in June and July of 2018 found that the majority of freelancers do so voluntarily.

Though video burned publishers who adopted platform-reliant strategies, many have created thriving and sophisticated video strategies. Complex turned video licensing into a “high eight-figure” business by working with Netflix, Hulu and other partners. The Hill, which is prioritizing its video capabilities ahead of subscriptions, learned from the past mistakes of others and does not rely on a single platform to generate the majority of its audience.

Mindbodygreen, a health and wellness based company, is expanding video production on its owned channels. The company now sells 80 video courses focusing on topics like yoga, nutrition and meditation to consumers from its own site.

“Almost all of the focus has been putting the best content on our owned and operated platform,” said Colleen Wachob, co-founder and co-CEO of Mindbodygreen. “There is a huge disconnect between the high-quality video content that does well on our site and the viral video content that does well on social platforms.’

3. Marketers and publishers boost podcast investment

As podcast listening in the U.S. continues to grow, marketers and publishers are racing to capitalize on the opportunity.

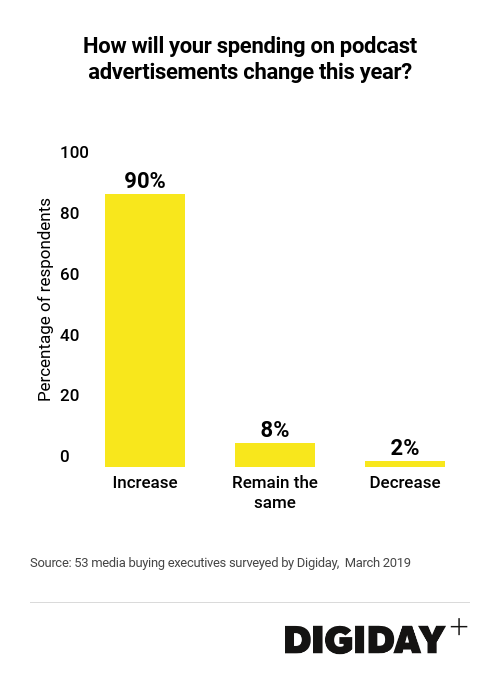

Ninety percent of marketers currently buying podcast advertising plan to grow their investment in the medium this year, according to a Digiday poll of media buyers conducted last week.

Meanwhile, forty-eight percent of 200 publishers surveyed by Digiday in February said they planned to produce more podcasts in 2019 than they did in 2018.

Marketer spending on podcasts remains a fraction of the billions of dollars spent annually on digital advertising, but marketers say they’re increasingly attracted to the medium for two key reasons: their performance, and their ability to reach highly-valuably audiences that are getting harder to reach through channels such as TV.

“Marketers are seeing strong results and better breakthrough,” said Marcus Pratt, vice president of insights and technology at Mediasmith Inc, whose clients are spending more on podcast ads now than ever before.

Part of the appeal for podcast advertisers is the share of voice they can offer marketers compared with formats such as online display advertising, which often results in ads appearing on cluttered webpages alongside those for multiple other brands.

“Podcasts offer an incredibly intimate and engaging environment for brands,” said Sam Appelbaum, general manager, at YellowHammer Media Group. If marketers wanted to achieve a similar level of isolation on a publisher site, “they would have to be willing to spend north of $100,000 with a publisher,” said Gylije Veljic, media director at ForwardPMX.

There’s an influencer element, too. When a podcast host reads an ad it can come across as them “endorsing your product,” Veljic said.

Beyond the nature of the formats themselves, marketers say another key lure of podcasts is the quality of the audiences they can reach.

“Marketers are spending more as users, especially higher value listeners who can be harder to reach through more traditional channels, listen more,” said Pratt. A study conducted by Edison Research in 2018 found that 26 percent of Americans aged 12 years and older, are now monthly podcast listeners.

But the key factor holding back further marketer investment in podcasts remains measurement challenges. While a slew of attribution and retargeting tools are being introduced, the lack of an established measurement system is “making it challenging to make the case to continue to shift more budget into podcasts,” said Anna Rudnick, group director at The Media Kitchen.

