Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future Publishing’s tech brand T3 relaunches with e-commerce focus

E-commerce has increased its share of Future Publishing’s revenue, and the company is now confident it can turbocharge growth by repositioning its technology brand T3 as a pure e-commerce play. As part of this, it’s expanding the brand’s content to cover men’s lifestyle verticals, including fashion, travel, culture and fitness.

The publisher, which has around 50 brands focusing on specialist interests like music, gaming and photography, has seen e-commerce revenues increase by 72 percent from the last year, according to its financial review, reaching £6 million ($8.1 million) in revenue during the first half of 2017, or 15 percent of the publisher’s total revenue.

“We want to make e-commerce a much bigger part of the overall mix rather than just incremental,” said Zack Sullivan, operations and marketing director at Future. “We’re expecting it to be the majority [revenue stream]. T3 will be the only site in the portfolio where this is the case.”

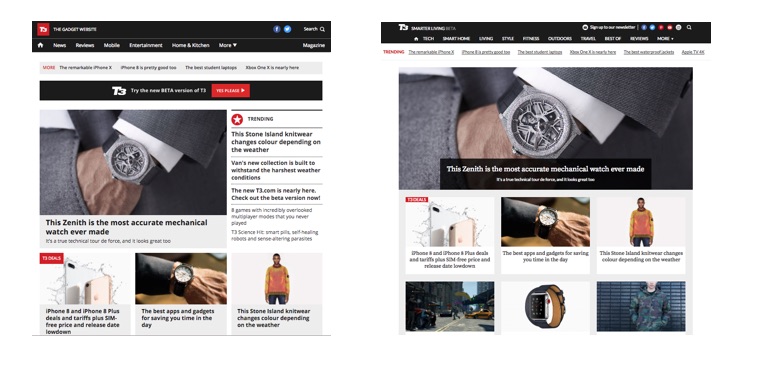

The rebooted T3 has a cleaner, simpler and image-led design. It has also reduced the number and type of display ads it can serve, made the buy buttons much more prominent and changed the way it thinks about the user’s purchase journey — and as such, the content it creates to suit users’ needs.

“We’re moving away from ‘here’s the five best watches’ to ‘here’s how you can get the most out of this experience,'” said Sullivan. “It’s an interesting shift in consumer behavior to want to buy more experiences.” Before the redesign, around 40 percent of content on T3, which produces around 300 articles a month, had an e-commerce element. Sullivan said now, virtually all pages have an e-commerce element.

T3’s editorial team of four people — it’s looking to hire more — creates the content. Around 210 transactions a day occur on T3, the company said. The content is designed to catch people further up in the purchase funnel, rather than Future’s other sites like TechRadar, which are more transactional and heavily feature buyer guides, product reviews and comparisons based on what is trending in social and search data.

Sullivan explained that now a reader could find an article giving a brief history of Swiss watchmaking, for instance, that leads to a related article on Swiss versus French watchmaking, which directs to a related article on what makes chronograph watches special and then brings up a long list of the best watches with “buy now” links. “It’s a more natural journey; users didn’t come on to explicitly buy a product, but we know they are looking to spend money,” said Sullivan. “You have the content, a relevant element and then the retail buying experience all on the same site — it’s more how a retailer would behave.”

T3 is also doing more direct deals with niche retailers. It already reaches half a million retailers through its partnerships, as well as 45,000 API feeds that come through Hawk, its proprietary e-commerce platform. Future doesn’t fulfill the orders. Instead, it sends the user to the merchant. The publisher takes a cut of anywhere between 2 and 10 percent.

The success of T3baby also spurred the broadening of T3’s content. T3baby launched in March 2017 as Future’s first brand centered around commerce, creating buyer guides around common search terms. Conversions are better than its more established site TechRadar: T3baby earns £28 ($38) per 1,000 pageviews, compared to around £20 ($27) for TechRadar, according to the publisher.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.