Last chance to save on Digiday Publishing Summit passes is February 9

While more than 1,300 brands have boycotted far-right publisher Breitbart, these moves are likely to have little impact unless ad tech firms on the demand side move to cut off access to their aggregated buying power. It looks like just that is slowly happening as clients and agencies take a more proactive approach.

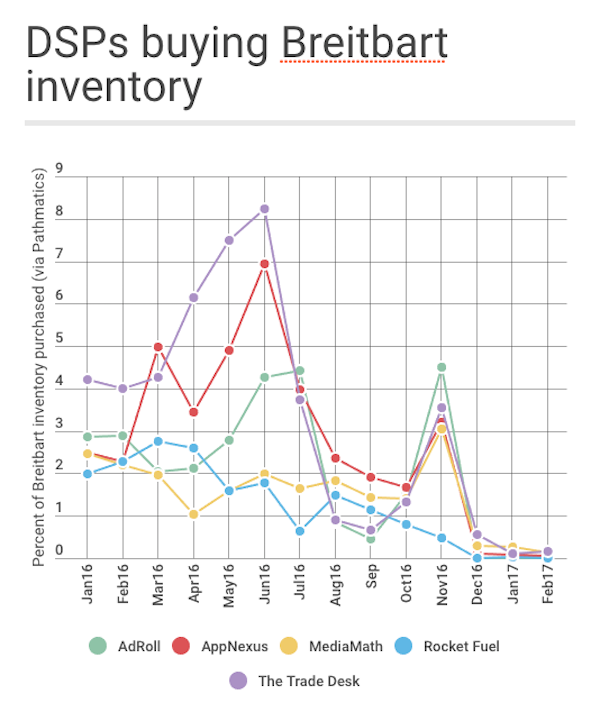

Ad tracking data shows that several ad-buying platforms have reduced their transactions on Breitbart by placing the publisher in a brand-unsafe list, and in one instance, by automatically blacklisting the website for clients. Major ad suppliers like AppNexus, The Trade Desk and Rocket Fuel have dropped Breitbart from all or most of their buys.

AppNexus made news when it cut ties with Breitbart, but other ad tech companies have followed suit, albeit less publicly. Ad tracking firm Pathmatics shows that since the presidential election, big platforms have significantly dialed back their transactions on Breitbart specifically. During the first two months of 2016, AppNexus, The Trade Desk, AdRoll, MediaMath and Rocket Fuel were collectively responsible for purchasing about 15 percent of Breitbart’s inventory. But so far in 2017, they have collectively purchased less than 0.5 percent of Breitbart’s inventory. AppNexus, AdRoll and MediaMath declined interview requests. Breitbart did not respond to requests for comment.

Andrew Arnold, senior director of marketplace quality at The Trade Desk, said that in December his firm added Breitbart to its list of brand unsafe websites because the website violated the DSP’s hate-speech policies. Clients don’t automatically exclude sites from the brand unsafe list by default, but The Trade Desk recommends that they do, and nearly 90 percent of clients opt to use the list, Arnold said.

“There is some editorial decision there, which is why we leave it to the buyers,” he said.

Since Breitbart has been on this list, The Trade Desk went from transacting on 3.5 percent of Breitbart inventory in November to 0.1 percent in subsequent months. DataXu uses a similar strategy with Breitbart, and has subsequently transacted on 0 percent of Breitbart inventory in 2017.

The drop in Breitbart purchases from major platforms might appear encouraging to critics of the so-called alt-right, but sources said that the impact of this trend will be minimal as long as Breitbart can use Google’s ad exchange to sell off most of its inventory. Google’s activity on Breitbart has increased over time, as nearly 90 percent of Breitbart’s display inventory has been sold through Google in 2017, while only about 65 percent was sold through Google during the first two months of 2016.

A Google spokesperson said that its ad exchange does have policies concerning hate speech, and that so-called alt-right publishers using AdX are either “not in violation of our policies, or we are not aware that they are in violation of our policies.”

It’s also worth noting that Breitbart is an outlier when it comes to advertising boycotts. Other sites propagating fringe viewpoints – such as 21st Century Wire, Before It’s News and Zero Hedge – have sold about 50 percent to 70 percent of their inventory through Google, with the rest running through other major exchanges and DSPs. None of the publishers mentioned in this story replied to interview requests.

Arnold said since the election, The Trade Desk has blocked about three dozen extremist publishers. “But there are other ones that haven’t been profiled as hateful, or they are flying under the radar in the post-truth era we are in,” he said.

Brands like Kellogg’s got a lot of attention for boycotting Breitbart. But because there are more brands than there are ad tech vendors involved with buying and selling inventory, the less-sexy boycotts from programmatic platforms are more likely than brand protests to impact the publisher’s ad revenue. And demand-side vendors, which are a step closer to advertiser dollars, have more boycott power than supply-side vendors who can always find indirect ways into exchanges, said Mike Caprio, general manager of programmatic at ad tech platform Sizmek.

Caprio and others believe it is rare for programmatic platforms to completely block websites that publish legal content, regardless of how unseemly the site’s content might be. But these bans do occasionally happen.

Rocket Fuel took a more direct approach than other DSPs and blacklisted Breitbart by default for its clients this fall, said Rocket Fuel CEO Randy Wootton. Since November, Rocket Fuel totally eliminated their buys on several so-called alt-right publishers, in addition to Breitbart, after blacklisting the websites.

“We are not trying to legislate or enforce policy that restricts the ability to express views,” Wootton said after being asked if the blacklist violates the First Amendment. “However, we are making a judgment on extreme political views and violence, and I think it is a judgment you have to make as a business leader.”

More in Media

Brands invest in creators for reach as celebs fill the Big Game spots

The Super Bowl is no longer just about day-of posts or prime-time commercials, but the expanding creator ecosystem surrounding it.

WTF is the IAB’s AI Accountability for Publishers Act (and what happens next)?

The IAB introduced a draft bill to make AI companies pay for scraping publishers’ content. Here’s how it’ll differ from copyright law, and what comes next.

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

Q4 gave publishers a win — but as ad dollars return, AI-driven discovery shifts mean growth in 2026 will hinge on relevance, not reach.