Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Atlas Obscura wants to be profitable before raising funds in a tricky media market

Atlas Obscura wants to turn a profit this year before it raises another funding round, at a time when publishers are facing lower valuations and pickier investors as deal activity slows.

Last year Atlas Obscura more than doubled its revenue to $18 million, up from $8 million in 2021, said CEO Warren Webster. Its trip-planning business doubled revenue year over year and became profitable in the fourth quarter of 2022. Its entertainment business (books, TV, film and podcasts) was already profitable.

But the next challenge is getting its digital publishing business to profitability this year before it looks for more investment. Webster declined to share how much money Atlas Obscura lost last year.

“Overall, we expect to be profitable this year. That’s our plan,” Webster said. “Probably the biggest change inside our business is we’re thinking more about sustainable profitability rather than just top-line growth at all costs. I think that’s maybe a healthy correction from the days of pushing, pushing, pushing on top line and not being so concerned about the bottom line. We addressed that, and are making sure that every project we do and every department within our company is either profitable or heading on a path to profitability.”

Atlas Obscura is currently conducting a search for a new head of brand partnerships and a director of media. Webster said the company is on track for profitability by the second half of 2023, and that part of Q4 2022 was profitable.

Atlas Obscura restructured its trips business to conserve costs by outsourcing some operations and “eliminating a few positions” last August, Webster said. He wouldn’t say how many people were let go or how much money these moves saved the company.

A former Atlas Obscura employee who left before these layoffs told Digiday, under the condition of anonymity, that they had heard the company was having trouble raising investment. Atlas Obscura’s last funding round was a Series B round in 2019, in which it raised $20 million from investors like Airbnb, A+E Networks and VC firm New Atlantic Ventures.

Webster said that he is currently “taking the temperature” of investors, but is holding off on the next funding round until the business and market have improved.

“We want to make sure we are raising at a time when the business is profitable and growing organically. That’s always the best time to raise. And when the market is in a place where there’ll be the most favorable terms. So we are taking it slow,” Webster said. “I think by the middle of next year, my prediction is things will become a lot more clear in the venture and funding world.”

Rightsizing in the meantime

Atlas Obscura isn’t alone in this approach. Many publishers are feeling the pressure to rightsize their organizations, according to conversations with two media investors and a consultant. The recent wave of media layoffs is also evidence of this.

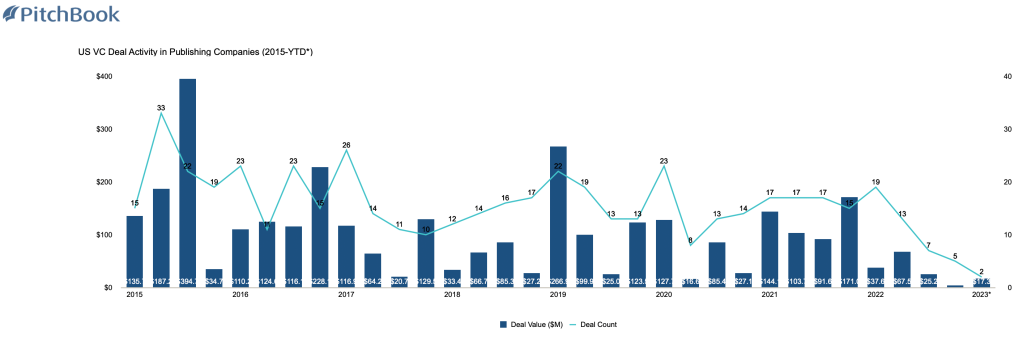

Data from capital market research firm Pitchbook confirms this too: There were just five U.S. venture capital deals involving publishing companies (defined as providers of print and internet publishing services, such as newspapers, magazines and books) in the fourth quarter of 2022, with a total deal value of just $4 million. That’s down from 15 deals in the same quarter in 2021, 14 in 2020 and 13 in 2019. It was the smallest deal count and deal value in the fourth quarter since at least 2015.

“[Private equity] firms everywhere are scrutinizing their potential investments more. I think we’ll see some prospective investors not committing to new investments until they see how the market performs in the next [three to six] months,” Andrew Perlman, co-founder of VC firm North Equity and Recurrent Ventures, said in an email.

Sam Thompson, senior managing director at mergers and acquisitions advisory firm Progress Partners, called Atlas Obscura’s strategy a “level-headed” one. He said now is the time for media companies to take advantage of the slower market to “clean up” their businesses before investors return, especially companies looking for middle-stage and later-stage investors.

“I’m sure publishers’ CFOs right now are working overtime to restructure their businesses to be as solid as possible, and if not profitable as possible,” Thompson said.

Investors’ media interest cools

Perlman predicted that there will be smaller funding raises going forward. For now, most companies are focusing on “optimizing their operations and profitability,” he said.

When it comes to what kind of companies Recurrent is looking to invest in, Perlman said the firm wants “brands that have authority in their space, dedicated enthusiast audiences, a diverse revenue model, and strong partnership opportunities.” The company’s M&A strategy is focused on deals that would add value to its existing verticals, as it watches “how the market evolves,” he said.

Notably, VC firm Lerer Hippeau — co-founded by Ben Lerer, who sold Group Nine Media to Vox Media last year — no longer invests in new media companies, and media is not currently a priority sector for the firm, a spokesperson said. The company recently invested in areas like Web3, health, data and software platforms. The last investment Lerer Hippeau made in a content production company was in 2020, when it invested in Meet Cute, a company that produces short-form audio rom-coms, according to its website.

What this means for valuations

Last week, CNBC reported that Vice News is restarting its sales process with a much lower valuation of under $1 billion, compared to $5.7 billion in 2017. The company sought a valuation of about $3 billion when it attempted to go public via a special purpose acquisition company in 2021, but instead raised $135 million from existing investors.

Vice’s valuation drop wasn’t a surprise to the media investors Digiday spoke with, as valuations have continued to slide downward amid an uncertain ad market and high interest rates that have slowed down the private markets. Because demand isn’t high and competition is lower, “irrational” prices that people were paying for businesses have come back down to earth, Thompson said.

But Vice’s valuation is a contrast to Axios’ sale last August to Cox Enterprises that valued the company at $525 million, roughly five times its projected 2022 revenue of over $100 million. However, Axios was profitable — Vice is not (though CEO Nancy Dubuc told The New York Times the company is aiming to break even this year). Thompson said Axios’ sale and Vice’s valuation “will be used as market [comparisons].”

Times like these — when competition is low — are also when traditional media companies go out to purchase assets to grow their own businesses, Thompson said. Insider reported this week that Vox Media is looking to raise $200 million to do just that.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.