Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Advertisers are divided over branded content efficacy

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday Marketing Summit in December, we sat down with over 30 industry executives from major brands across the country to discuss developing trends such as branded content. Check out our earlier research on brands’ social media spending here. Learn more about our upcoming events here.

Advertiser aren’t sure if branded content works

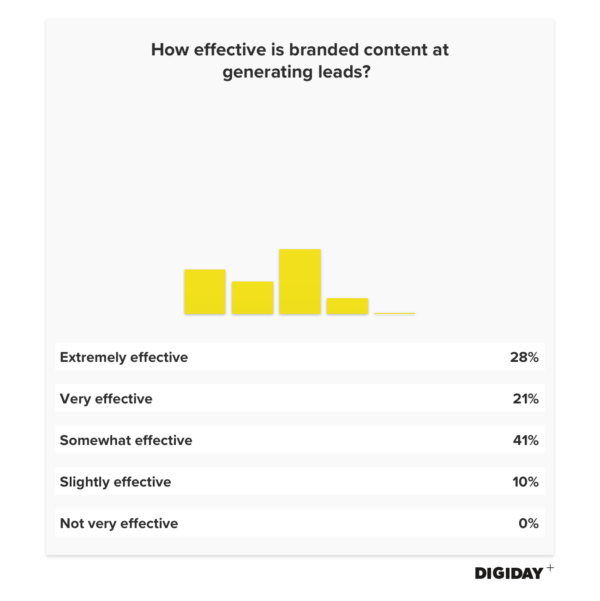

Brands are spending a lot of money on branded content — $10 billion in 2016, to be exact, according to Forrester’s most recent report. Given how much is being spent, marketers might expect branded content to perform exceptionally well, but that’s not necessarily the case. Respondents to Digiday’s survey were split on the effectiveness of branded content. Although no one thought branded content was completely useless, marketers we surveyed were just as likely to consider branded content incredibly effective or just somewhat effective.

Brands themselves aren’t particularly adept at producing branded content. Research from Havas on brands’ content found that 60 percent of consumers think brand content is “clutter” and is “poor, irrelevant or fails to deliver.” As a result, companies increasingly rely on publishers and publishers’ in-house teams to produce content for them. The BBC, Bloomberg, PopSugar and The Telegraph are among the many publishers that have dedicated in-house content studios.

Marketers, wanting to assess the effectiveness of branded content, have pressured publishers to provide tangible results from campaigns. Publishers have responded by supplementing their standard metrics with additional data. The BBC used eye-tracking technology for its clients to measure how readers engaged with their branded content. This is part of a larger effort for the BBC to rely less on traditional metrics such as pageviews and time spent on page. The BBC is not alone in its pursuit of new data metrics to value its campaigns. The Telegraph is capitalizing on data from thousands of previous campaigns to create benchmarks for performance guarantees on its branded content campaigns. Bloomberg Media Studios worked with a third-party research firm to provide an extra layer of campaign analysis. Vice similarly teamed up with Millward Brown to survey readers. The stakes are high to prove the effectiveness of branded content for Vice and other publishers, as custom content becomes an increasingly larger part of companies’ revenues.

Content studios face demand challenges

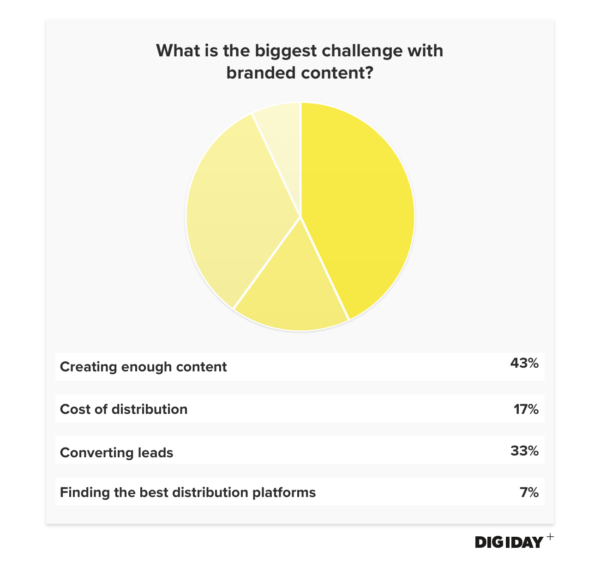

The amount of publishers that offer branded content has ballooned since 2013, from around 15 companies to over 1,000 in 2017. Yet meeting demands for content is still the greatest challenge advertisers face, with 43 percent of respondents indicating it as their No. 1 obstacle. That’s partly due to the increasing expectations for content studios, with many now producing videos, podcasts and GIFs.

Kayvan Salmanpour, who formerly ran the New Republic agency Novel, summed up the challenges of creating sufficient branded content, saying, “We didn’t have the scale, infrastructure, resources, technology to execute.” Brands and publishers that want to push their problems onto agencies shouldn’t expect better results, as agencies also report struggling to create this content.

More in Marketing

Pitch deck: Why Amazon believes its premium streaming inventory is worth the money

Amazon is pitching its DSP to make the case.

In Graphic Detail: The state of the marketing agency sector

Revenue figures from Omnicom, Publicis and Havas, and new employment stats, offer a snapshot on a quickly evolving industry.

Future of Marketing Briefing: The mental gymnastics of principal media

Welcome to the psychological CrossFit class of modern marketing. Here’s how marketers are learning to move through it.