Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Google might be close to a breakup, but sources warn authorities to ‘be careful what you wish for’

The Department of Justice is spearheading efforts to break up Google, accusing it of a decades-long attempt to monopolize the $600 billion online advertising market. Although, would a divestiture be that simple or even practical?

The case kicked off in an Eastern Virginia courtroom last week where DOJ lawyers made the case, presenting evidence of Google’s efforts to “crush” competition and silence critics” (both external and internal) when quizzing witnesses.

Separately, multiple internal communications from former Google employees that were admitted into evidence hinted at an internal cognizance that publishers were trapped by the feedback loop created by policy decisions following the FTC’s approval of the $3.1 billion purchase of DoubleClick.

DOJ attorneys seek remedies, including a court-mandated break-up of the online ad giant’s sell-side ad tech. Still, some sources consulted by Digiday liken the potential of such a seismic move to the opening of Pandora’s Box.

The potential fragmentation of a foundational industry cornerstone could harm publishers’ programmatic revenues; such is the extent of their reliance on the advertiser demand facilitated by the tightly woven relationship between Google’s ad server and its ad exchange.

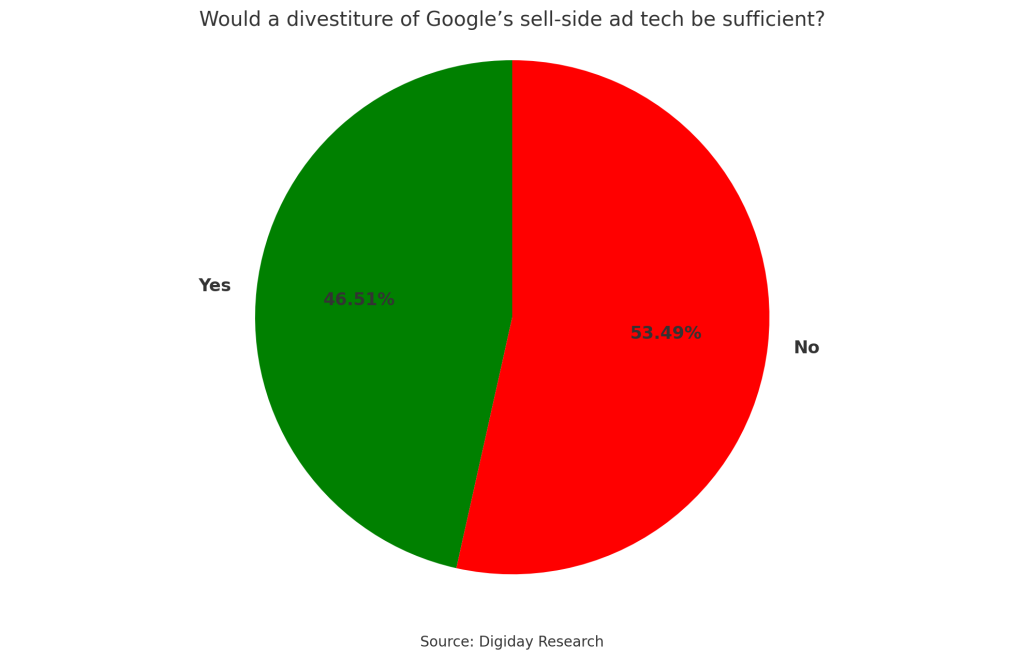

In a survey, Digiday readers were split on the effectiveness of the DOJ’s proposed divestiture, especially when Privacy Sandbox — remember that? — brings the prospect of transferring traditional ad server and supply-side platform roles to Google Chrome.

Gregory MacDonald, CEO of consultancy service Chelsea Strategies, told Digiday, “It [the survey results] highlights the complexity of the ad tech ecosystem and a sensitivity to the costs associated with any potential change to foundational pillars.”

David Kohl, CEO of Symitri (the ad exchange formerly owned by publisher trade org. DCN known as TRUSTX), told Digiday that Google has defended its market dominance by claiming it’s good for user privacy.

“This [Google’s ad tech assets] have been the lowest [profit] margin-generating part of Google, and they’ve been willing to sacrifice it in return for YouTube revenues where they get much higher margin, and it’s growing at a much higher rate,” he added. “I don’t think the break-up of Google is the panacea here, I think it’s been planning for that.”

Google’s hegemony provides order

Meanwhile, Mathieu Roche, CEO of ID5, told Digiday the proposed divestiture would not be enough and that additional guarantees around market conduct would need to be sought.

“I think you need to disconnect the Google-owned-and-operated properties, that’s YouTube and Search, from Google Ads,” he added. “If you remove that dependence on Google-originated demand, then that spend can go anywhere.”

Some (not least Google’s trial defense team) point to the convenience offered by Google’s ad stack, a two-sided marketplace that does a lot of the heavy lifting for either side of a media trade.

Many media buyers dread the prospective disruption to their established workflows, and even the most vocal of Google critics among publishers acknowledge that the divestiture of its sell-side ad tech would negatively impact their ad revenue, at least in the short term.

However, for Roche, the status quo is akin to a totalitarian state that takes care of residents’ basic needs but at the cost of their fundamental freedoms.

‘Freedom comes at a cost’

He extended this political analogy further, likening Google’s prospective breakup to the fall of the Berlin Wall, a symbolic development that accompanied the decline of Communist dictatorships across Eastern Europe in the late 1980s and early 1990s.

“Freedom comes at a cost, and when you want to make your own decisions, it’s difficult; a lot of people are quite happy just doing what they’re told, and that’s exactly what’s happening with Google right now,” he added.

‘Tangled web of interdependencies’

Meanwhile, U of Digital‘s Shiv. Gupta and Myles Younger said the survey results reflected a widespread cynicism about Google’s intentions, many of which have been backed up by recent trial evidence, but remedies are unlikely to come easy.

“Part of the problem is that Google has created a monopoly, unlike any others in history where you could argue where it has theoretically helped publishers make more money, and I think we’re seeing that in the survey,” said Gupta. “A break up would be a case of taking one step back… but many can’t afford to take a step back, as they’d just fall off the cliff.”

Younger added that Google’s ad stack is central to the online advertising ecosystem’s “tangled web of interdependencies” and that peeling off parts of Google would have myriad side effects that will likely be contested in court for years to come.

“You have to wonder if we’re going to still be having this conversation in 2030,” he added, pointing to the drawn-out efforts to deprecate third-party cookies within the Chrome web browser, an effort Google has to run by political authorities, while rivals such as Apple Safari and Firefox were able to complete unilaterally.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.