Digiday Research: Agencies are struggling with demands for content

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Digiday’s “Research in brief” is our newest research installment designed to give you quick, easy and digestible facts to make better decisions and win arguments around the office. They are based on Digiday’s proprietary surveys of industry leaders, executives and doers. See our earlier research on the European publishers preparing for the GDPR here.

The demand for advertising content has ballooned to a $10 billion market in the U.S. based on Forrester’s most recent report. Speaking on the importance of content, one anonymous source at a prior Digiday Content Marketing Summit said, “Content marketing isn’t a nice-to-have; it’s a must-have.” That pressure has been heaped onto agencies, and they are struggling to keep up.

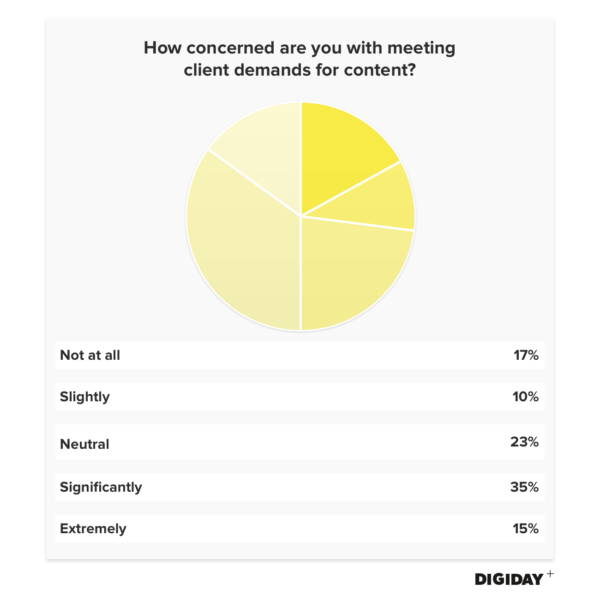

In a survey of 50 agency executives at the Digiday Agency Summit in Charleston, South Carolina, one out of two reported that they are significantly or extremely concerned with their company’s ability to meet client demands for content. Comparatively, just more than a quarter thought it was not at all concerning or slightly an issue.

This has forced some agencies into compromising positions, with several scrounging ideas from their competitors or other sources. Some industry voices have called for brands to hire specialized content agencies of record as a solution to forecast demand. Elsewhere, publishers have rapidly emerged as a threat to agencies, with over 600 now offering in-house branded content solutions.

News that major brands are slashing their digital advertising budgets may come with a sliver of good news for the overworked masses of creatives. Companies like Unilever are cutting the amount of ads they produce and increasing the runtime of the new content they create. Keith Weed, marketing director for Unilever, admitted it produces an excess of content and will look to reduce its production by 30 percent in the coming year.

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.