Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: Where European publishers get their video revenues

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Key takeaways:

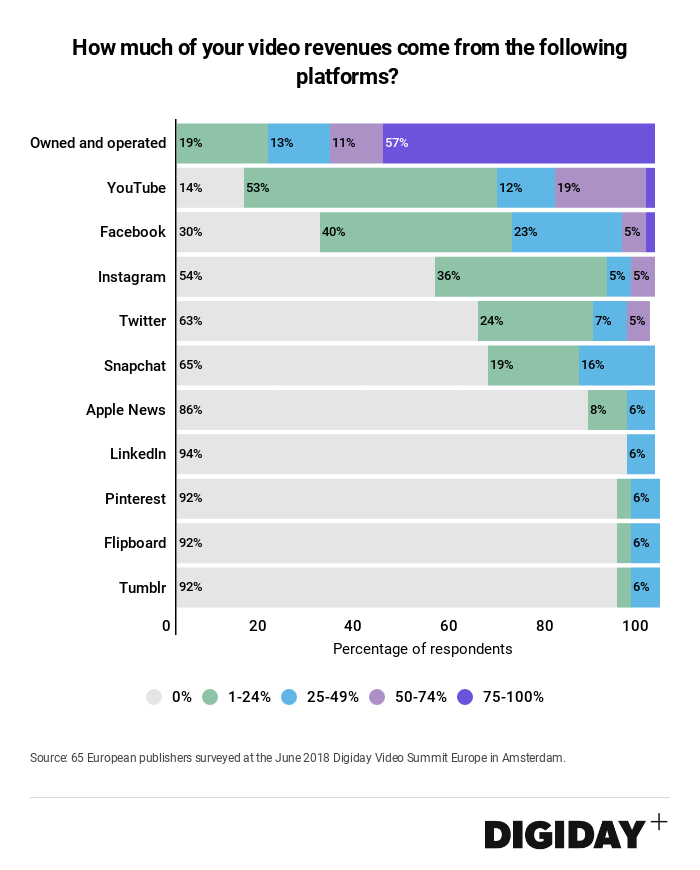

- Nearly seven in ten European publishers make the majority of their video revenues from their own sites

- Fewer European publishers monetize platforms Apple News, Pinterest and Twitter among others than U.S. publishers

- Thirty percent of European publishers make at least a quarter of their video revenues from Facebook compared to 12 percent of U.S. publishers

Based on recent figures released by the IAB Europe and IHS Markit, spending on video advertisements is taking off in Europe. In 2017, the amount spent on video ads grew 35 percent over 2016 to reach $6.17 billion. Given that, we surveyed 65 European publishers last month to break out what platforms, owned and social, contribute what to their video revenues. Since Snapchat ended upfront licensing fees to Discover partners and Facebook Watch has yet to fully launch in Europe, the vast majority of revenues from the following platforms is from advertising.

Owned and operated sites generate the majority of video revenues for European publishers. Sixty-eight percent of the publishers surveyed reported making at least 50 percent of their revenue from their owned sites.

European publishers were also far likelier than U.S. publishers to make a greater proportion of their video revenues from Facebook and YouTube. Twenty-one percent of European publishers make at least half of their video revenues from YouTube compared to just 6 percent of U.S. publishers. European publishers are also twice as likely to earn 25 percent of their video revenues from Facebook.

For Facebook, European publishers earning more revenue, especially through midroll ads, could also help explain why they rated the social platform as significantly easier to monetize than U.S. publishers. But both platforms likely play a larger role in European publishers video revenues because of a lack of a monetization opportunities at alternative platforms. Platforms including Twitter, Apple News, Flipboard and Pinterest were responsible for smaller percentages of European publishers than U.S. publishers. Flipboard in particular is committed to expanding its relationships with European publishers.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.