Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Pitch deck: How Amazon is selling ads on Prime Video to advertisers

This article is part of an ongoing series for Digiday+ members to gain access to how platforms and brands are pitching advertisers. More from the series →

Amazon bulldozes into new markets, upending the status quo and challenging rivals. Today, it’s the turn of the ad-supported streaming world, and Amazon is coming out of the gate strong.

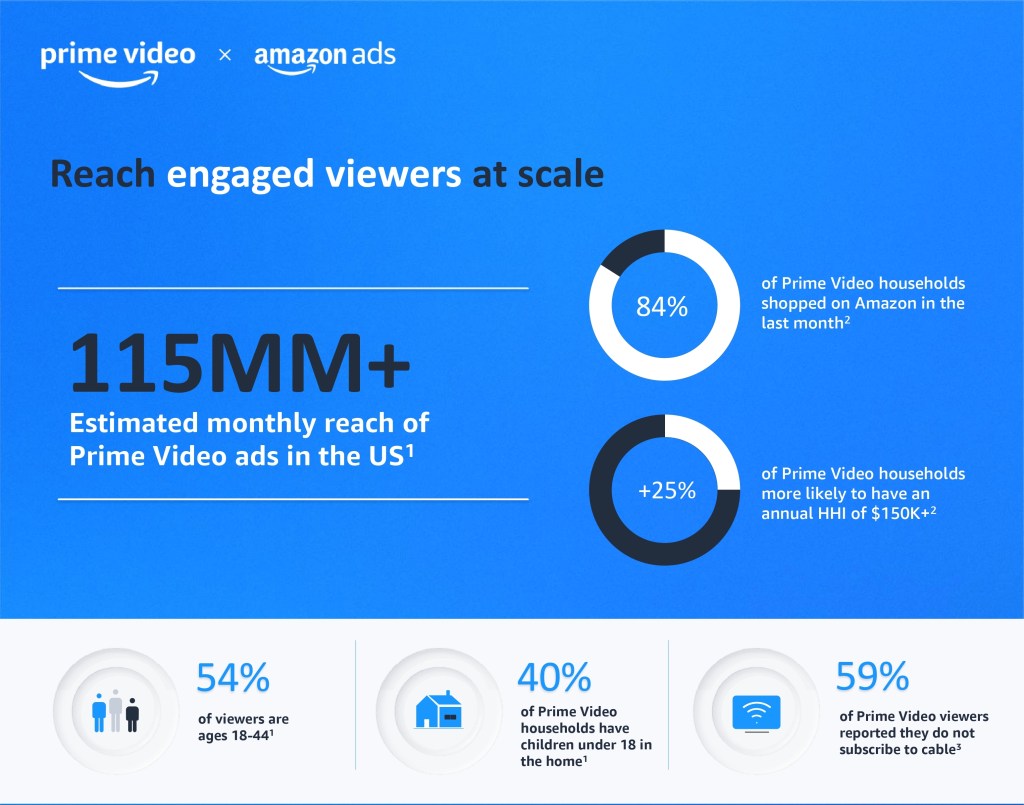

Why, you ask? Because Amazon is serving marketers an opportunity beginning today to reach a whopping 115 million monthly viewers in the U.S. alone, courtesy of its bold move to make the ad tier default for tens of millions of subscribers worldwide.

Speaking of scale, this kind of reach is bound to make existing advertisers reach deeper into their pockets for Amazon, especially those larger advertisers who tend to spend big on TV. In fact, Amazon is already knocking on the doors of holding group brand teams to fan the flames of that interest. Mind you, this is on the cusp of a presidential election cycle and Super Bowl spend frenzy.

Could the relatively high $36 CPM (cost per thousand impressions) undermine those discussions? Not a chance. Advertisers are eagerly embracing the chance to partner with Amazon, thanks to the invaluable retail and e-commerce data they provide, coupled with a robust closed-loop attribution system that’s tough to match.

Add it all up and this is a boon for a lot of marketers, no doubt about it.

Sure, they have to buy ads on Prime Video through Amazon’s ad tech, and yes none of those buys will include Thursday Night Football games or Amazon Freevee. But let’s be real, none of that’s going to scare them off. Not when those same marketers can choose between the ease of a managed service or being in the driver’s seat, advertising across Amazon Originals from Prime Video and licensed TV and movies through sponsorships, guaranteed buys and preferred deals at the aforementioned CPM prices. These prices, of course, will shimmy up or down depending on the audience, falling in the mid-to-low $30 range.

