Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Bold Call: The ad industry’s herd mentality risks an unnecessarily severe slowdown

This article is part of a new series in which Digiday challenges industry assumptions and explores why today’s long shots could be tomorrow’s inevitabilities. More from the series →

A downturn is coming, but the ad industry might talk itself into making it worse.

We get it. The world is a mess. Tariffs are doing the economic hokey pokey, geopolitics are one long anxiety attack, and President Trump is back with his signature brand of chaos.

It tracks that 2025 ad spend forecasts are sliding. Who wouldn’t be skittish?

But the danger isn’t the downturn itself — it’s that the ad industry is about to catastrophize itself into a deeper hole than necessary.

And this isn’t some new quirk. It’s a muscle memory. One shaky earnings call sparks a narrative shift. A modest pause in spending becomes a full-blown freeze. Budgets get slashed, campaigns scaled back, and marketers retreat — not because they necessarily have to but because of everyone else.

It happened in 2022. The industry flinched early and often. As industry analyst Brian Wieser pointed out back then, the fear hit harder than the fundamentals.

And now, the signs are stacking up again. Holding companies have revised targets, CMOs are dragging their feet on approvals. Layoffs are rolling out before the quarter’s even up. The downturn hasn’t arrived, but the industry’s already halfway into fetal position.

Meanwhile, the fundamentals that actually drive ad spending are still hanging on.

Profit margins, not political drama, drive ad spend

Tariffs make headlines. Earnings drive decisions. And so far corporate profitability hasn’t taken a direct hit from all the geopolitical noise — not in a way that justifies slamming the brakes on advertising. The balance sheets still look decent. Until that changes, the panic is mostly vibes.

“We haven’t had the Q1 results season yet, so it is hard to know what companies are doing, but (so far) the feeling is corporate profitability is not being impacted dramatically,” said Ian Whittaker, a market analyst and founder of Liberty Sky Advisors. “I think the risk is advertisers think the industry is slowing down, their competitors are likely to be cutting, and therefore they should do the same.”

Volatility cuts both ways

The sheer unpredictability of the moment might be the best argument against overreacting. Why cut budgets now when the policy landscape can change again in a few weeks? Marketers have been through this cycle before, and most would rather stay nimble than make drastic moves they’ll just have to reverse by summer.

That’s also why analysts, despite the noise, are treading carefully. The consensus so far isn’t alarmist. But if conditions worsen — if tariffs escalate and drag the U.S. economy toward a recession later this year or in early 2026 — ad budgets could tighten more aggressively, said Karsten Weide, an analyst at W Media Research.

The instability is real, but so is the risk of overreacting to it.

“You know the famous [Franklin] Roosevelt quote — ‘the only thing we have to fear is fear itself,’” said Vincent Létang, evp of global market intelligence at IPG’s Magna, which revised its full-year 2025 total media spend downward by half a point, from 4.9% to 4.3% on Wednesday. “Anxiety and pessimism is not necessarily self-fulfilling.”

Létang reminded that in late 2022, all economists, not just advertising experts, expected 2023 to be a recessionary year. “They were not thinking whether or not we were going to have a recession in 23 but how big it would be,” he said. “In the end, we had 3% GDP growth. So that’s an example of anxiety expectation that did not self-realize.”

CEOs still want pricing power, and ad dollars help buy it

The brands that stayed visible during past volatility didn’t just survive, they kept pricing power intact. Think Kellogg’s during the 2008 financial crisis or Procter & Gamble through the pandemic. That lesson still lingers. Cut spend now, and it’s not just awareness on the line, it’s your ability to charge what you want — within reason, of course.

“It’s definitely possible that buyers could eventually overcorrect if recession fears grow stronger,” said Weide. “For now, though, what I’m mostly seeing is advertisers pulling back spending in reaction to negative economic news as it happens — without tightening beyond what’s necessary.”

That discipline matters. It could mean the difference between a soft landing and a hard fall. The smart play is to focus on what can be controlled: strategy, pricing, power and staying top of mind. The forecast will change — it always does. But brands with a steady hand tend to come out ahead.

“Our clients — from retail to CPG to B2B — are still bullish on their media investment in the U.S. and in Europe,” said Jeff Matisoff, partner at Brandtech Group’s Jellyfish. “Most of our clients’ budgets are increasing year on year.”

Narratives move markets

Shoppers may be rattled but they haven’t shut their wallets, which makes every ad spending decision a test of nerve.

“If agencies like ours don’t provide the right guidance based on what we know about ad spend in the markets as a whole, I think you can end up with clients pulling back instead of leaning in,” said Scott Shamberg, president/CEO of independent media agency Mile Marker. “Our guidance has been, let’s not do anything foolish. Let’s see once we get into the second quarter where interest rates are, where the leading economic indicators are, and then revisit — because most of our clients have plans in place for the year.”

