Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Media Buying Briefing: As independents set bullish goals for 2022, they grow their consultative powers

This Media Buying Briefing covers the latest in agency news and media buying for Digiday+ members and is distributed over email every Monday at 10 a.m. ET. More from the series →

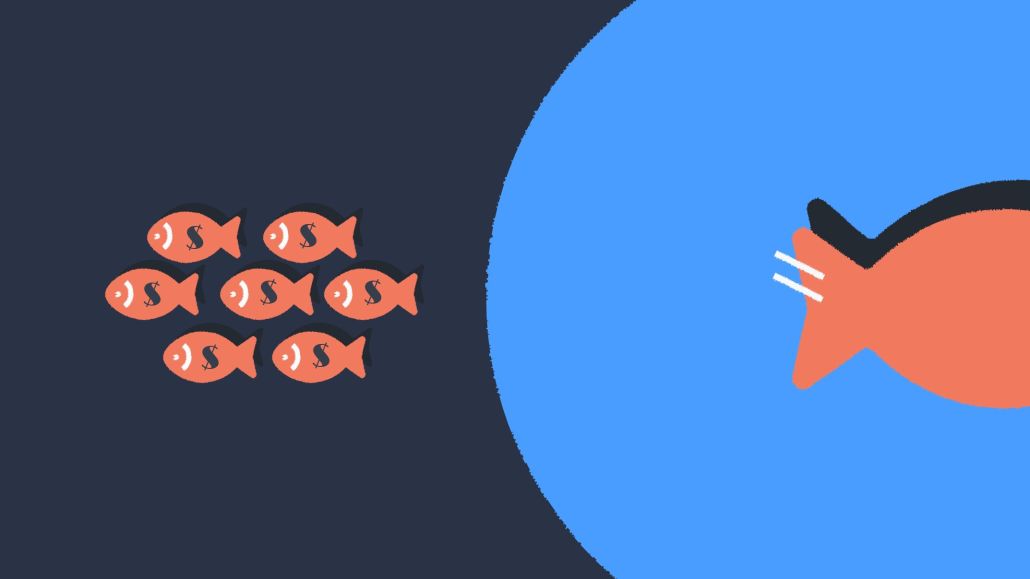

Could 2022 be the year of the independent media agency? And will their success, if achieved, come more out of the hides of the agency holding companies or the consultancies that have made their push (with limited results) into agency turf?

An informal canvas of several independent agencies (including PMG, Crossmedia, Media Matters Worldwide, Traction and Worldwide Partners) yielded some common traits among them. They all came off strong 2021 financial results — PMG said revenue grew 75 percent over 2020, Traction grew 30 percent, and the others cited similar double-digit percentage growth — and are quite bullish on their prospects to maintain similar levels of growth this year.

“Not only was 2021 back to the trajectory we saw in 2019, but agencies demonstrated and delivered the best year in their history, not just from a bottom-line perspective but based on top-line and bottom-line levels,” said John Harris, president and CEO of Worldwide Partners, a network of independent agencies including all disciplines.

“It’s going to be a great year because of the momentum we have,” echoed Josy Amann, co-founder and managing partner of media agency Media Matters Worldwide. More clients, she said, “are making the switch quickly to pivot to independent agencies, and now it’s like a tidal wave.”

The executives base that belief on:

- Their flexibility in adapting to and investing in data-intensive tools for their clients

- Their cultural adaptability to retain talent;

- Their relative overall agility compared to holding company agencies;

- And prioritizing the involvement of senior talent with clients to help solve business problems that go beyond media planning and buying.

Interestingly, it all nets out that independents may actually be beating the consultancies at their game as they are stealing away clients and talent from the holding companies.

“I consider us more of a consultancy than an agency today,” explained Adam Kleinberg, founder and CEO of Traction, which erased its “agency” handle and renamed itself a “marketing accelerator” after he retrenched the shop in 2018 by dropping difficult clients and shedding personnel. “So many clients we see are in this growth-hacker mindset, fighting against the algorithms in how they go to market and buy media. We’re helping them untangle that and figuring how to get them back on a performance track.”

“While we do integrated marketing and media and full-funnel strategy work with [clients], there are certain niches in their business they’re trying to solve for, things they haven’t faced before,” said Lindsay Weeks, vp of client strategy at PMG. “For us it allows us to take off this, let’s put on another hat and tackle this together and solve, whether it’s bringing in partners or even building something from scratch, that’s what’s allowed us to be nimble.”

That approach can be a challenge to be compensated for those efforts, but Weeks said PMG’s solution is easy: set it up as project work, as opposed to AOR or retainer-based. “Whether it’s in the initial scope or grow our scope, it’s certainly started new conversations with how we engage with our brands,” she added.

