Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

In Graphic Detail: The puny nature of regulatory fines compared to Big Tech’s financial prowess

Big Tech players are poised to outline their respective management’s visions of an AI-fueled future in what is likely to be another pivotal earnings season, outlining the full-year performance of the likes of Alphabet, Amazon, Apple, and Meta.

From here, the markets will scrutinize not just topline growth and AI spending, but how regulatory penalties — including billions in antitrust and privacy-related fines — stack up against each company’s financial prowess.

Investors and policymakers alike will be watching whether Big Tech’s cash generation and strategic pivots can absorb regulatory hectoring and use the outcomes to outline narratives around accountability and competitive positioning.

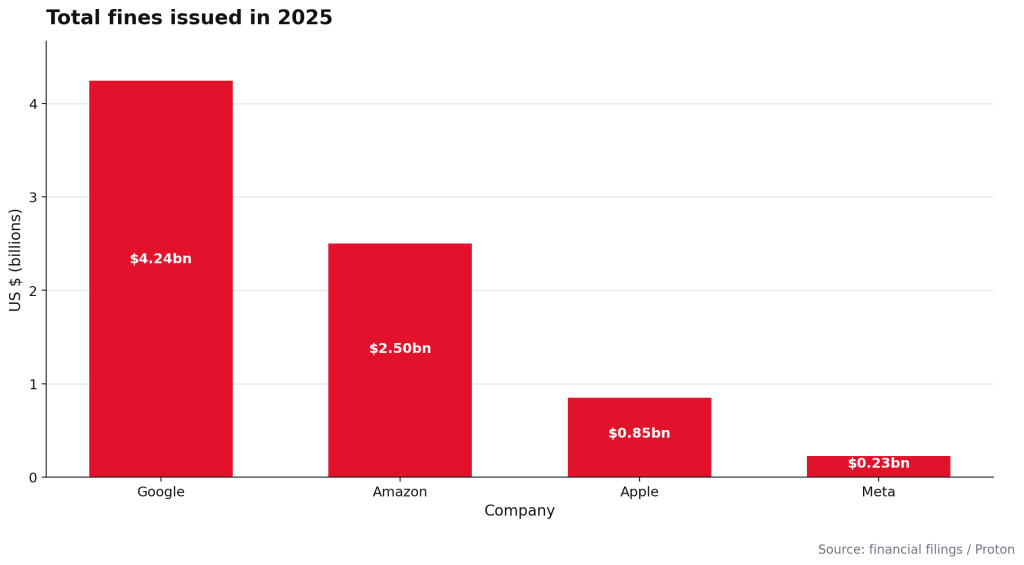

However, a recent analysis from Proton, dubbed a Big Tech Fines Tracker, suggests that while the $7.8 billion in fines — the total amount issued globally, issued against such players by government entities such as the European Union in 2025 — sounds punitive on paper, when stacked against free cash flow, the financial impact of such actions is marginal at best.

This compares the absolute value of fines levied against Google (Alphabet), Amazon, Apple and Meta during 2025. Google dominates on a nominal basis, largely due to a €3.5 billion EU fine tied to ad-tech conduct.

