Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In Graphic Detail: What to expect in media in 2026

Though the Christmas party season is just around the corner, CMOs and agency partners are hard at work plotting out budgets and media plans for 2026.

Ammunition for next year’s best laid plans can be found in a tranche of recent forecasts from WPP, Dentsu, consultancy Madison & Wall and WARC.

One key finding in WPP’s end of year forecast was the prediction that retail, financial services and travel media spending would overtake all television by the end of this year. “Using commerce data to target and measure shoppable TV is something that just wasn’t possible a few years ago, and is only getting more accessible as players like Amazon expand the footprint of entertainment partners they work with,” said Ryan Walker, head of retail at PMG.

TV advertising companies, meanwhile, want to lean into the demand for commerce and commerce-adjacent media. Minai Bui, director of product marketing at Samsung Ads, told Digiday that building out its suite of shoppable and interactive ad formats was a high priority.

“Shopping on TV isn’t the natural instinct right now. So in order to change that behavior, we do need to make sure that it’s really seamless,” she said.

There’s more than just the changing of the marketing guard here, though. Let’s take a look around the corner.

Midterms and the beautiful game drive American ad investment

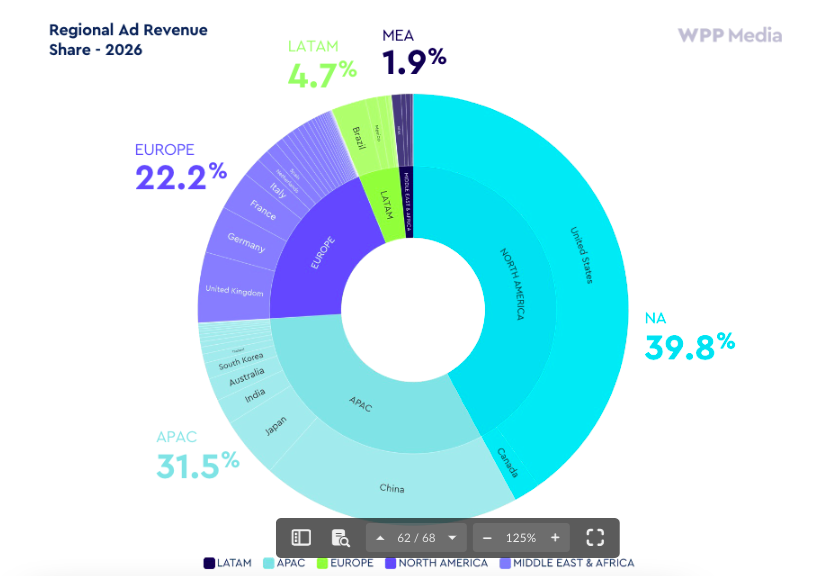

Credit: WPP

North American ad revenue, which totaled $452.9 billion this year, will grow 7.6% in 2026 per WPP’s This Year Next Year report. As usual, the bulk of that spend, and its growth, will come from the United States, though Mexico and Canada’s ad markets should expect an assist from the soccer World Cup. The U.S. is also predicted to see high political ad spend in the run-up to the midterm elections later in the year.

Other drivers of macro advertising growth to keep an eye on include AI investment and freedom from the ambiguity sewn this year by President Trump’s tariff push. As such, WPP’s overall ad revenue projection suggests global ad revenues will rise 8.8% next year.

Booze and tech boost ad dollars

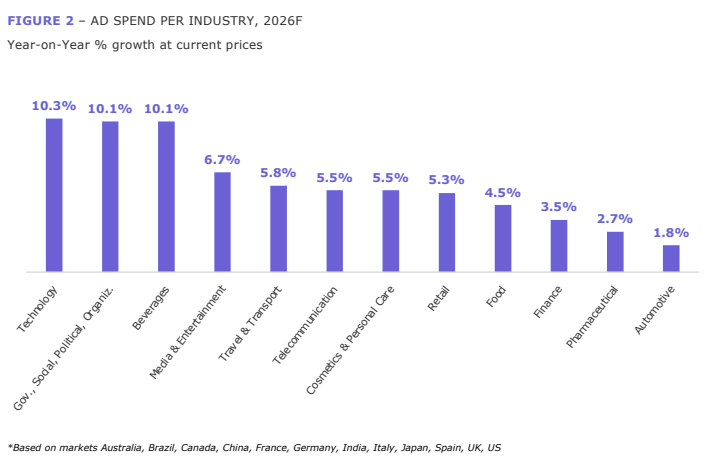

Credit: Dentsu

Product launches and the need to put branding meat on the bones of AI products are expected to drive higher tech spending next year, while global government and political spending will be boosted by elections in Brazil and the U.S.

