Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

There are three concurrent crises at play: The coronavirus pandemic, the economic crisis and the wave of protests across the country protesting racial injustice, that amounts to a social crisis.

For the publishing industry, this confluence of disruption has had a massive impact of on advertising revenue.

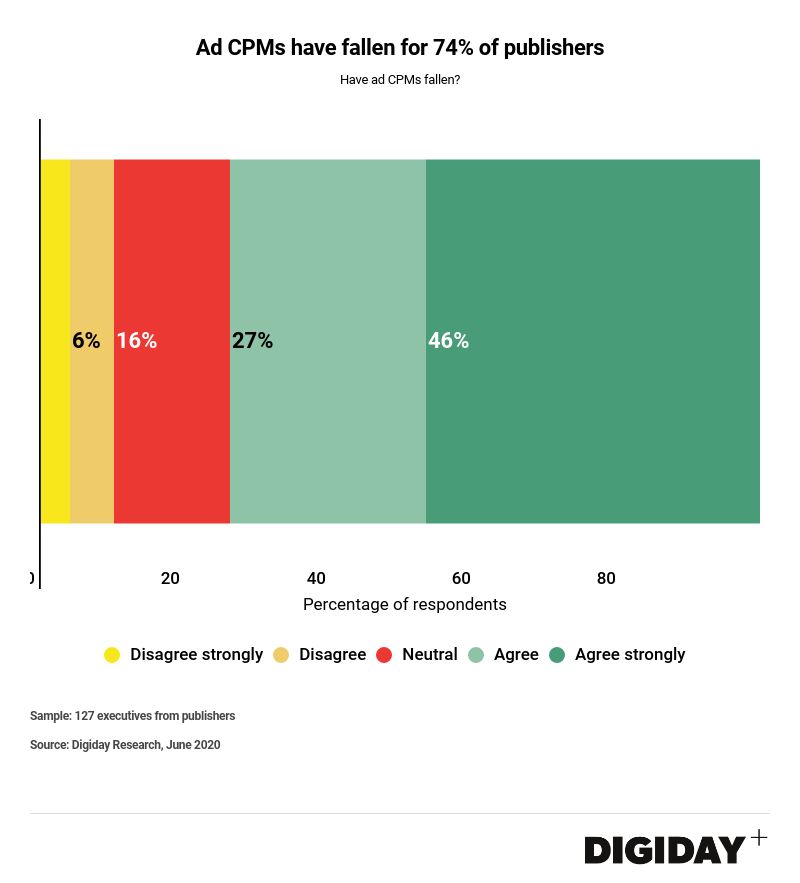

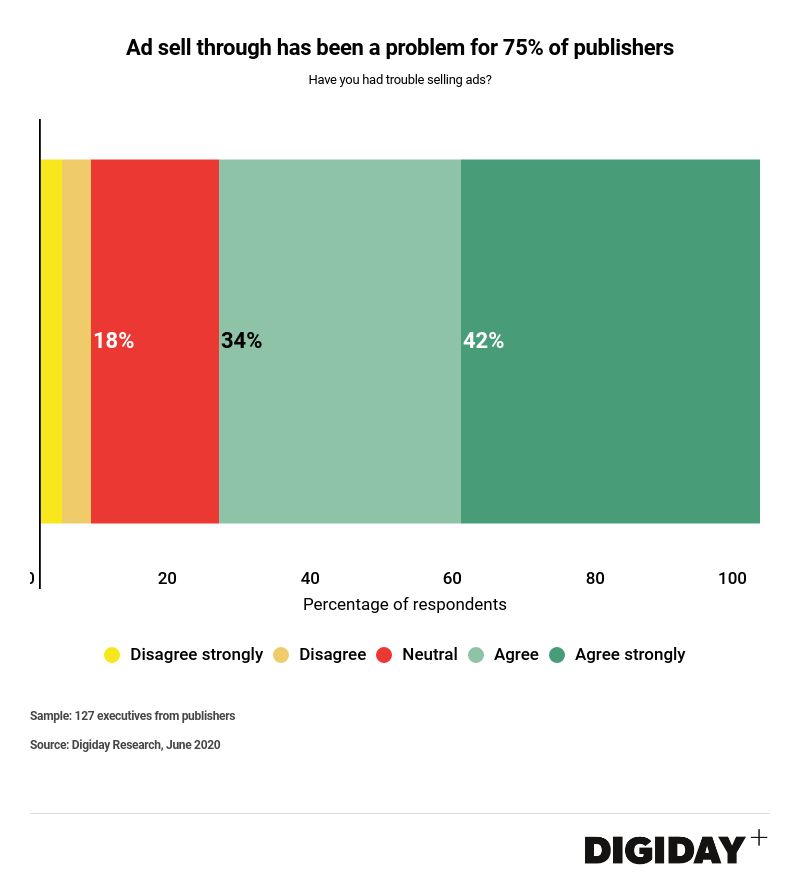

About 74% of 127 publishing executives surveyed by Digiday this month said the crises have driven ad CPMs down, while 75% said they’ve had difficulty in ad sell through. Programmatic ad CPMs have been driven down between 10% and 20%, with some publishers choosing to reduce inventory instead of selling it at an extremely low rate.