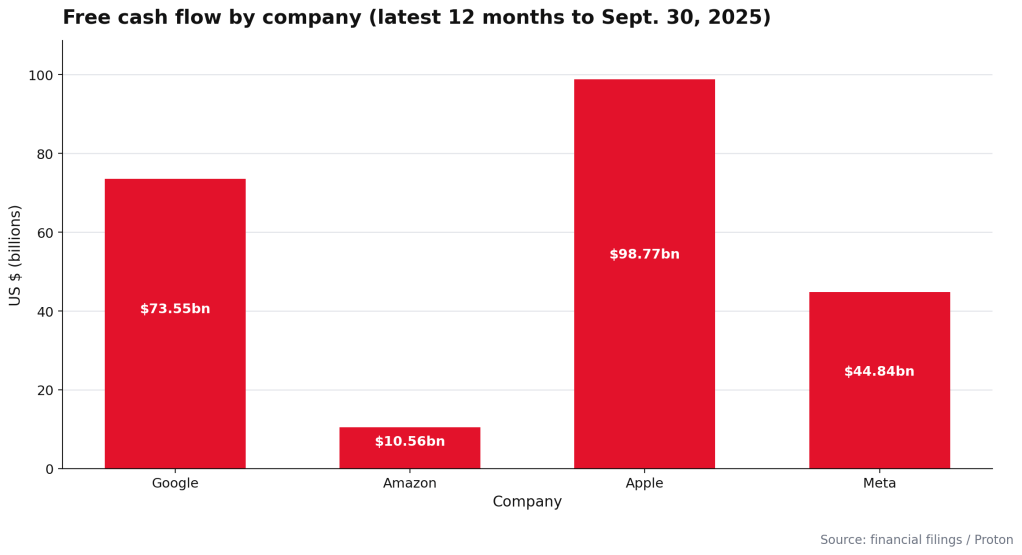

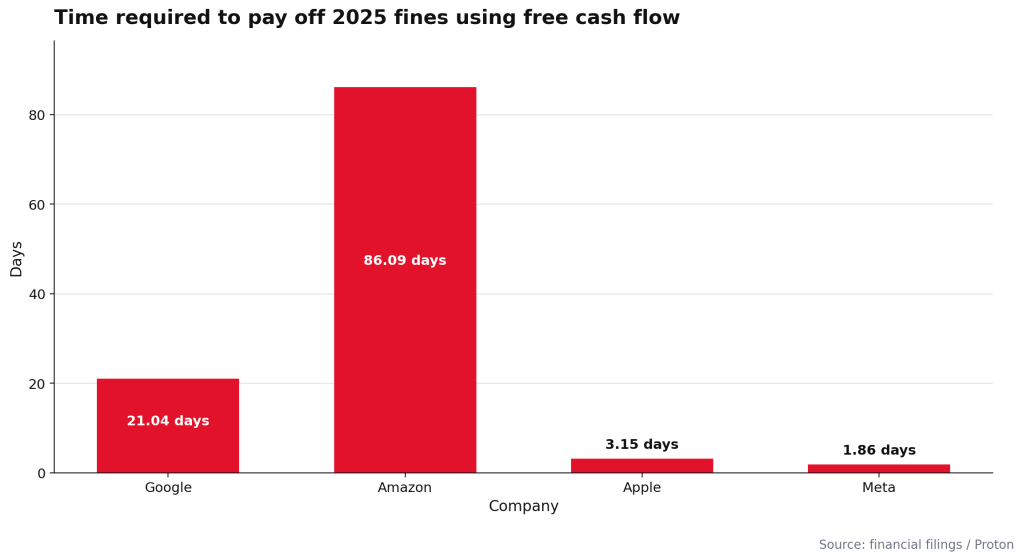

Google absorbed the largest share of fines, north of $4.2 billion, yet its cash-generation engine means those penalties equate to roughly three weeks of free cash flow. Apple’s situation is even starker: despite multiple high-profile rulings under Europe’s Digital Markets Act and national privacy regimes, its 2025 fines amount to just over three days of free cash flow. Meta’s penalties are measured in hours, not weeks.

Amazon stands out as the relative outlier. A $2.5 billion settlement tied to Prime subscription practices stretches to nearly three months of free cash flow, reflecting its thinner margins rather than a uniquely aggressive enforcement posture.

The broader implication is uncomfortable for regulators. Fines are rising and enforcement activity is persistent, yet the deterrent effect remains questionable. Since Proton began tracking these penalties in 2022, cumulative fines have exceeded $21 billion — still a rounding error relative to the cash these companies throw off annually.

The chart above shows each company’s reported free cash flow for the most recent 12-month period, based on publicly available filings aggregated by Proton. Apple and Alphabet generate orders of magnitude more discretionary cash than Amazon and Meta.

“Clearly, fines are not working,” said Proton’s public policy manager Romain Digneaux, adding that fines risk being “treated as a cost of doing business,” rather than a mechanism that meaningfully alters corporate behavior.

Per his assessment, years of enforcement actions against each player have produced little change, suggesting regulators need greater powers to drive meaningful change.

“Big Tech is still abusing consumers’ personal privacy, still leveraging its market dominance to stamp out competition and innovation, and still raking in money hand over fist as a reward,” he added. “Regulators must be given teeth big enough to make Big Tech feel some real pain for breaking the rules.”

Underlining Digneaux’s point, chart 3 converts fines into a time metric by dividing total fines by each company’s normalized daily free cash flow. It illustrates how quickly each firm could theoretically absorb its penalties.

The results are stark, demonstrating that the cumulative fines make only a small dent in the pockets of such corporations.

- Meta Platforms: Wed Jan. 28, 2026 (after market close) — Q4 2025 results.

- Apple: Thu Jan. 29, 2026 (after market close) — Fiscal Q1 2026 results.

- Alphabet: Wed Feb. 4, 2026 (after market close) — Q4 2025 results.

- Amazon: Thu Feb. 5, 2026 — Q4 2025 results.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.