“I think what I’m most excited about is having more buyer signals, and really understanding the audience to really help our brand partners understand who they are getting in front of today,’ said Stephen Tyler Reagan, who has considered advertising on Prime Video in his capacity as president and chief strategy officer at global retail media and marketplace agency Macarta, a division of Mindgruve. “But also you stack that with business and brand objectives.”

Comments like this weren’t unusual in the reporting of this article. Buyers seem genuinely pumped about advertising on Prime Video. They don’t believe it’s going to face the same uphill battle that some other ad-funded streaming platforms have encountered.

So much so that industry observers, from Winterberry Group to Insider Intelligence, predict Amazon will be a driver of CTV ad spending in 2024 and beyond. The real question is how big a driver it will actually be. Forecasts range from $3 billion (Bank of America) to $6 billion (UBS), but the likelihood is that Amazon will net out on the lower side.

What lies ahead for Amazon

Remember, Amazon’s ad-supported and ad-free content already share users’ time, so it’s not an overnight shift from no ads to all ads. It’s been happening incrementally — arguably as far back as last May when Amazon migrated over 100 Amazon Original series and movies from Amazon Prime Video to its ad-supported free streaming service, Amazon Freevee. This marked the first time marketers could advertise against this content batch, and in a traditional ad format. Spending shifted accordingly, and the chances are it’s only going to do so again now all Prime Video is open to advertisers — well at least to a point.

As Insider Intelligence principal analyst Ross Benes put it: Prime Video will inject “a few billion dollars” into the CTV ad market by 2024. While it’s not definitive, the data on Amazon’s estimated ad revenue from streaming across all of Amazon (including Prime Video, Freevee, Twitch and Fire) in the U.S. offers a glimpse of what lies ahead. This year, it’s expected to account for 10.7% of Amazon’s ad revenue, up from 7.3% in 2023. Some of this growth will come from ad dollars from traditional TV, and some of it will come from other streaming platforms, said Benes. Not to mention the upside from a general increase in streaming ad spending as more ad inventory becomes available, he continued.

Regardless of where the money comes from, it’s probably going to be spent by Amazon’s seasoned marketers — those who’ve mastered advertising on Amazon’s search and display ads and are hungry to invest more in video. This unanimous sentiment is shared by the seven ad buyers interviewed by Digiday for this article, with their clients already strategizing ways to expand their existing Amazon deals through Prime Video advertisements.

“What Amazon is doing with Prime Video is exciting because it allows my team to talk to endemic partners about incrementality, and the idea of expanding their digital shelf beyond optimizing against sponsored product ads,” said Molly Hop, evp of Havas Media Network’s e-commerce business Havas Market.

But make no mistake, those dollars aren’t the endgame.

Ultimately, Amazon needs ad-supported streaming to lure a fresh wave of brand dollars into its ads business. This way it becomes a place for all advertisers to spend more money, not just those with a storefront there.

