Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Media Briefing: Black-owned media execs are watching whether advertisers’ diversity commitments will withstand a recession

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

In this week’s Media Briefing, senior media reporter Sara Guaglione reports on how a recession may — or may not — affect Black-owned publishers’ advertising businesses.

- Proven enough to be recession-proof?

- The role of registration walls in sparking subscribers

- Digiday experiments with NFTs

- Dotdash Meredith’s affiliate ambitions, Semafor’s video plans, Google’s ad tech olive branch and more

Proven enough to be recession-proof?

The key hits:

- Brands and ad agencies’ commitments to support and invest in Black-owned media companies have had an incremental but positive impact on some of those businesses.

- The threat of a recession has executives worried that those allocated ad dollars will be the first to get cut if budgets get squeezed.

- Others argue the industry has changed enough that advertisers won’t renege on the commitments made – and that if budgets shrink, it will not have an outsized impact on Black-owned publishers.

Black-owned media businesses are seeing some impact from the ad spend and investment commitments made since 2020 by brands and ad agencies. While some executives worry that a possible recession may cut back those improvements, others believe these publishers have proven their value to advertisers and should be able to withstand any brand budget-tightening.

Sticking to those commitments amid the gusts of economic headwinds will be another way for advertisers to show their claims to support Black-owned publishers were made in good faith.

Brands that have made these spending commitments “on paper” allocate around 2% to 10% of their budgets on media with “diverse media” (non-white owned media or media targeting non-white audiences), according to Lisa Torres, president of Publicis Media’s multicultural practice Cultural Quotient. Historically, that money would be at risk amid an economic downturn, but Torres said she believes clients “will maintain” that spending should a recession hit.

However, even if maintaining that spending was sustained — it still only represents a sliver of advertisers’ budgets, executives of Black media businesses told Digiday.

“Brands could use that incremental lift that diverse media provides, that will positively impact [a brand’s] bottom line in the recession,” said Dévon Christopher Johnson, CEO and founder of BleuLife Media Group and co-founder of non-profit organization The Black Owned Media Equity and Sustainability Institute. Budgets, he argued, should get cut from the top “because you’ve already been spending there. You want new customers, to grow your customer base… Give it to us, don’t take it from us.”

Incremental improvements

After the Black Lives Matter movement reached fever pitch in the summer of 2020, marketers vowed to support Black-owned media companies with a portion of their ad budgets. Agencies got in on the conversation — last July, as an example, Publicis Media formed a two-year initiative called the Once & For All Coalition to support and invest in minority-owned media. It now includes over 30 of Publicis’s clients.

Group Black — which was co-founded last year by CEO Travis Montaque, chief strategy officer Bonin Bough and chairman Richelieu Dennis to urge marketers and agencies to shift more of their ad spending to Black-owned media outlets — has brought in about $500 million in ad-spending commitments from companies such as Procter & Gamble and agencies like WPP, Dentsu and IPG, according to The Wall Street Journal.

These efforts have led to ad revenue growth for some Black-owned media businesses, according to four executives who spoke to Digiday.

Morgan DeBaun, CEO of Blavity, said ad revenue has grown by 56% in the first half of 2022 compared to the first half of 2021, though she did not provide specifics.

Thanks to some deals with new advertisers, annual ad revenue for digital media company Her Agenda increased by 140% in 2021 compared to 2019, said Rhonesha Byng, CEO and founder of Her Agenda and co-founder of BOMESI.

There are “way more” advertisers working with Black-owned media businesses this year — though the ad budget increases have been “incremental,” said Johnson, without naming specific companies.

Diverse media investment and vendor lists have grown, according to Torres. O&FA client members have a 27% higher budget allocation toward diverse-owned media than Publicis Groupe’s non-member clients. O&FA members advertise with 16% more diverse-owned and targeted suppliers than non-members. (Publicis declined to share specific investment figures).

‘The first thing that gets cut in a recession is us’

Losing this investment as the economy faces unsteady conditions has some executives worried.