Rising demand for alcochol-free options and sporting events like the World Cup or the Winter Olympics will boost beverage spending. (Depending on your political persuasion the midterms themselves, of course, may also be driving beverage demand.)

More ad spending will be programmatic spend

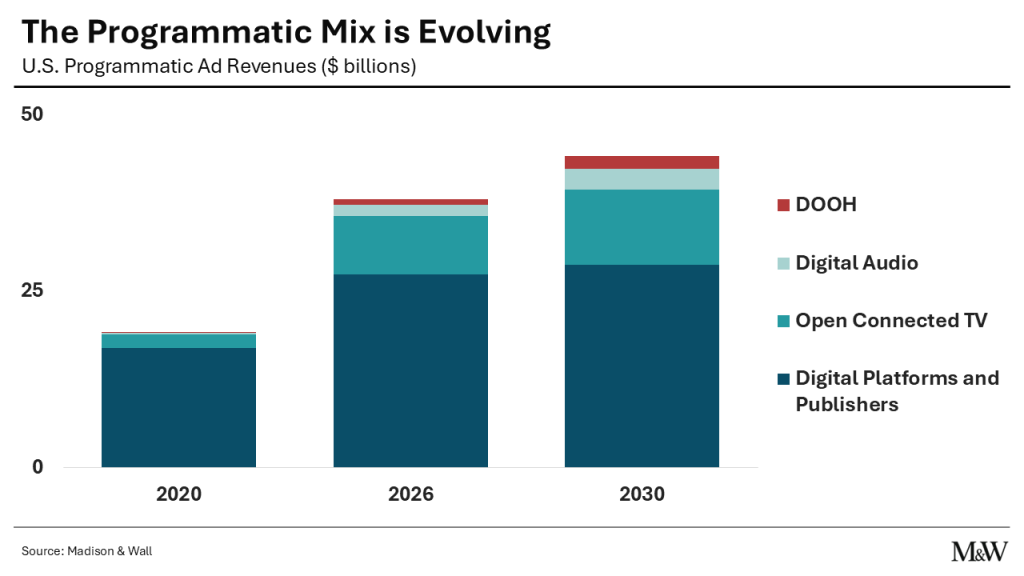

Credit: Madison & Wall

More television, more audio and more commerce media will be transacted programmatically next year, according to Madison & Wall’s December update to its Q4 forecast.

Programmatic digital out-of-home and digital audio will both rise 30% next year while open CTV inventory will increase by 26%, contributing to 4.4% overall growth in programmatic spend next year. Madison & Wall estimated that programmatic buying will account for 74% of total open web revenues next year.