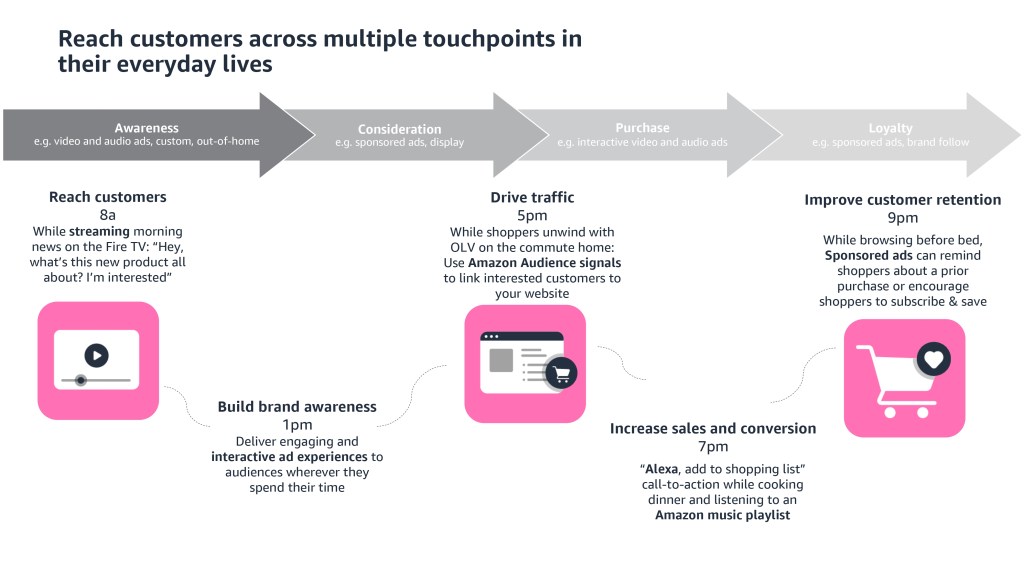

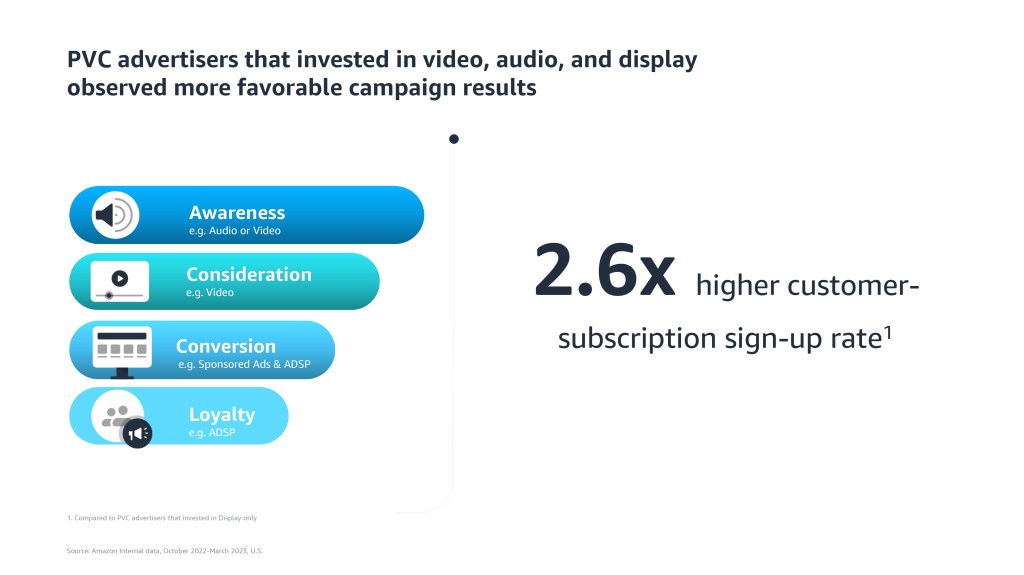

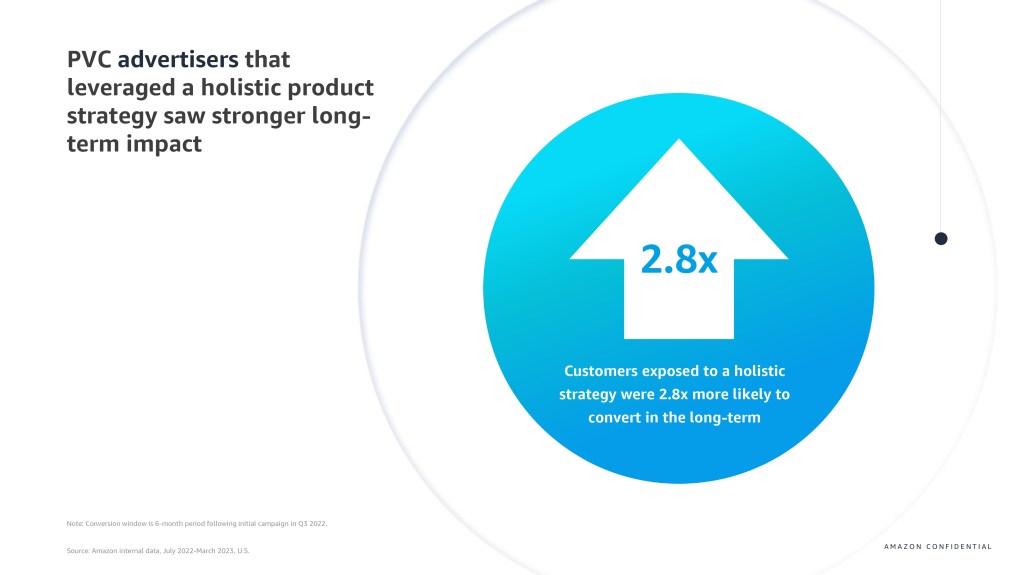

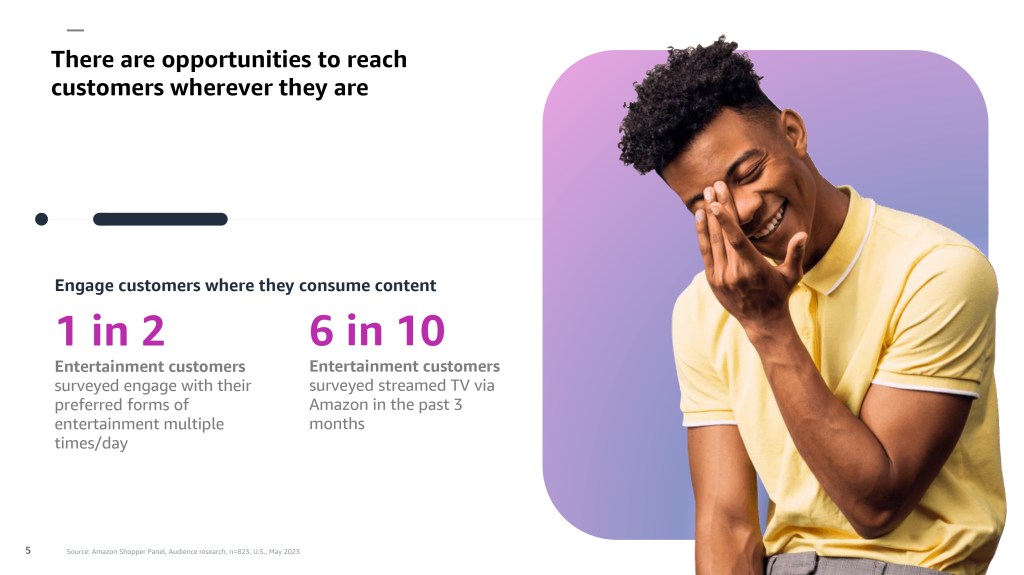

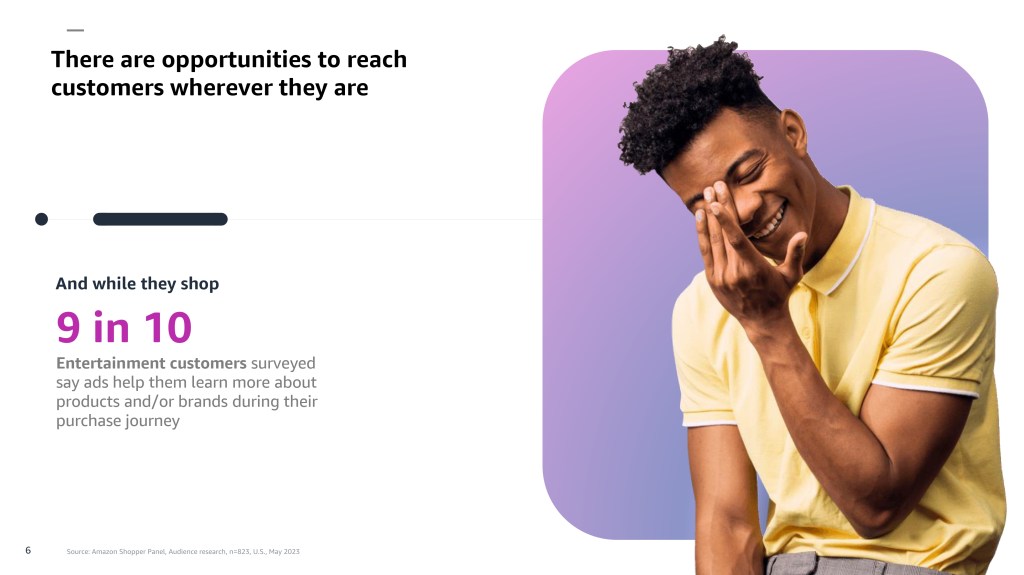

It’s all there in its pitch to advertisers. Amazon wants it to cater to as many of them as possible so there’s less emphasis on advertising on Prime Video as a standalone offering and instead positioning it as an integral part of a comprehensive media buying strategy.

And this approach appears to be striking a chord.