“The first thing that gets cut in a recession is us,” said Joe Anthony, founder of creative and digital agency Hero Collective and media and tech company Hero Media, which formed this month. “If you are brown, you get turned down. We start being looked at as a ‘nice to have,’ not a ‘need to have.’”

During a recession, brands increasingly focus on lower-funnel marketing (such as performance-based metrics, like conversions) as opposed to upper-funnel marketing (such as brand building metrics), Anthony argued. That can “filter out” investments in diverse media, with business models and ad tech infrastructures that are often not fully built-out for those lower-funnel metrics, he said. Diverse media “will suffer as a result,” Anthony said.

‘We have changed behavior’

However, Group Black’s Bough is “not worried” about brands and agencies cutting diverse media ad spend should a recession hit. “The results that we see in the partnerships that we do is outsized returns. So as long as organizations continue to look at the business case behind this investment, then I’m not worried.”

Publicis’ Torres agreed: “Enough has changed in our industry, to prove and show value in [diverse media’s] proposition.”

If anything, the recession would reduce ad budgets across the board. Overall ad spend will decrease, but the list of publishers that get those dollars will stay the same, Torres said.

“That’s the change. Historically [that budget] would just go away, and [brands] would cut all of it,” she said. “But that’s not happening. We have changed behavior over the last two years. They have developed partnerships and see the value in the media… so they’re willing to keep it on. What we want is equity in that. We don’t want just one set of vendors to get cut.” – Sara Guaglione

What we’ve heard

“The financial services space is more complicated. There [are] compliance issues that don’t exist in other categories. You have to sort of prove yourself with a lot of issuers of credit cards, as an example, before you can become an accredited affiliate partner for them.”

— Dow Jones chief revenue officer Josh Stinchcomb

The role of registration walls in sparking subscribers

Publishers’ subscriber growth is slowing compared to the Trump era and early days of the pandemic, but a “subscription slump” may be too harsh of a classification, according to Michael Silberman, svp of strategy at paywall platform Piano. Editor’s note: Piano is a contracted vendor with Digiday.

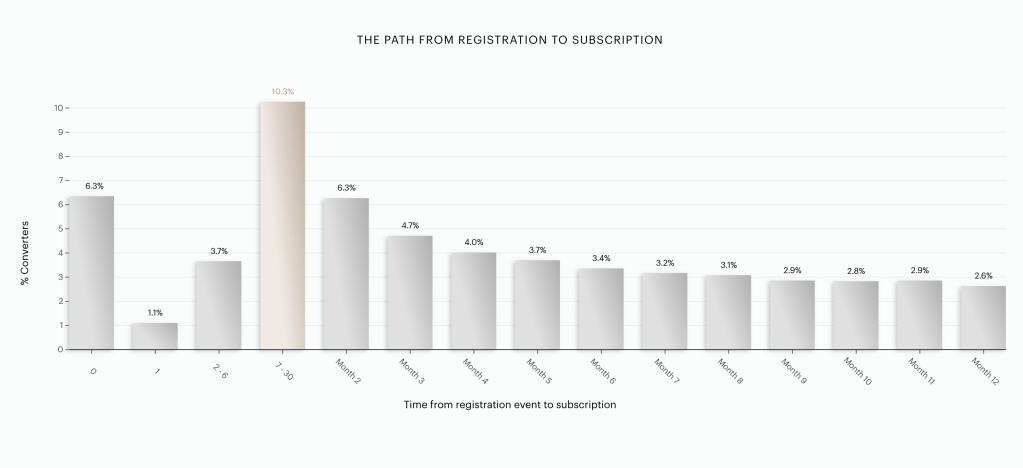

In Q1 2022, the median number of active subscribers across 120 of the largest sites on Piano’s platform grew by 5.2%, down from 11.5% growth in Q1 2021 and 13.5% in Q1 2020, according to Silberman. To slough the subscriber slowdown, publishers may benefit from running readers into a registration wall since they cannot necessarily count on converting loyal readers as frequently, as indicated by Piano’s 2022 Subscription Performance Benchmark Report.

