‘A glimpse of the internet of the future’: For a fee, Spiegel offers anti-tracking browsing

As privacy regulations and internet browsers tighten up, anti-tracking options emerge from publishers.

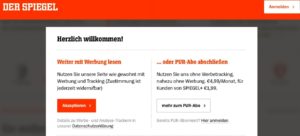

This month, German publisher Spiegel, which publishes weekly news magazine Der Spiegel, introduced a paid, ad-free subscription offer where users have the option of not being tracked by third-parties. Spiegel Pur is a response to a number of developing trends: Tightening privacy regulations, mounting user concerns with being tracked and more internet browsers restricting cross-site tracking.

Since Feb. 10, readers visiting Spiegel have had the option to browse non-subscriber content for free with ads and ad tracking still functioning. Or, they can buy a Pur subscription without ads and ad tracking for €4.99 ($5.38) a month for non-Spiegel+ subscribers. Spiegel+ subscribers can pay an additional €1.99 ($2.15) a month for no ads and no ad trackers.

In the announcement, the publisher said that with the Pur subscription some ads, like podcast ads, will remain because of the technical work to remove them. There will also be some tracking for internal analytics. The publisher did not respond to comment by press time.

While the additional revenue doesn’t go unwanted, Pur is about preserving existing programmatic advertising revenues, according to the publisher’s Medium announcement. In the coming months the Planet49 regulation, which states no cookies without consent, is expected to be drafted into German law. Advertisers and agencies requesting to target audiences who have explicitly given their consent will benefit Spiegel, who will still be able to charge premium prices for its ad slots. Without consent, the value of inventory drops.

Spiegel said Pur is a response to ad block-curious readers saying they would pay to turn off ads so they are no longer tracked. Germany experiences some of the highest cases of ad block users in Europe although the trend is stabilizing as the ad experience has improved and publishers have been more transparent and communicative about how their content is funded.

“With Spiegel Pur, this is a tiny glimpse of how the internet of the future will look,” said digital strategy consultant Oliver von Wersch. “Spiegel has become the first-mover in this instance. It has always had the willingness to be first, and now it is.”

Spiegel Pur is modeled on the Austrian publisher Standard’s consent framework. According to von Wersch, German data protection authorities suggest Standard’s consent framework meets certain regulations during ongoing discussions with German publishers about the finer points and interpretations of the law. However, the exact notion of what is compliant isn’t yet clear. Spiegel plans to iterate Pur.

Other publishers offer anti-tracking versions of browsing, but few so explicitly as Spiegel. For European audiences, The Washington Post offers and paid ad-free and anti-tracking experience.

Media analyst Thomas Baekdel questioned the legal basis for this option.

“If they are discussing ‘pay to not be tracked’, I don’t see how that would be accepted by the European Union,” he said. “It would dramatically undermine what the General Data Protection Regulation was designed to do. Publishers can offer an ad-free version for a price, but the tracking part is not legal to require payment to avoid.” Ultimately, publishers and the rest of the ecosystem are looking for more clear guidelines from data authorities about what is compliant.

Spiegel has subscriptions and ad revenue streams but ads are still the majority: In July 2018, 99% of Spiegel’s revenue came from online ads. In December it had 9.2 million monthly unique users in Germany according to Comscore stats, out of 61 million internet users in Germany.

In Germany, publishers have felt more keenly the impacts of audiences decreasing in value as browsers tighten tracking loopholes. Partly because Mozilla Firefox has a higher-than-usual market share of 14.24% according to Stats Counter Global Stats, third behind Google Chrome and Apple Safari. This makes finding new ways to monetize programmatic audiences without third-party tracking cookies especially critical. Equally, more publishers like Spiegel are creating their own logged in environments where they can monetize audiences on their own terms, making future monetization on the open web seem hazy.

More in Media

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.

In Graphic Detail: AI licensing deals, protection measures aren’t slowing web scraping

AI bots are increasingly mining publisher content, with new data showing publishers are losing the traffic battle even as demand grows.

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.