Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last week, Google’s parent company Alphabet reported that 2025 revenue was an eye-popping $403 billion, making the last 123 months its highest-earning year – almost $114 billion in Q4 alone – with these sums representing a 15% and 12% respective annual increase.

But as dollar bills stacked up, so did the legal citations. All this came the same week the IAB hosted its flagship annual conference, where the growing chorus of adland voices willing to try a new means of measuring effectiveness – many cite this as the crux of Google’s near stranglehold on ad spend – could be heard.

For example, state plaintiffs in Google’s search antitrust case filed a motion to challenge Judge Amit Mehta’s poorly received (among voices in the ad industry, anyway), just weeks after the European Union issued a preliminary ruling against Google’s ad tech, echoing a ruling in a separate U.S. courtroom in 2025.

Viewing the numbers together helps readers understand the scale of the challenges ahead (see charts below) and should further temper expectations that an imminent change is in the air, even with the likes of OpenAI bringing new offerings to market.

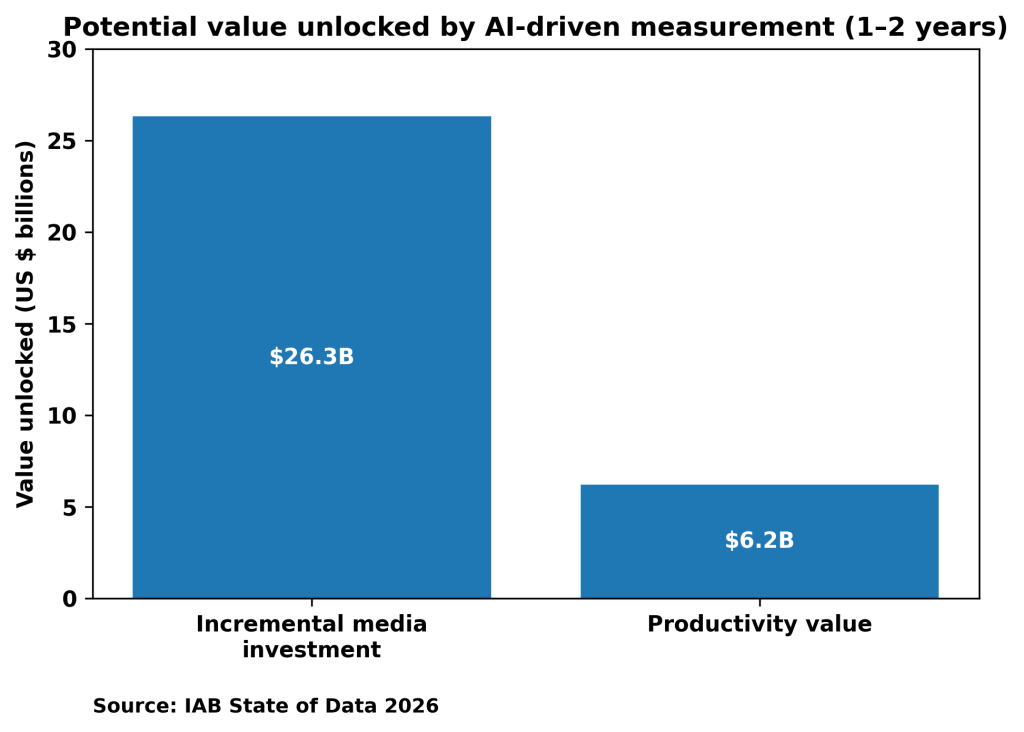

According to results from an IAB survey this week, which probed 400-plus senior brand and agency decision-makers, buyers believe AI-driven improvements to advanced measurement could unlock $26.3 billion in incremental media investment plus $6.2 billion in productivity gains.

And sentiments like this helped spur initiatives such as Project Eidos, also announced this week by the IAB, aimed at more equitably distributing ad spend across the ecosystem through the establishment of “a single-channel fix or a one-off framework.”