Part of the issue for measuring podcast ads is an absence of commonly accepted metrics. Without standardized and consistent metrics across platforms, “marketers are left with reports from multiple data sources that each use their own definition of a download or play,” Rudnick said. Due to the lack of standardization, podcast campaign performance reporting can be more of an art than a science.

Aside from platforms, publishers also contribute to podcast measurement troubles. “Publishers don’t have full-funnel measurement capabilities that tell you if someone actually bought the product after hearing about it,” said Veljic.

Given that marketers are under greater pressure to prove their spending is leading to tangible results, podcasts could be a tough sell to marketers who want a clear view into the results of their spend.

However, there are alternative solutions to some, but not all, of the podcast’s measurement woes. Promo-codes are an obvious method for marketers to track how direct-response campaigns are working. “We’re also increasingly seeing marketers push listeners to subdomains through podcast ads rather than use promo-codes,” noted Appelbaum. “If a consumer doesn’t buy the product, brands can develop a unique and discrete data asset,” he said.

In the end, marketers continuing to pour more dollars into podcast ads is proof that measurement issues aren’t a total roadblock to spending. In fact, marketers are actually now “including podcasts in their long-term planning,” said Pratt. Forecasting by the IAB predicts the amount spent on podcast ads will grow 28 percent next year from $514.5 million in 2019 to $659 million in 2020.

Meanwhile, publishers increasing podcast production will provide increased supply and an ability to reach more granular audiences. More podcasts mean more advertising opportunities and more chances for marketers to spend their money.

![]() 4. Chasing revenue, news publishers are producing more evergreen content

4. Chasing revenue, news publishers are producing more evergreen content

Life as a news publisher isn’t easy. Content can be expensive to produce, difficult to monetize, and often has a shelf-life of just hours or minutes as the news cycle spins quicker than ever.

In an attempt to offset those challenges, news publishers say they are now investing in more “evergreen” content instead, with the hope it will attract a steadier stream of traffic from search and social channels and better satisfy the demands of advertisers.

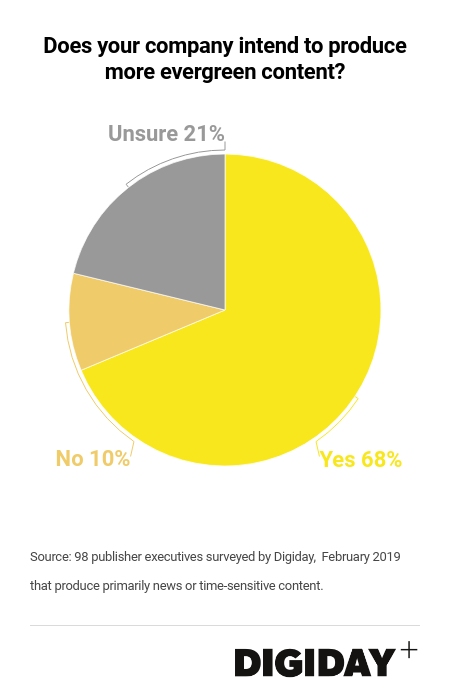

Sixty-eight percent of the news publisher executives surveyed by Digiday in February said their companies intended to produce more evergreen content this year.

Evergreen content isn’t necessarily what news publishers do or know best, but it has its appeal. Whereas breaking stories can quickly garner lots of views, they also become irrelevant faster. Content with a longer shelf-life lends itself better to repeated social distribution and, of course, search queries.