Media Matters Worldwide’s Amann said she also believes that the ramping up of data/analytics tools and expertise has not only been necessary but a standout distinction for independents, in this environment where consumer behavior has become indelibly altered and much more digitally-driven. “That’s big to us, because clients big and small have broken systems, and they don’t have their data story worked out,” she said. “We need clean data in and clean data out. And we need data to tell the story — analytics should be agile. We’re hyper-focused on working with our clients and our future clients on agile measurement.”

Though he didn’t dispute Amann’s notion, Forrester’s Pattisall pointed out that indies are largely playing catch up when it comes to data. “The holdcos have spent well over $12 billion in data technology acquisitions and investments,” he said. “As [indies] shorten the distance between their data strategy and activation capabilities and the holdcos, they will become more competitive.”

Meanwhile, other headwinds continue to prevail for the entire marketing services industry, elements from which independents aren’t immune. Talent retention is a huge problem for the entire agency universe. Forrester global agency analyst Jay Pattisall noted that the U.S. agency industry lost 40,000 employees between September 2019 and the end of 2021. “The independents’ bullishness is warranted when it comes to talent, as most are in the position to use their culture and autonomy to attract and top talent, but that only goes so far,” he said. “The talent challenge is among both holdcos and independents.”

Crossmedia co-founder and CEO Kamran Asghar said he approaches talent retention less as a we-can’t-lose-you quandary and more as a positive step in an employee’s career. “It’s like their career Airbnb,” said Asghar. “They’re going to stay with us for a period of time — could be a year, could be three, could be 10. But that experience with us has got to be really awesome and really beneficial for their career and mutually beneficial.”

The one looming uncertainty that could batter the entire marketing/communications ecosystem, Traction’s Kleinberg acknowledged, is the effect of inflation/supply chain issues since most CEOs and staffers alike have never experienced anything like this. “This isn’t a typical inflationary period, we could see double-digit inflation this year and for the next few,” he said. “It’s informed by the supply chain crisis (disruptions all caused by COVID), and it’s informed by trillions of dollars pumped into the economy, which saved a lot of jobs but is artificial money. Brands are going to be impacted by the price increases. There is no template for the modern marketer for dealing with inflation at this level.”

Color by numbers

Video advertising, in its linear/traditional and various digital forms, appears to be as red-hot as ever, according to the latest Video Advertising Convergence Report from Advertiser Perceptions, which surveyed 250 U.S. advertisers (63% agency, 37% marketer). Video beat out all other media (search, social, display, audio, print, and OOH) in achieving advertising goals.

- Among all forms of video, TV (which includes linear and streaming) ranked highest at 47% – up from 36% in last year’s report; by contrast, 46% put digital video first, down from 53% a year ago.

- Streaming is enjoying the greatest increase in interest from advertisers, 40% of whom plan to increase spend by an average 16%. Oddly, linear TV, which had 12% of advertiser say they plan to decrease spend, still got 24% of advertisers to say they will increase by an average of 19%.

- Finally, within digital video, short-term professional video tops advertiser rankings for meeting KPIs, with 61% putting it ahead of social media influencers videos (49%), user-generated video (39%) and advertising in sporting events (36%, down from 44% a year ago).

Takeoff & landing

- Stagwell last week said it had combined its Media Kitchen and MMI agencies, both part of Stagwell Media Network, into one agency brand, MMI, led by MMI CEO Maggie Malek.

- Over at IPG, Lynn Lewis moved from U.S. CEO of UM to global CMO of Mediabrands, while also retaining global CMO duties for UM. Replacing her as head of UM is Joe DeMiero, who comes over from Publicis’s CRM agency Hawkeye.

- Digital OOH industry association DPAA expanded its board to include Blake Sabatinelli, COO of B2B video service Atmosphere and Chip Harding, senior vp of business development at real estate developer Simon.

Direct quote

“Compensation has to be motivating and inspiring to the agency partner. It’s not all about efficiencies and turning the screws on the agency, or extracting every drop of blood and treating them like a vendor. We want them to come up with innovative ideas and fantastic media deals … We’re flexible. One of the biggest mistakes brands do is to hold their agencies to ransom. You cannot hold the sword of the RFP over an agency’s head and expect them to be committed to you for the long term, and be inspired to win together with you.”

Mastercard chief marketing & communications officer Raja Rajamannar, speaking on a Madison Alley Executive Lounge webinar

Speed reading

- Digiday senior news editor Seb Joseph caught up with newly named Brandtech Group (formerly You & Mr. Jones) CEO David Jones who shared his thoughts on growth for the burgeoning new-model holding company.

- Read senior media editor Tim Peterson’s smart take on the effect a changed definition of a “households” is having on video measurement, in his latest Future of TV briefing. Stay for the hilarious and informative video he made to define what a “household dilemma” is.

- I got my hands on a Tinuiti report showing that Meta’s properties Facebook and Instagram continue to grow and have been largely unaffected by such challenges as Apple’s ATT changes and advertiser boycotts.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.