Digiday Research poll: Facebook’s algorithm change isn’t all bad for publishers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

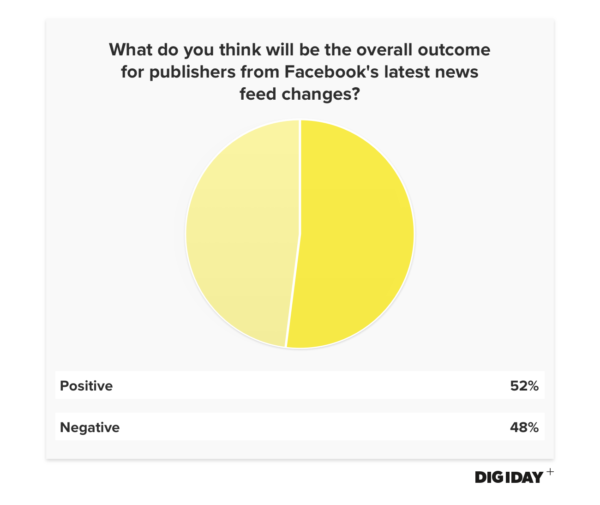

Facebook grabbed headlines when Mark Zuckerberg announced in January that there would be changes to the algorithm powering its news feed. The update will see Facebook deprioritize news stories in favor of content from friends and groups. In an online survey of over 30 Digiday+ members, respondents were split almost down the middle about how Facebook’s changes would affect publishers.

Why it could be positive for publishers:

Trustworthiness: Facebook told publishers that content from “reputable publishers” will still be surfaced and announced further measures designed to filter out fake news stories. With fewer dubious articles clogging up the news feed, established news publishers could enjoy more prominence.

Diversification: Facebook is a hard addiction to break for some publishers, but its steps to limit organic reach could encourage Facebook-reliant publishers to develop more balanced audience development strategies. Some publishers have already started the process. Free from trying to predict and prepare for Facebook’s algorithm tweaks changes, audience development teams now can reprioritize. Both publishers and some Facebook users may also migrate to other content-driven platforms such as Flipboard.

Content: Publishers may begin emphasizing different types of content, which could lead to a boost in traffic from referrers such as Google. Companies that flooded their Facebook pages with hundreds of click-seeking posts, for example, will have to readjust. As David Siegel, CEO of Investopedia said, “When you create great content, Google tends to reward you.”

Engagement: Although nascent, publishers are building out Facebook Groups as hyper-interested communities are more likely to engage with that content.

Better ad yields: When it comes to video revenue, most companies make a minority of their video revenue on Facebook. A deemphasis on Facebook could lead them to focus on more lucrative video platforms. Publishers were also struggling to monetize Facebook video ads prior to the news feed update.

Why it could be negative for publishers:

Traffic: The obvious one, but a big one. When Facebook tested the news feed without news content in several European countries, publishers in those countries saw major drops in traffic. The shift also comes at inopportune time, as many digital media companies struggle to find sustainable business models.

Reader loyalty: At the height of the 2016 presidential election, 44 percent of people in the U.S. got their news from Facebook, according to the Pew Research Center. While these users may have noticed seeing less news since then, almost 40 percent of people went to Facebook to seek out the news. If publishers weren’t able to convert them into loyal readers, it might be too late. One-growing subscription numbers have fallen flat.

At Digiday, we’re proud to say that our subscribers are some of the most knowledgeable and intelligent readers in the world of media, publishing, and advertising. It why we value so highly your opinions and insights. If you’d like to be a part of future Digiday+ research, be sure to join our exclusive panel here. Digiday also conducts research at every one of 40+ annual events. Learn more about how to attend and take part here.

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.