Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

How made-for-advertising publishers are stopping the ad industry’s sustainability goals

For many publishers, sustainability has become a key pillar within their company mission statements. And now, as advertisers and their agencies start prioritizing low carbon emissions in their media buys, there is financial incentive as well to reduce the carbon footprint of their advertising businesses.

But not all publishers are feeling — and responding to — that pressure to become more sustainable: chiefly made-for-advertising sites.

In fact, some experts believe that there is going to be a plateau in the ad industry meaningfully reducing its carbon emissions if a handful of particularly bad players don’t fundamentally change the way they sell their programmatic ad inventory.

It’s not surprising that companies whose revenue streams are dependent on ad sales wouldn’t be willing to reduce the number of programmatic auctions they sell their inventory in. And as it stands, most of the carbon reduction on the sell-side has begun with supply path optimization (SPO), which means reducing the number of ways the same ad inventory is sold.

Publishers like Insider, Hearst and The Guardian have started looking for ways to eliminate redundancies in their programmatic sales processes. But, these types of publishers are already transacting in significantly fewer programmatic auctions than made-for-advertising companies, meaning their SPO efforts contribute less to meeting the ad industry’s sustainability goals, according to Chris Kane, founder of programmatic supply chain management company Jounce Media.

“Gannett, Insider, Daily Mail, Vox, Hearst, Penske, you could split some hairs here, but they’re just normal web portfolios. But when you get to the [made-for-advertising sites and] these are off the charts — like 100 times or 220 times more auctions per user session,” said Kane.

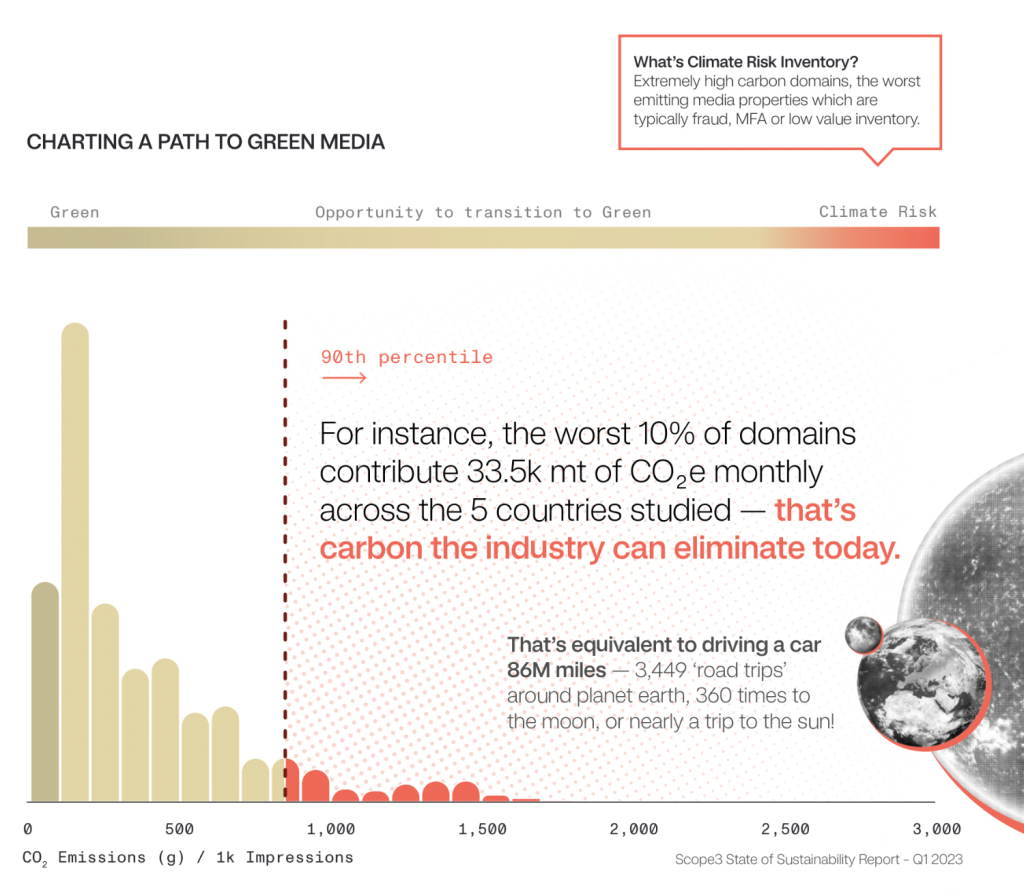

In an analysis of the top 50 web portfolios performed by Kane’s company, many of which were publishers, companies were indexed based on the number of programmatic auctions used per user session. The top 11 publishers on that chart over-indexed by at least 56.5 times, up to 220 times the average. Kane declined to name the publishers on the list, but many in the top 20 could be classified as “made-for-advertising” publishers. He continued that only 15-20% of programmatic dollars even get spent within those channels, but they make up more than half of the total digital ad market bidstream.

“It’s a crazy amount of auctions that come from a small number of publishers that operate really low-quality supply that most brands and agencies don’t want to buy in the first place,” said Kane. “They are [contributing] … something on the order of like half of the industry is carbon emissions.”

Because these top-offending publishers are not trying to reduce carbon emissions in their ad businesses, buyers and advertisers are being advised to intentionally avoid buying their inventory.

“We are building out [the] nuance [within our buying strategy so] that we can truly reward the best players. Medium players, we don’t cut them out, but then the truly lowest [publishers], we are cutting out because it’s poor quality inventory anyway and we really shouldn’t be there,” said Kris Doerfler, director of innovation at ad agency CMI Media Group.

Carbon emission measurement firm Scope3 advocates for buyers to defund this type of inventory, which not only reduces carbon footprints, but sends a direct message to the made-for-advertising content farms that the way they do business is unethical from a sustainability perspective.

The cherry on top of all of this is that publishers are now equipped to create even more content pages than ever before through generative AI and because of that, significantly more ad inventory is being created — sometimes by the magnitude of hundreds of web pages per day.

An investigation conducted by anti-misinformation firm NewsGuard last month found that nearly 50 content farms have been created that use “chatbot journalists,” per a report by the Guardian, meaning that upwards of hundreds of stories are being created every day and ad spots within those stories are being sold in myriad programmatic open auctions.

Not to mention that operating that technology themselves comes with its own carbon emissions baggage.

“There’s like 10 companies [buyers can] cut out of the bidstream. It’s an easy problem to solve … politically it’s a nightmare, but practically speaking, it’s [a] very clear solution,” said Kane.

More in Media Buying

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Canadian indie Salt XC expands its U.S. presence with purchase of Craft & Commerce

Less than a year after buying Nectar First, an AI-driven specialist, Salt XC has expanded its full-service media offerings with the purchase of Craft and Commerce.

Ad Tech Briefing: Publishers are turning to AI-powered mathmen, but can it trump political machinations?

New ad verification and measurement techniques will have to turnover the ‘i just don’t want to get fired’ mindset.