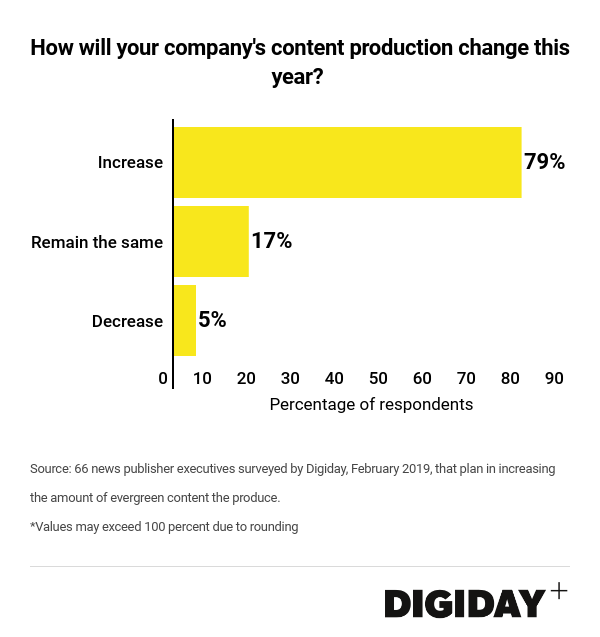

But producing content with longer-term appeal does not mean news publishers plan to pivot away from news. Rather, the hope is that more evergreen content can provide incremental traffic to shore up their less-predictable news gathering efforts. Of the news-based publishers who said they plan to make more evergreen content, seventy-nine percent said they still expect to increase their overall editorial outputs this year.

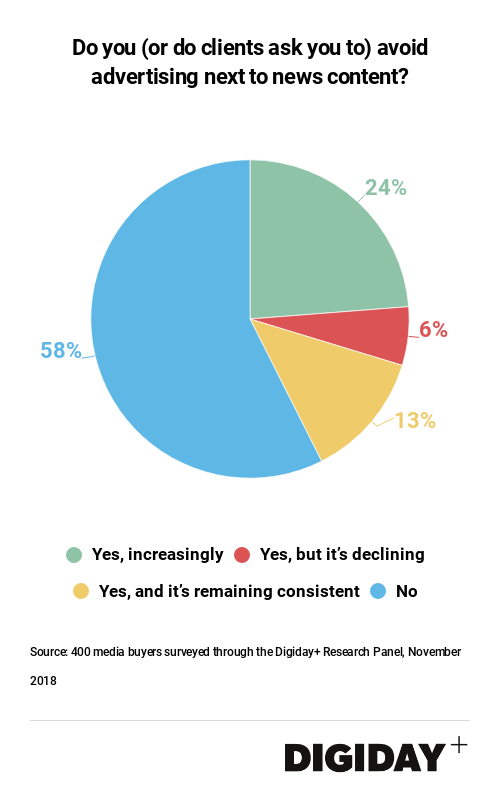

Another appeal of evergreen content for publishers: it’s typically more advertiser-friendly. As brand safety concerns persist, and advertisers express a growing desire to avoid sensitive and divisive issues in the news altogether, publishers say they’re finding it harder than ever to monetize hard news content. Ad buyers themselves report that clients are increasingly asking them to skip news sites altogether on their media plans. Earlier Digiday research found that 43 percent of media buyers avoid advertising next to news-related content.

PinkNews discovered that producing more long-tail content has allowed it to plan more proactively and form deeper relationships with potential advertisers than when just selling just programmatically according to Ellen Stewart, head of platforms at PinkNews. “It enables us to go to advertisers with a calendar of evergreen features. From there we can ask them if they want to partner on any of it and collaborate on more creative solutions,” she said.

For those publishers courting commerce dollars, evergreen content can serve multiple purposes. Buying “guides” and product reviews can prove effective at generating both audience and commerce revenue for publishers while potentially reducing their reliance on ad revenue in the process. Major news publishers such as the New York Times, Insider and New York Magazine have all pushed into affiliate commerce with evergreen content in recent years with The Wirecutter, insider Picks and The Strategist, respectively.

A look into publisher revenues by Digiday this past fall found that 35 percent of publishers now generate e-commerce revenues, primarily through affiliate links. Additionally, 62 percent of publishers generating income from e-commerce said those revenues grew in the past year.

Other publishers said evergreen content can simply be resurfaced more frequently than hard news. “Adding evergreen content or headlines that highlight a specific lesson and are tied to a news event helped us differentiate our articles,” said Allison Fass, vice president of digital growth at Mansueto Ventures, parent company of Inc. and Fast Company. Because so many publishers report on the same story, it can be difficult to stand out. By taking a different approach, both Inc. and Fast Company can still cover breaking stories while wringing more value out of them, she said.