What Amazon is offering

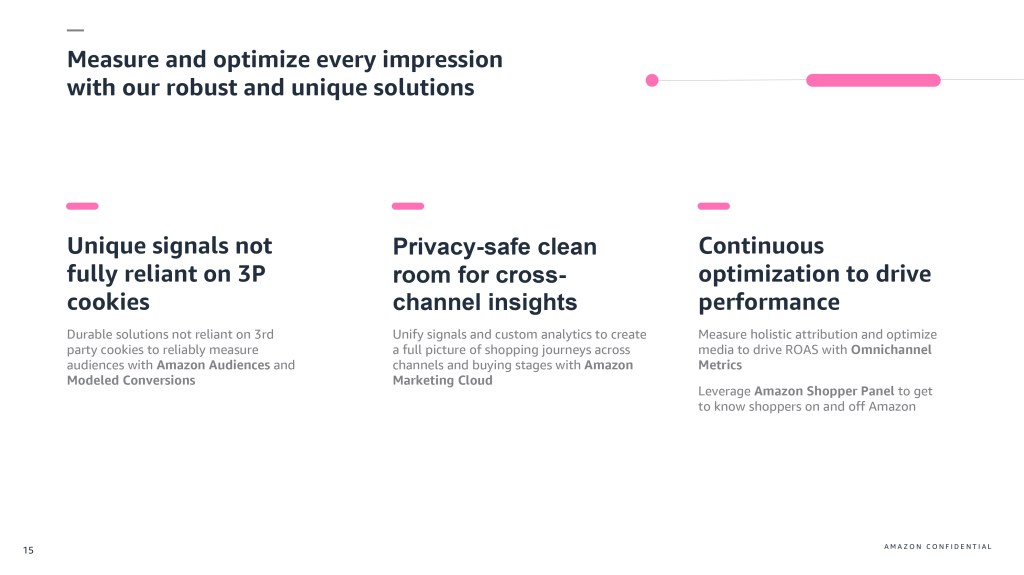

Marketers who have been on the receiving end of Amazon’s pitch have been notably impressed by the platform’s flexibility and adaptability. Gone are the days when they had to navigate the complexities of working with the Amazon Web Services team, which wasn’t always the most accommodating in accessing such critical data. Now, they can do this through the demand-side platform, as it’s now integrated with the Amazon Marketing Cloud.

These technical tweaks mean marketers can blend their own first-party data with Amazon’s vast trove of data within the Amazon Marketing Cloud clean room. This then allows them to promote their brands, boost sales, and even set the stage for subsequent purchases across the Amazon ecosystem, all without any concerns about data integrity.

And if that’s not enough, Amazon’s ads business comes fully loaded with all the bells and whistles a marketer would expect from an ads business of this scale.

Think third-party verification so that advertisers can run the rule over advertising Amazon wants them to check. Then there’s standard demographic targeting, bolstered by some extra contextual and lifestyle features.

Plus, there’s the promise of predictive segments, data partnerships with the likes of GrubHub as well as smart algorithms to prevent people seeing the same ad too many times.

These aren’t the typical Amazon fare advertisers are accustomed to. In the past, cobbling together your total investment with Amazon has been like solving a complex puzzle. But now, the tides are turning, and it’s becoming a whole lot simpler. As Sam Bloom, head of partner strategy at PMG, explained: you can bring your first-party data to Amazon and say “I want to understand how we can understand how people like them consume content on Amazon or spot various triggers, and the team there are able to help. It’s not just simply over in this place called Amazon Marketing Cloud or Amazon Web Services. It’s all connected in one place where you can buy.”

When you add it all up, it seems a bit of a head-scratcher as to why the early forecasts for Amazon’s dive into ad-funded streaming are playing it so safe. Even the buyers we’ve chatted with aren’t going all out to hype it up. They’re saying advertisers are “leaning in,” which basically means they’re intrigued but not fully committed. But dig a little deeper and it all starts to make sense.

It’s a lot for marketers to digest. The way they advertise on Amazon could potentially undergo a seismic shift with the arrival of advertising on Prime Video. It was always going to take some time for marketers to navigate this. As Bloom put it, the challenge here is whether a marketer uses 5% or 80% of the platform. Amazon needs to prove itself, especially to performance advertisers early testers of this new inventory. If the results don’t stack up, they might walk away.

That being said, Amazon now wields more bargaining power than ever to persuade even the most skeptical advertisers to invest. They’ve got incentives in their arsenal. Some are tied to specific campaigns, so if a marketer spends $50,000, they’ll get a 20% rebate in free impressions. Of course, there are some conditions to these deals. Namely, that those free impressions are un-targeted media.

On the flip side, there are other incentives linked to vendor media joint business plans and agreements. If the vendor commits a certain amount of money and is part of a larger retail program or partnership, Amazon sweetens the pot with $100,000 in upper-funnel managed service media through Twitch, IMDb, or any other video channel it owns.

View the full pitch deck below:

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.