Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: Brands are spending more to advertise creators’ content, making usage rights a focal point

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at what brands spending more money to promote creators’ content means for creator compensation models.

- Pay to play

- Netflix’s live programming product, Fox’s creator studio and more

Pay to play

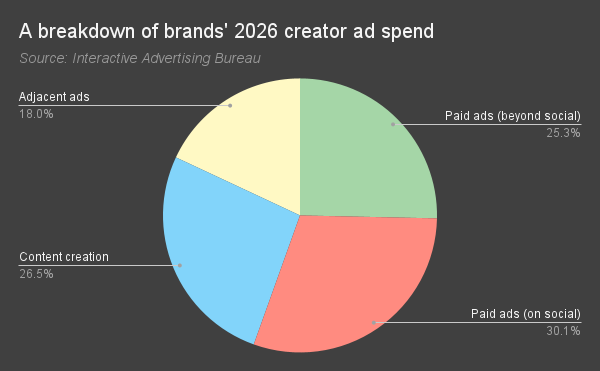

The Interactive Advertising Bureau’s recent Creator Ad Spend & Strategy report featured an eye-popping stat that I don’t think has gotten enough attention.

Of the $43.9 billion that advertisers in the U.S. are expected to spend on creator marketing in 2026, most of that money – 55% – will go towards ads amplifying the creators’ content, not to the actual creation and posting of content by the creators themselves. And that spend is only increasing as creator content becomes a more popular choice for ad creative and paid amplification provides brands with the analytics to be able to more effectively gauge the impact of creators’ content on their businesses.

“Creator content works way better in paid media than anything an agency or studio produce. And that’s how you get true ROI,” said Gabe Gordon, co-founder of creator marketing agency Reach Agency.

Ok, so a significant amount of money brands spend on creators doesn’t really go to the creators. Which raises the question: Do creators and their representatives need to reevaluate how creators are compensated when brands use creators’ content for ads?

“Short answer is yes. In speaking as someone who represents the interest of talent clients that are partnering with brands against their content, the money being spent to amplify their content is vastly more lucrative globally than what is being spent on the organic,” said Ryan Polun, head of sales at CAA Creators, the talent agency’s creator arm.

To be clear, creators do receive some compensation for brands running their content as ads on social platforms as well as elsewhere like on streaming services. Called “usage rights,” this compensation gets negotiated as part of the broader deal between a brand and creator, and at this point, most brand-creator deals include usage rights at this point, according to creator representatives interviewed for this article.

“100% of our deals today include some form of usage rights, particularly for branded social and digital owned-and-operated distribution,” said Andrew Perlman, CEO of Recurrent Ventures, in an email. The media company owns Donut Media, which is primarily known for its YouTube channel.

“It’s high. I’m going to go on a limb and say that it’s over 90% of what we’re seeing,” said Polun.

“Honestly half the time that brands pay for usage rights, they don’t even end up using the content, which is a funny thing when you’re going back and forth negotiating,” said Michael Curtis, CEO and founder of talent management firm Proud Management.

That’s probably changing, though, given the popularity of creator content among brands. “Most influencer content is being used for paid media usage, whether it’s being boosted or whether it’s being dark-listed and used on owned-and-operated [properties],” said Gordon.

Given that, if more than half of money brands spend on creators is going toward ads, having those usage rights in place is important. There are no standard terms for usage rights, though. Generally usage rights cover a brand being able to use a creator’s content for 30 days, with pre-negotiated usage rights renewal terms – locking in terms for extending usage beyond that initial window – becoming more commonplace. How much the brand pays for that usage is usually calculated as a percentage of how much money the brand is spending on the ads, according to the creator reps. But the actual percentage can vary significantly.

“You will see some people who will price that out as a per-30 days cost. You will see some who ask for a portion of the budget. So if the overall paid media budget is $100,000, they’ll ask for anywhere from 3% to 10% depending on how wide that paid usage portion is,” said Victoria Bachan, svp of creators at talent management company Wasserman.

That bit about “how wide that paid usage portion is” – that’s important. While most of the paid amplification dollars go toward promoting a piece of creator content on social platforms, brands are putting more money toward running creators’ content as ads elsewhere, such as on traditional TV and streaming or even in brick-and-mortar stores. And on those latter platforms, it can be hard for creators and their representatives to make sure that brands are honoring usage rights agreements.

“Aside from the social platforms and when the ad codes remain active or inactive, there’s really not a sophisticated way [to monitor usage rights]. And there’s also not a sophisticated way to then request compensation overages,” said Bachan.

“There have been times that we’ve had to message brands and say, ‘Hey, this ad is still running,’” said Curtis.

In both Bachan’s and Curtis’s experiences, the brands have been amenable after being called out for using creators’ content beyond the agreed-upon window.

But as more brands invest in creators and as their usage of creators’ content as ads grows and extends beyond social platforms, the issues around usage rights becomes one more thing that brands and creators will need to address as the creator economy matures.

What we’ve heard

“In typical reporting, you’ll see average frequency, but that’s like saying your head is in the oven and your feet are in the freezer, and that on average, you’re fine.”

— Omnicom Media’s Megan Pagliuca on frequency management in TV and streaming

Numbers to know

40%: Percentage share of active Netflix accounts that were on the ad-supported tier by the end of the third quarter of 2025.

$101 billion: How much money streaming services are expected to spend on shows and movies this year.

61%: Percentage share of U.S. households that primarily use a smart TV to stream.

2,000: Minimum number of consumption hours that a video podcast needs to participate in Spotify’s monetization program.

3: Number of years in which Roku CEO Anthony Wood believes a fully AI-generated “hit” movie will debut.

What we’ve covered

Digiday’s extensive guide to what’s in and out for creators in 2026:

- “Bigger, longer” seems to be a theme of the trends that may dominate the creator economy this year.

- The maturation of the creator economy is another theme across what may be in and out in 2026.

Read more about creators here.

Omnicom Media tackles frequency issues in TV via partnerships with Amazon and Roku:

- The agency holding company will use data from Amazon and Roku to try to get its reins around how many times people are exposed to ads on TV and streaming.

- Omnicom will be able to assess frequency in a matter of 1-2 days versus months of exposure.

Read more about Omnicom’s latest frequency management efforts here.

What we’re reading

Netflix’s live programming product:

The streaming service has aired more than 200 live events since March 2023 and plans to make an international push and push out new features this year, according to The Wall Street Journal.

The debut of Spotify-owned “The Bill Simmons Podcast” on Netflix on Sunday marked Netflix’s push into video podcasts, though the company has been offering low six- to seven-figure payments to podcasters that some have rejected for being too low, according to Bloomberg.

Tubi’s parent company has formed a division focused on creators and assembled a roster of food-focused creators, including YouTube star Rosanna Pansino, to develop content, according to Variety.

FanDuel Sports Network’s MLB exodus:

The remaining nine MLB teams that had deals for regional sports TV network FanDuel Sports Network to air their games have canceled those deals because of the TV network’s financial struggles, according to The Athletic.

TikTok’s creator chief’s exit:

TikTok’s global head of creators Kim Farrell is leaving the platform amid a broader reorganization of its creator and publisher teams just as the U.S.-only version of the video platform is about the debut, according to Business Insider.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Long-form creators eye taking over TVs – and chasing bigger brand budgets

Long-form episodic creator content is drawing in large numbers of highly engaged viewers, but ad budges are lagging behind. We explore why.

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.