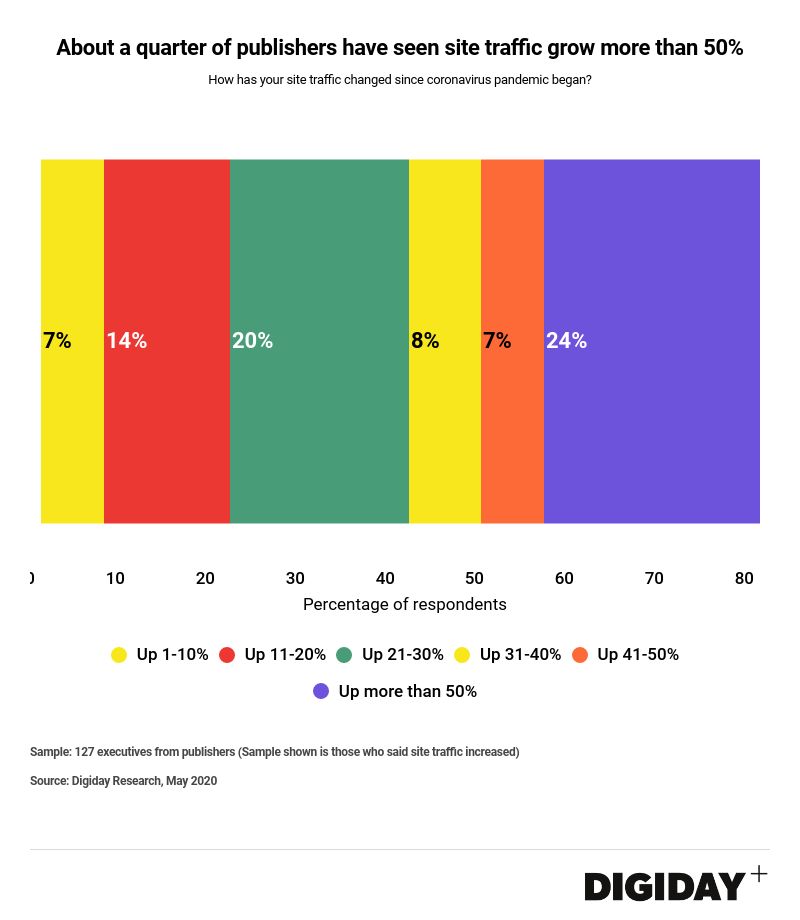

Despite traffic growing, (see our earlier research) publishers, particularly news publishers, have found it hard to make ad revenue from that increased traffic. Some of this is is due to keyword blocking: Coronavirus-related keyword blocking is a problem for 43% of publishers as advertisers try to avoid buying ads adjacent to certain types of content.

It’s been a similar problem more recently as protests and unrest have continued: As we reported earlier this week, the current news cycle makes more advertisers nervous, with keywords like “death” or “violence.”