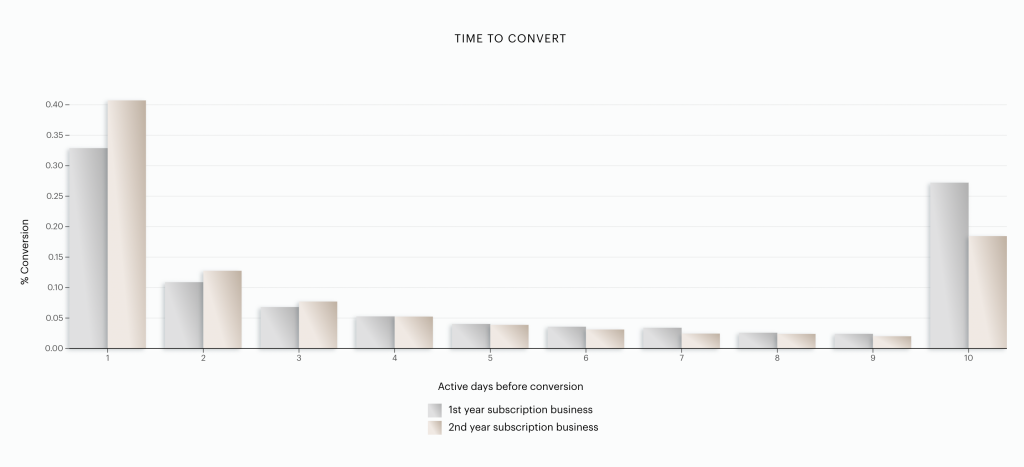

In the first report Piano conducted in 2021, a larger group of readers converted after spending 10 days on the site then in 2022. Meanwhile, more readers are converting on their first day of visiting the site, suggesting publishers should focus on ways to convert new readers more, including by implementing registration walls.

“That’s always been the assumption [that] it’s the loyal users who subscribe, but over time, the number of loyal users that are in that pool have either chosen to subscribe or decided not to subscribe [and] that available pool shrinks,” said Silberman.

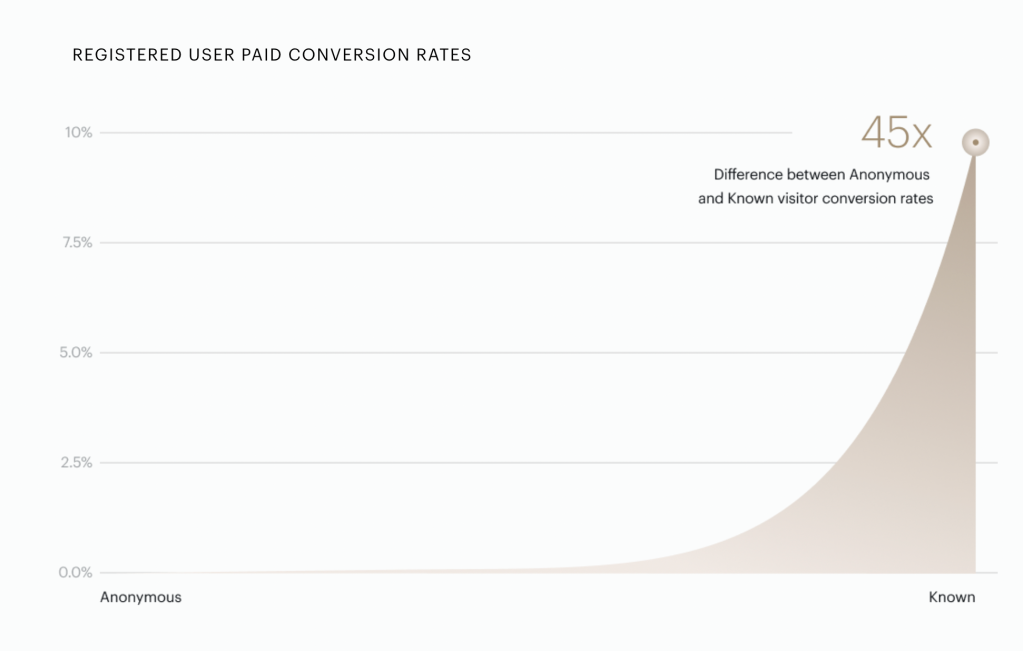

Registration walls are proving to be a boon to publishers’ subscription businesses. The conversion rate for a registration wall is about 10 times higher on average than a paywall, Silberman said. And registered users are 45 times more likely to convert to subscribers down the line, serving as another avenue to get readers on the path to becoming a paid subscriber.