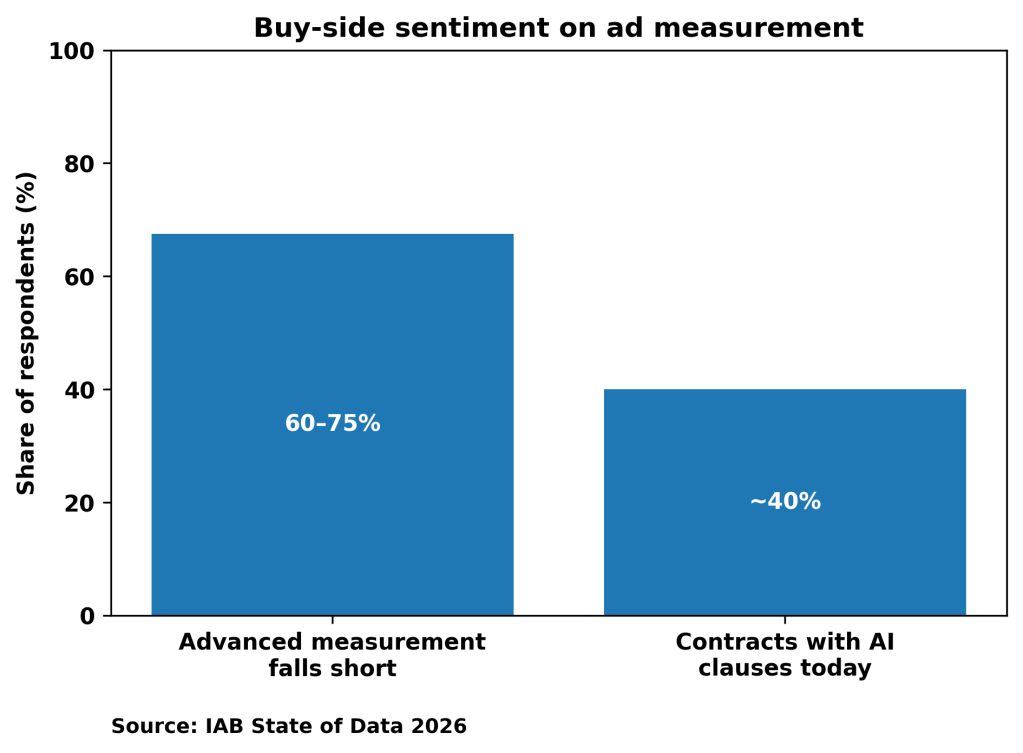

Further findings intimate widespread dissatisfaction with current measurement systems – remember, this is widely interpreted as the jewel in Google’s ad industry crown – with no respondents in the IAB survey believing all paid channels are adequately represented in current marketing mix models (MMMs).

Meanwhile, amid the latest wave of AI-disruption, almost half of all agency-brand partner contracts contain clauses to ensure greater governance of how such technology is used in campaign measurement; a development some hope will erode Google’s vice-like grip on advertisers’ budgets.

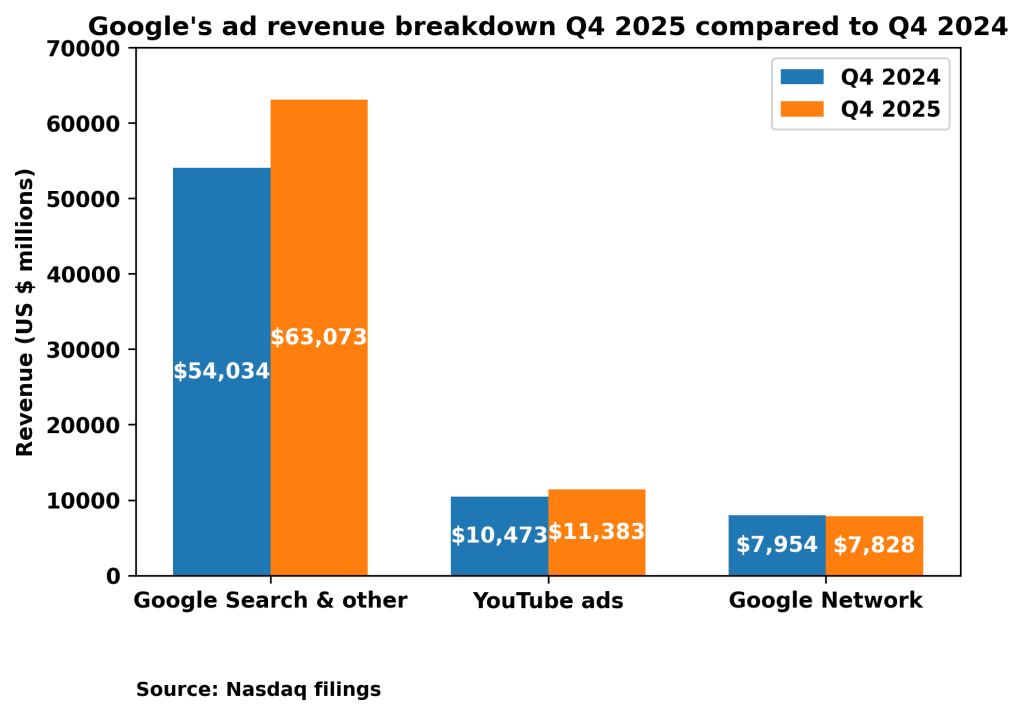

However, at this stage, it’s worth taking a reality check: the recently released Big Tech Tracker from Proton revealed the paltry nature of regulatory fines relative to Big Tech’s financial prowess, and the chart below, which breaks down its advertising revenue in the three months to December 21, 2025, shows how Google’s ever-escalating ad revenue further underscores this.

In fact, the only area of its ad business in decline (Google Network) is the division on the chopping block in the U.S. antitrust case presided over by Justice Leonie Brinkema, who is expected to issue her remedies ruling within weeks, if not days. Per the February 4 filings, total ad revenue for the quarter exceeded $82 billion, up from $72 billion in the year-ago period, with traditional search advertising up 17% year over year (see chart below).

Total advertising revenue for the period topped $82 billion, with Alphabet and Google CEO Sundar Pichai reporting that YouTube is now experiencing a welcome diversification of revenue streams, which topped $60 billion for full-year 2025, driven by an uptick in premium subscriptions to the video-streaming service. Hence, it would appear that the wind is still very much in Google’s sails.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.