Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Publishers pull ad inventory from programmatic markets to protect ad prices

In a weak ad market, conventional wisdom would have publishers trying to sell more ads to offset lower ad prices. But some publishers are doing the opposite. They are taking inventory off the table in hopes that the short-term revenue hit will protect their ad prices and help their businesses in the long run by not baking in price cuts that are hard to claw back.

Since the programmatic advertising market operates under an auction system, the combination of lower advertiser demand and higher traffic to publishers’ sites has pushed down programmatic ad CPMs by 10% to 20%. To prevent ad prices from bottoming out to the point of devaluing their inventory over the long run, some publishers are reducing the inventory they make available in the programmatic open market in order to keep prices from falling too far that it takes longer for CPMs to return to their normal levels. That can mean using the ad slots to push internal subscriptions programs and other internal needs — or simply eliminating the ad slots from pages. For example, BuzzFeed is removing display ads that receive lower viewability scores.

There is difficulty in assessing the kind of impact these individual actions can have on a vast market with thousands of participants acting independently. OPEC is able to move oil market prices by constricting supply because it is a cartel. There’s no OPEC in digital media.

However, the publishers are not trying to move the broader market. Their aim is more narrowly focused on protecting their own inventory prices from falling so low that it will take longer to return to their previous levels, especially if advertisers buying their impressions at a bargain now are unwilling to pay more later.

When advertisers return to their normal spending amounts, “they’re going to absolutely remember that a publisher was 25 cents [per thousand impressions] in April of 2020,” said Andy Ellenthal, CEO of ad sales reporting platform STAQ.

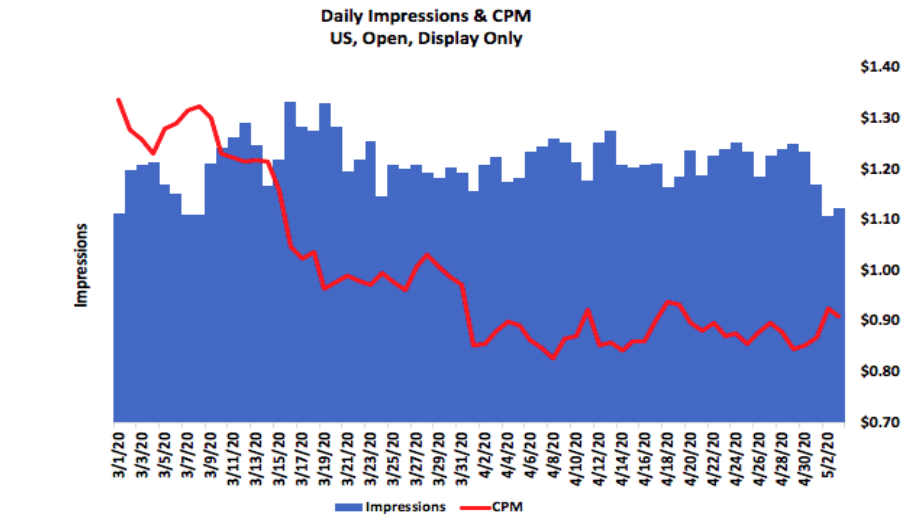

The average U.S. display ad CPM in the open auction has fallen from a high of $1.34 on March 1 to $0.91 on May 3, according to STAQ.

While the average CPM has rebounded since bottoming out at $0.83 on April 8, Ellenthal said he expects CPMs won’t experience a U-shaped recovery. “Probably it’s more of an L-shaped recovery, like a Nike swoosh, a slow, steady march upwards,” he said. That slower rebound means that the publishers whose CPMs have fallen the least will face a shorter road to returning to their previous prices.

“I’ve got to manage my supply to keep it in balance with demand, and demand has fallen so fast that now we’re trying to get ahead of the game. How much supply can we take off the table to control the CPM without actually truly hurting our business more than it’s hurt now?” said one publishing executive.

A second publishing executive said that removing one ad unit across their portfolio of sites equates to more than 1 billion monthly impressions. That’s a sizable number but is unlikely to be a market-moving amount. MediaMath’s demand-side platform, for example, sees more than 180 billion impressions per day.

“These publishers always have to strike a balance between fill and yield. Chances are they are not going to fill 100% of their ad slots right now. If you have a billion impressions that go unsold anyway, what’s the value of them if they’re only pulling down pricing for your better impressions?” said Ellenthal.

Not all publishers can afford to take the short-term revenue hit, though. “What we’re counseling our clients is to be reevaluating their overall tech stack, to be adjusting their price floors, but grabbing the money where they can at this point,” said Scott Bender, partner and global head of client strategy at programmatic advisory firm Prohaska Consulting.

Publishers have been adjusting their price floors, increasing the minimum price at which an impression can be sold. However, the lower ad demand has put a ceiling on those efforts and contributed to publishers pulling inventory to protect prices. “The big lever inside programmatic is price,” said a third publishing executive.

One publisher had been increasing its price floors by 15% every two weeks since the start of the first quarter. But in the second half of March, it reached a point at which a significant number of impressions went unsold. The publisher could have reversed course and lowered its price floors, but “in no way do I want to drop my floors to 25 cents because I don’t want crappy ads coming in,” said a fourth publishing executive.

The lower that ad prices fall, the higher the likelihood that it falls to undesirable advertisers, which could jeopardize their ability to attract advertisers. Additionally, as publishers use this time of lower demand to seek out prospective new advertisers, they are wary that low CPMs would mitigate those advertisers’ interests in doing programmatic direct or private marketplace deals with a publisher.

“So many people, as we prospect, are like, ‘Why would I light up a deal with you if I’m buying you for 75 cents in the open?’” said the fourth publishing executive.

In addition to hoping that the inventory pruning helps their programmatic ad prices rebound, publishers are looking to see whether repurposing impressions can boost their other businesses and make them less reliant on advertisers.

If a publisher is able to see that house ads touting its subscription product is able to attract subscribers and yield more revenue than auctioning off those impressions to advertisers, “we might actually not take revenue from programmatic advertising and send our house campaigns because that’s actually a better way for us to monetize,” said a fifth publishing executive.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.