“You need to think about [registered users] as a tier of customers that you want to communicate with,” said Silberman. “And not just send them messages about why [they] should be a subscriber, but also provide them some value” in exchange for the information they’ve willingly shared. – Kayleigh Barber

Numbers to know

-50%: Percentage decline in interactions with news articles on social platforms since the start of 2022.

$2 million: How much money seven BIPOC-led news outlets in Georgia will receive from The Pivot Fund.

$36 million: How much revenue Morning Brew generated in the first half of 2022.

Digiday experiments with NFTs

On Monday, July 24, Digiday will launch a special editorial report and project called Token to Play, which will include 10 stories exploring the challenges and opportunities associated with NFTs in media, marketing and gaming & esports.

In addition to this editorial package, we have also created 10 NFTs of robot avatars as art for the stories that are available to purchase on our OpenSea storefront. We’re using this drop as an opportunity for experimental journalism where we try our hand at creating and minting NFTs to get a better grasp of these digital assets to inform future reporting.

All of the proceeds from the sales of these NFTs will be donated to a charity that Digiday has worked closely with for years: Sandy Hook Promise. The non-profit organization is focused on preventing gun violence in homes, schools and communities.

Stay tuned for more information on the drop! — Kayleigh Barber

What we’ve covered

In esports media, layoff season is in full swing:

- Esports media outlets are in the midst of a wave of layoffs that began in the spring.

- Last week Inven Global laid off the majority of its editorial staff.

Read more about esports media here.

Why The Wall Street Journal is centering personal finance on its new commerce site Buy Side:

- The Wall Street Journal has finally entered the commerce space after spending a year figuring out what that business will look like.

- Dow Jones chief revenue officer Josh Stinchcomb and Buy Side head of content Leslie Yazel joined the Digiday Podcast to talk about the commerce site’s launch.

Listen to the latest Digiday Podcast episode here.

What creators say separates TikTok from Instagram Reels from YouTube Shorts:

- Creators are taking advantage of the short-form vertical video platforms’ similarities to cross-post videos.

- But they have noticed that trends are more powerful on TikTok, augmented reality effects do well on Instagram Reels and YouTube Shorts is a shortcut to long-form video.

Read more about short-form video platforms here.

While some publishers are slowing hiring plans, publishers like BuzzFeed and The Washington Post are not:

- After focusing on “critical” hires through April, BuzzFeed has resumed its regular hiring process.

- The Post is still on track with expansion plans set out at the start of this year.

Read more about publishers’ hiring plans here.

House of Highlights’ creator-led content triples revenue:

- Creator-led content accounts for 35% of the Bleacher Report-owned property’s overall revenue.

- That share has grown by 25% in the past year.

Read more about House of Highlights here.

What we’re reading

Dotdash Meredith wants to be Consumer Reports:

The media company has been rolling out product recommendation sites connected to various Meredith publications in an effort to increase its commerce revenue, according to The Wall Street Journal.

Semafor preps video push:

The upcoming news outlet founded by Ben Smith and Justin Smith has hired the co-founder of Vox.com’s video division Joe Posner to do the same for Semafor, according to The Hollywood Reporter.

Clubhouse survives:

Clubhouse has shed 72% of its monthly active users from February 2021, but the live audio app has been able to manage its costs to subsist on the $310 million in funding it’s raised to see it through several more years, according to The Information.

Google offers to (sort of) spin off its ad tech business:

To appease antitrust regulators, Google has offered to spin off its ad tech business into a separate company that would still be owned by Google parent Alphabet, according to The Wall Street Journal.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.