![]() 5. 70 percent of publishers say they personalize content

5. 70 percent of publishers say they personalize content

A survey of 200 publishers by Digiday this month found that most (70 percent) personalize the content they deliver to visitors. Once frowned upon by editors and consumers alike, the practice is becoming mainstream or publishers are now more willing to talk about it.

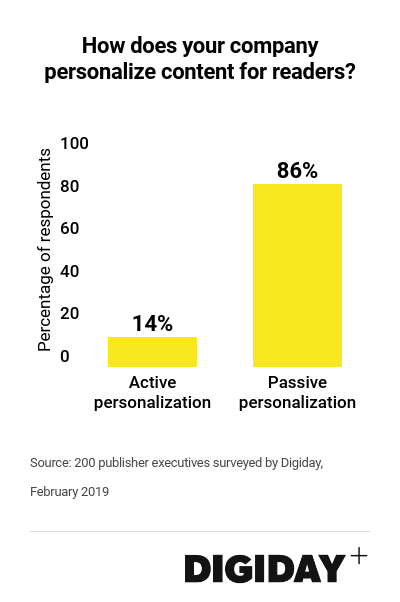

However, readers might not always be aware they are served different content than the person sitting next to them. Eight-four percent of publishers that do personalize content said they conduct passive personalization rather than active personalization. Passive personalization utilizes information like readers’ location or browsing history to tailor to the content they see, whereas readers self-select the content they wish to see more or less of in active personalization.

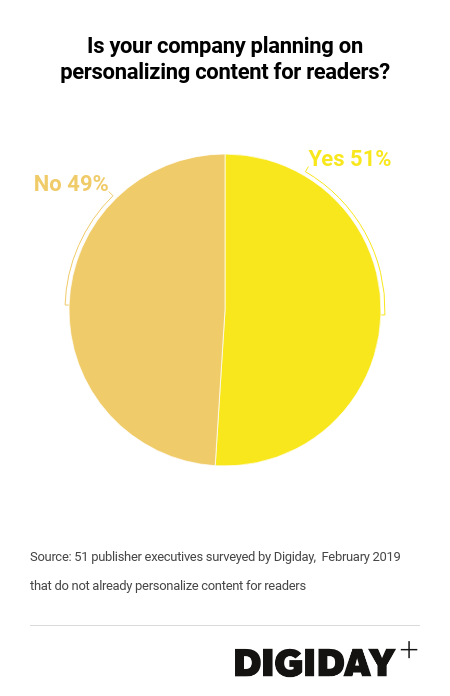

Over time, personalization is likely to become more popular among publishers. Half of publishers that do not currently personalize content said they are developing plans to do so

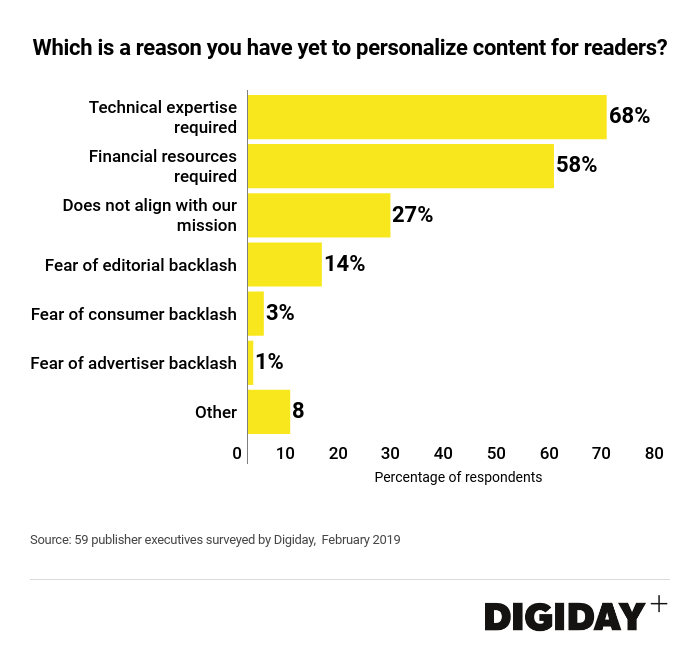

Costs, both technical and monetary, are holding publishers back from achieving personalization. Sixty-eight percent of companies that do not personalize content said they lack the technical expertise required and 58 percent were short of funding for such projects.