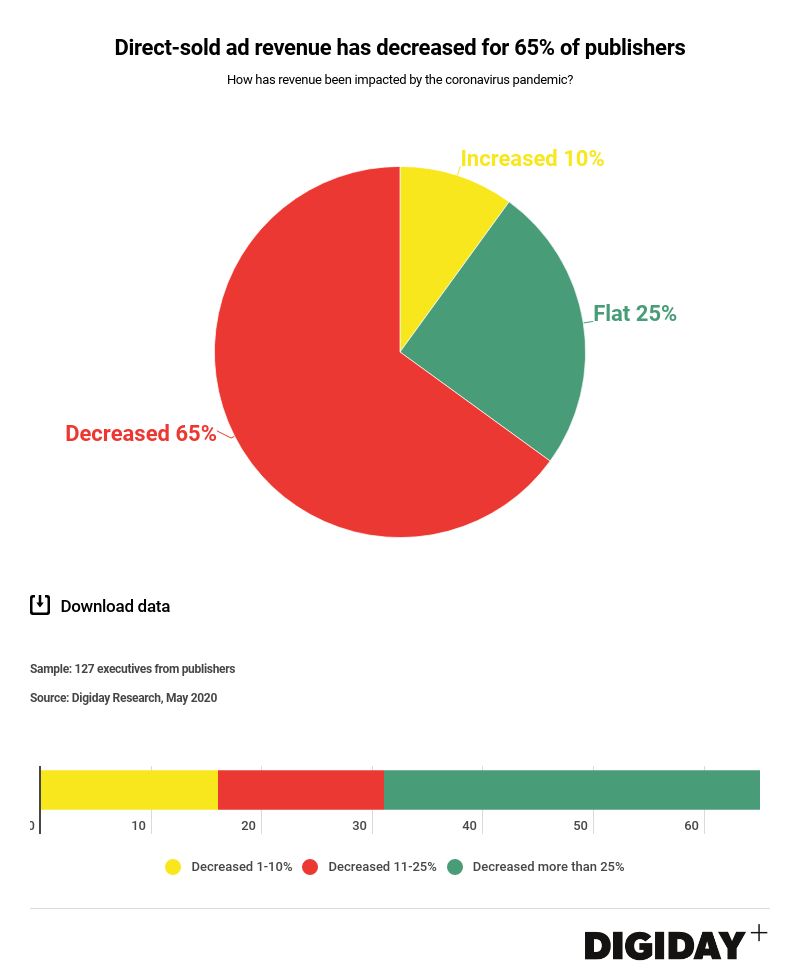

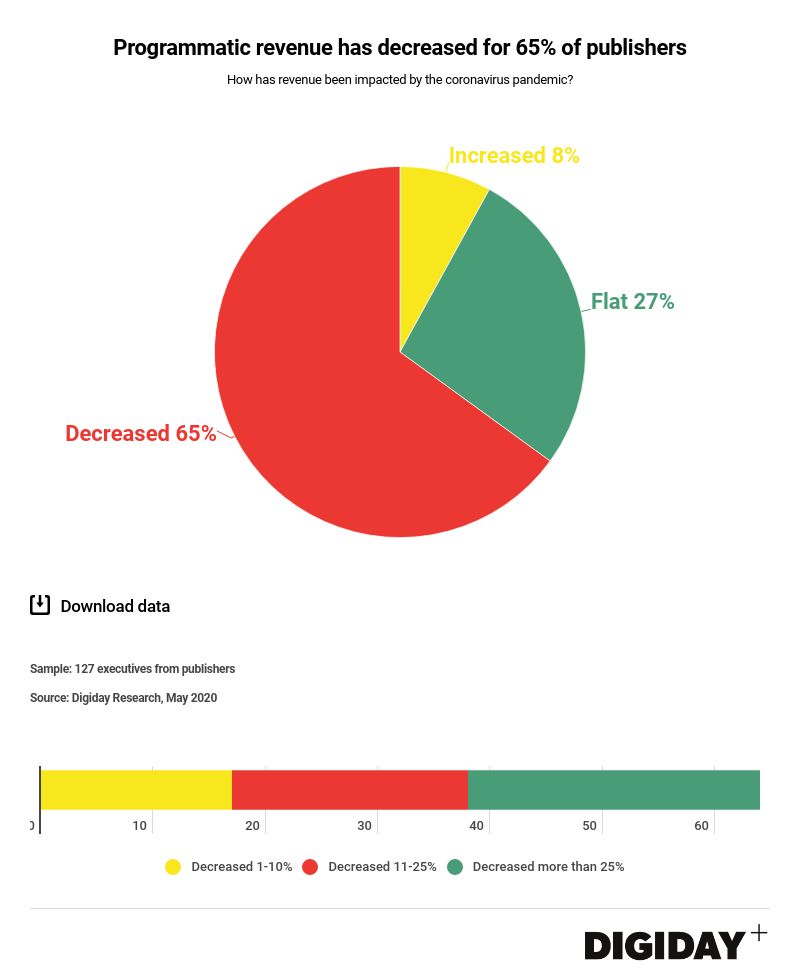

Among business lines, ad revenue was hardest hit in the first quarter, decreasing for a whopping 65% of all publishers. This included direct sold and programmatic ad revenue.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.