…but less of that will go to the open web

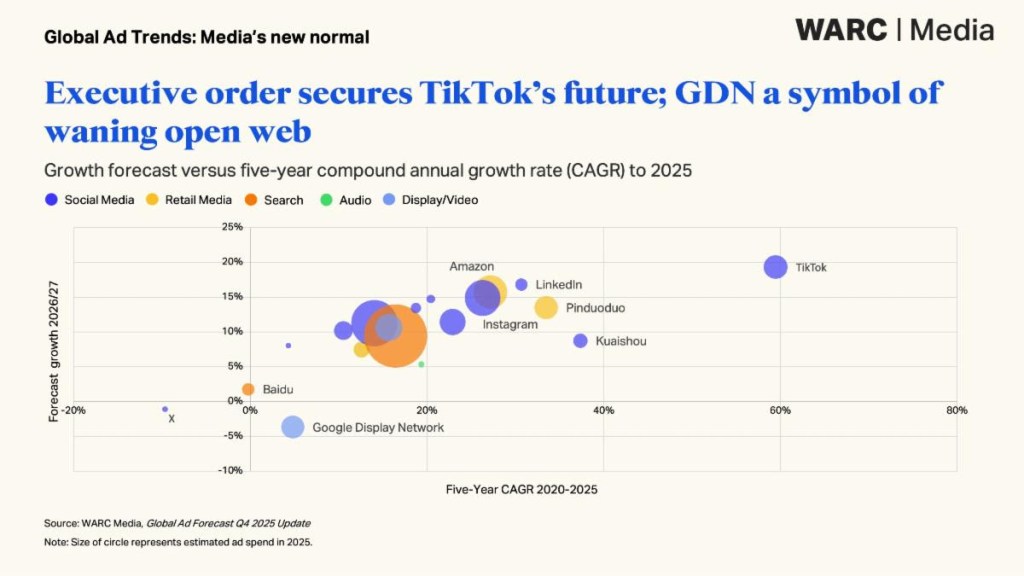

Credit: WARC

Make no mistake however — the walled gardens are where most growth is happening.

Revenue at Google’s Display Network will fall for the third year in a row in 2025, and continue to fall through to 2027. Meanwhile TikTok is on course to bag $45.2 billion in ad revenue by 2027, while Meta, Alphabet and Amazons’ combined share of the global ad market (58.8%) will eclipse China’s by the same year.

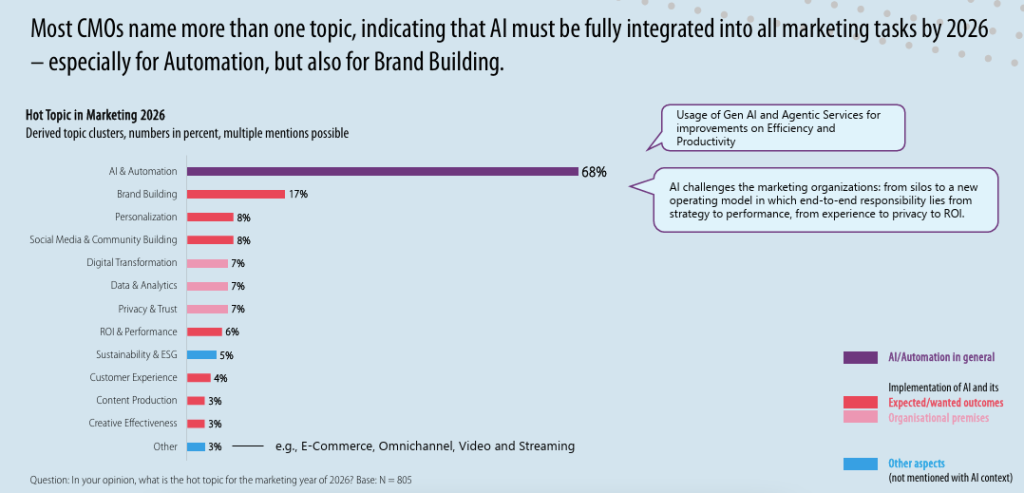

AI eclipses other marketing priorities

Credit: Mediaplus

Glaciers and polar bears are nice-to-haves, but far from essential, it seems. A survey by European media agency Mediaplus of over 800 marketers found AI & automation their top priority going into next year, well above creative effectiveness, sustainability or indeed brand-building activities.

51% of marketers rate efficiency as the highest potential AI outcome, according to the same survey.

More in Media Buying

The Rundown: Ad tech’s performance in 2025 was overshadowed by AI concerns and Big Tech

Despite revenue increases, the markets were brutal but reports over talks with OpenAI proved later upside.

As brands respond to AI search, walls crumble between paid and organic

Agencies are knitting SEO and PPC teams closer together as they adapt to the new rules of search that are driven by the use of generative AI.

Future of Marketing Briefing: Epsilon’s quiet bet against the LLM gold rush

In advertising’s AI race, Epsilon says the winners won’t pick one mode. They’ll orchestrate many.