Fewer respondents choose not to tailor content for readers due to ethical qualms or potential sources of backlash according to the Digiday survey. Only a quarter of respondents not personalizing content said it ran counter to their editorial missions and just 14 percent were worried about potential pushback from editors.

“Overall, I’ve seen publishers worry about not sounding caught-up if they’re not doing some form of personalization,” said one anonymous publisher executive. “They think they’re being left behind.”

Part of why personalization has become so widespread among publishers is that it has become a catchall for a number of projects. Tailored content has evolved beyond algorithms customizing homepages and now includes everything from popular-articles widgets to newsletters constructed based on reader interests.

“We don’t hear about personalization from readers,” said Jason Jedlinski, svp of consumer products at Gannett. He pointed out to social platforms like Facebook and Twitter for changing readers expectations around personalization.

![]() 6. Publishers look to technology to help keep down editorial costs

6. Publishers look to technology to help keep down editorial costs

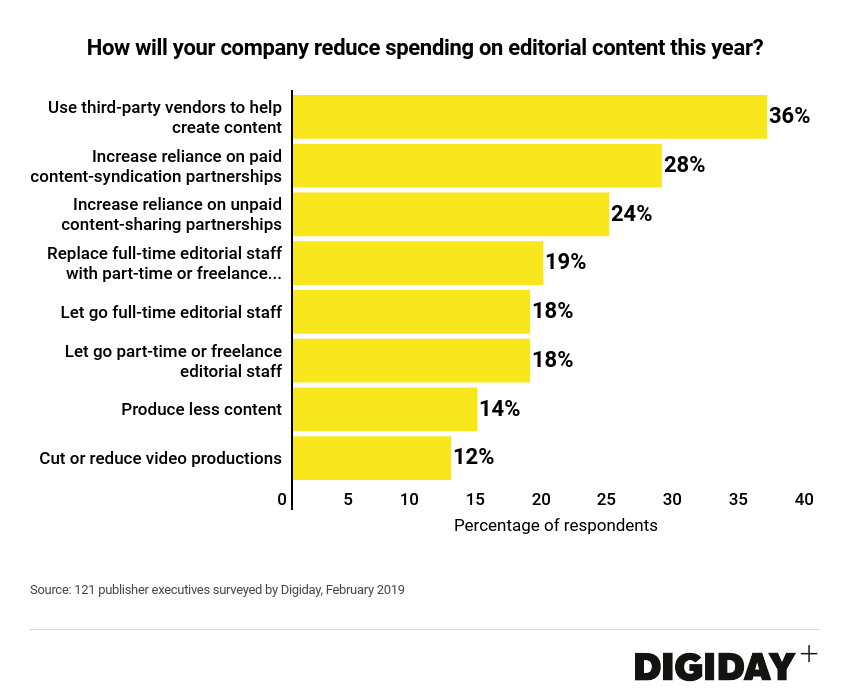

Publishers are turning technologies like artificial intelligence and content-curation vendors to create content at lower costs. Thirty-six percent of the 121 publishers surveyed by Digiday this month that are trying to costs said they are turning to vendors and AI tech.

Syndication and licensing from other publishers was also a common choice. Twenty-eight percent of publishers said they would rely more on paid content sharing agreements with other publishers, and 24 percent would utilize more unpaid content partnerships.

The Associated Press used an AI product to help write articles covering quarterly reports and sports that increased the amount of content it created by 1200 percent while saving reporters 20 percent of their time. Using AI in the newsroom “is not about shedding humans jobs. We think of AI as complementary to our editorial teams,” said Jeremy Gilbert, director of digital strategies at the Washington Post.

Gilbert said that Heliograf, the Washington Post’s technology, saved staff time by analyzing polling results in battleground states during the midterm elections.

Content licensing and syndication deals with other publishers offer publishers an alternative strategy. Publishers receiving content can use that content to fill gaps in their coverage areas. As publishers work to increase the amount of content they produce to meet consumer demands, licensing and syndicating content can be an effective strategy to help meet that demand. But publishers are not limited to working just publishers. Though online portals like Yahoo and MSN are becoming less important syndication partners, platforms like Facebook are picking up some of the slack.

7. 44 percent of publishers plan to work with fewer ad-tech vendors

For most online publishers ad revenue isn’t getting any easier to come by, as platforms swallow up a growing portion of advertiser budgets and layers of middlemen continue to chip away at media dollars before they reach publishers’ sites. As a result, the need to wring the greatest yield possible from their programmatic operations is only becoming more pronounced.

One way publishers are doing so is by actively shrinking the numbers of ad-tech vendors they work with.

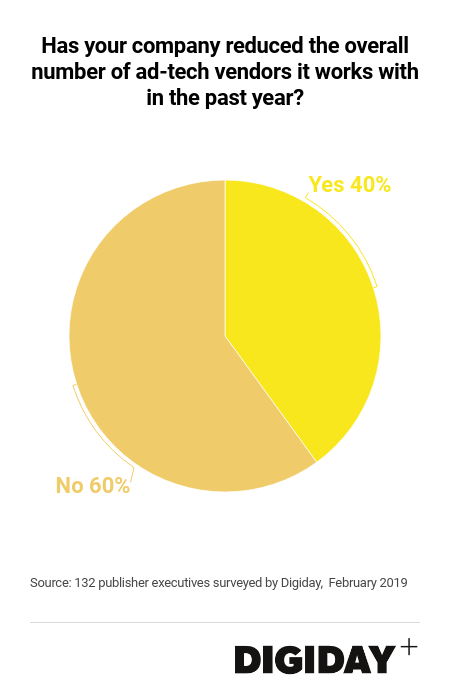

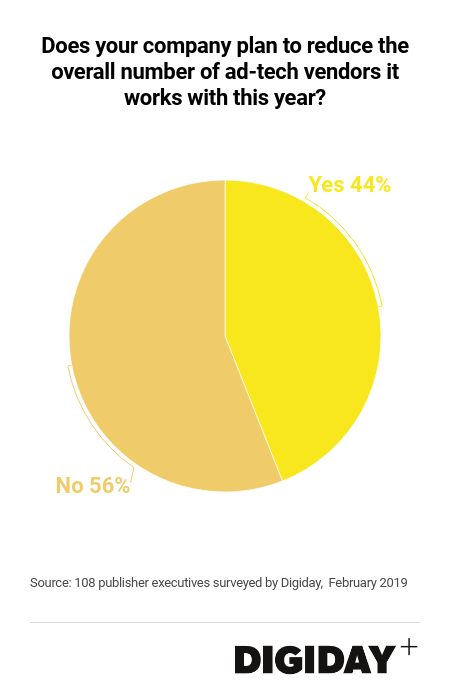

In a Digiday survey of 132 publishing executives with knowledge of their companies’ tech stacks conducted this February, 40 percent said they reduced the number of advertising-related vendors they work with in the past 12 months. Meanwhile, 44 percent of respondents also said they intend to cull the overall number of ad tech partners this year.

“There is definitely more momentum now to cut vendors rather than adding more,” said Paul Bannister, evp of strategy at Cafe Media, adding, “In most cases we found that more partners bring very little truly incremental value and solely exist for their own benefit and not actually to serve the publisher themselves.”

Part of the incentive pushing publishers to cut vendors is a maturation of their approach and a shift to cheaper in-house options. For the past two years, Ranker has undergone a mission to diminish its reliance on external vendors and build more of its advertising offerings in-house, for example, according to its chief technology officer Premesh Purayil. “By taking greater ownership of our advertising infrastructure we’ve been able to develop several more cost-effective solutions similar to the technologies vendors are offering,” he said.

While publishers might not be able to build tech such as brand-safety and fraud detection tools themselves, functions such as ad-serving and header-bidding might offer easier opportunities to cut out vendors.

Purayil thinks his experience of building in-house tech and then dropping vendors is far from unique. Rather than a single event like the enactment of the General Data Protection Regulation in Europe or growing adoption of ads.txt, he believes publishers are slowly and independently taking ownership of more of their advertising tech, which naturally leads them to cut vendors eventually. “Over the past year or so, I’ve seen more publishers now allocate at least one developer to advertising products. Once you get into the ad-tech side and are big enough, you worry about making sure your advertising products are independent enough.”

Earlier Digiday research found that 55 percent of publishers will increase their spending on ad technology in 2109.

As publishers’ understanding of programmatic advertising matures, their ability to evaluate and hone on those third-parties adding real value is improving also. Publishers are getting a better idea of what’s working for them and are whiting their partners down, and have moved beyond simply throwing technology against the wall to see what sticks.

For others, consolidation is a driving force behind their need to streamline. “After we were acquired, there’s naturally overlapping technology between the companies. Since last year, we’re in the process of trying to merge or let go of the redundant vendors we use, but it takes time,” said one anonymous executive. Given the continued consolidation in digital media, vendors could increasingly find themselves out in the cold as the market shrinks.

Elsewhere, advances in tech mean working with fewer partners is increasingly feasible. After adding on a lot of demand partners when header bidding was first created, “we’ve cut back the number of SSPs we’ve worked with – at one point it was above 40 to now just over 30 this year,” said Marc Ropelato, director of programmatic revenue at Future Plc.

He noted that most of the SSPs Future Plc no longer works with were smaller vendors that hardly bid or won any ad impressions. Now, if Future is considering new SSPs, Ropelato said, “we want to make sure they have unique demand sources, otherwise we can fill that ourselves.” Research from Pathmatics found that SSP use among publishers declined by 26 percent from 2016 to 2018.

Working with fewer ad-tech vendors also has obvious advantages for publishers. Doing so can improve publishers’ site speed, reduce ad load times, better reader experience and create more predictable revenue.

As publishers continue to take ownership of their advertising products or become consolidated into other companies, the trimming of their programmatic offerings of excess vendors is likely to continue. For vendors, well they can do themselves a favor by actually providing meaningful value to advertisers.

![]() 8. 52 percent of publishers haven’t started preparing for the California Consumer Privacy Act

8. 52 percent of publishers haven’t started preparing for the California Consumer Privacy Act

The California Consumer Privacy Act will come into effect in January, but many publishing executives remain completely unaware of the new law.

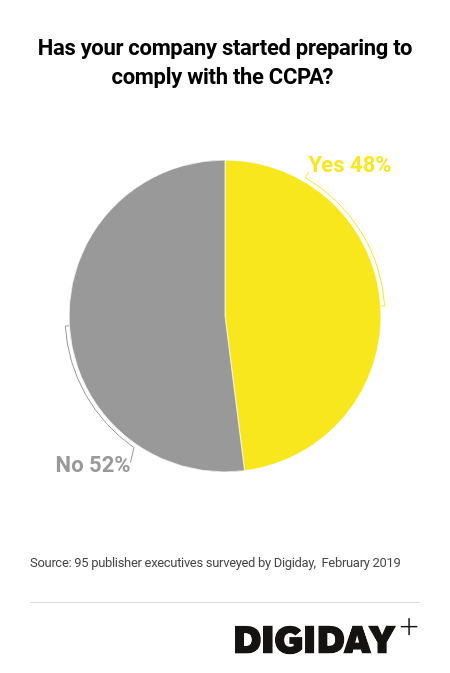

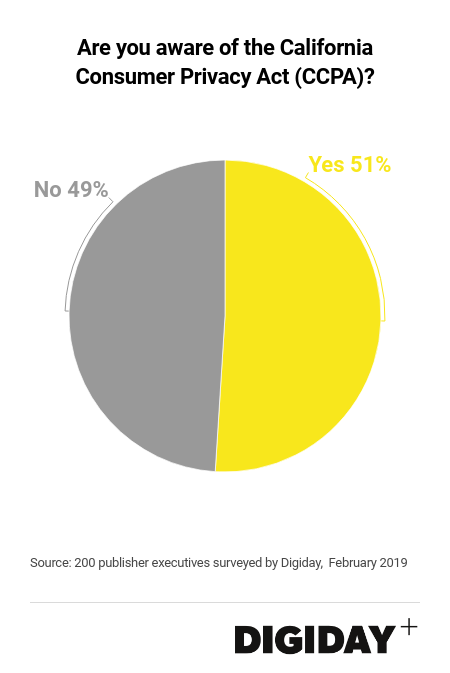

When Digiday polled 200 U.S. publisher executives this February only half of them said they were aware of what CCPA was, and over half of those aware of it said their companies have not yet begun preparing for its introduction.

The CCPA will grant California’s 40 million residents access to any personal data collected from them by publishers and other online advertising companies, and will allow them to request its deletion. The law could also mean penalties on companies of up to $2,500 per person for each violation they commit, such as selling the information of a person who has specifically asked that their information not be sold.

But despite the fact the legislation becomes enforceable in less than a year and could have considerable financial repercussions for non-compliant companies, few publishing executives who were aware of the legislation said their companies were taking steps to prepare. Of the respondents who know of the CCPA, only 48 percent said their companies had begun work to ensure compliance.

If companies have yet to begin working on CCPA regulations, they should do so quickly. Some believe that complying with the CCPA will be harder than adhering to General Data Protection Regulation. Compared to the four years companies had to prepare for GDPR, publishers have just months to prepare for CCPA.

And because CCPA is not identical to the GDPR that went into force last May in the European Union, companies won’t be able to copy and paste their GDPR provisions to their California audiences and claim to follow the law. There are some “overlapping similarities”, however, according Stephen Hicks, general counsel at Ziff Davis.

To make matters more complicated, there remains significant uncertainty around what the final legislation will actually look like due to potential amendments, trade group recommendations and ongoing lobbying efforts in Congress to create Federal-level laws.

Because of the uncertainty, “no publisher can say it’s completely compliant now,” said Hicks. But he added, “it is not too soon for publishers to spend time understanding it and taking measures to prepare like updating privacy policies.” Other steps publishers can take is mapping out their user data sources to more easily identify California residents data. Building out and testing “Do Not Sell” buttons on their homepages for consumers to opt out of having their data sold to third-parties isn’t a bad idea either.

One reason CCPA hasn’t garnered as much attention in the media world as GDPR is that agencies and brands aren’t reliant on publishers gaining user consent for them to collect consumer information. Unlike GDPR where companies needed a legal basis to collect consumers personal information, that is “not necessarily an issue with CCPA,” said Hicks. Without shared responsibility to collect personal user data, marketers aren’t culpable if publishers aren’t compliant.

Some publishers are adopting a wait-and-see approach with regards to CCPA regulations. One mid-sized publisher told Digiday that it was waiting, “to see if the Federal government steps in,” before it spends time and resources to the issue.

Regardless of the reason, many expect publishers to scramble at the last-minute to satisfy the CCPA requirements. The anonymous publisher admitted, “we didn’t start working on GDPR until six months before the deadline, and we’ll probably do the same for CCPA.”

Meanwhile, publishers have other reasons to be concerned with the CCPA. Under it, consumers can request publishers stopping selling their personal information to third parties like agencies or ad-tech vendors that use it for targeting purposes.

While selling audience data does not provide significant revenues for publishers, it is not uncommon either. Earlier Digiday research found that nearly 25 percent of publishers sell their audience data. And in a time of squeezing margins for media businesses, every extra dollar helps.

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.