Some of the hesitation may be muscle memory. In late 2022, the industry braced for a recession that never really hit. This moment has echoes of that, Wieser said.

“That was certainly where economists’ consensus was, even if it seemed (to us, at least) that a recession was unlikely,” he continued.

This time, though, he sees more downside risk. Too many factors are working against ad spending for history to repeat itself.

Ultimately, the steepness of any slowdown will, in part, come down to psychology — not just economics. Pullbacks can snowball, but so can confidence. It’s the kind of moment that separates the cautious from the calculated — or as Warren Buffett put it, the fearful from the greedy. The sharper the instinct to retreat, the greater the reward for those willing to lean in.

Market research firm Big Chalk crunched the last three years of historical marketing mix data, and came to two conclusions it’s directing to the C-Suite: CFOs should be hesitant to shut off the marketing spigot, lest they make a common strategic budgeting mistake. And CMOs should take a surgical approach to media budgeting, lest they squander precious funds.

A familiar playbook for uncertain times

Economic volatility doesn’t stop marketers from spending. It forces them to get sharper. Time and again, downturns have prompted advertisers to invest in what works, especially performance channels like search and social, where ROI is measurable and flexibility is built in.

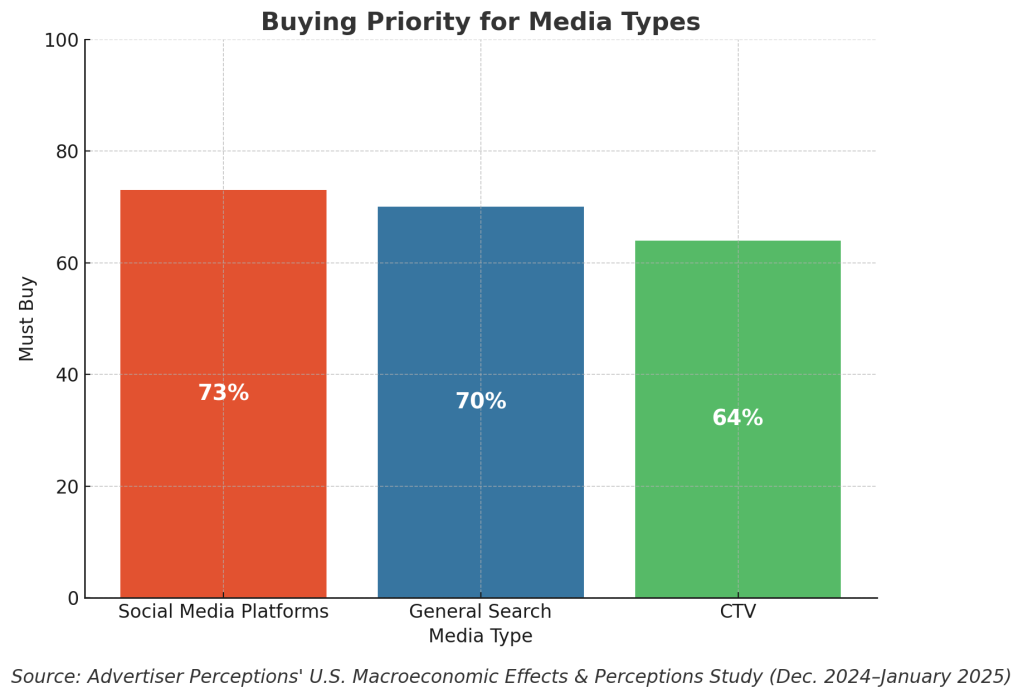

That’s playing out again in early 2025. Advertiser Perceptions’ most recent Macroeconomic Effects and Perceptions Study found social and search remain core pillars in media plans, even as budgets tighten elsewhere (see chart).

“If agencies like ours don’t provide the right guidance based on what we know about ad spend in the markets as a whole, I think you can end up with clients pulling back instead of leaning in,” said Scott Shamberg president/CEO of independent media agency Mile Marker. “Our guidance has been, let’s not do anything foolish. Let’s see once we get into the second quarter where interest rates are, where the leading economic indicators are, and then revisit — because most of our clients have plans in place for the year.”

Advertisers interrogate fee structures

Of course, marketers need to prove an ROI (specifically return on ad spend) in the boardroom, and in early 2025, efficiencies are a priority. Advertiser Perceptions’ most recent Macroeconomic Effects and Perceptions Study finds that social media and search remain a core priority on survey respondents’ paid-for media plans.

Greg MacDonald, CEO of Chelsea Strategies, noted the looming economic uncertainty among advertisers, especially in verticals like CPG or manufacturing. In this climate, marketers focus on proving performance and adding value, especially in ad tech.

“What does that look like? Brands are scrutinizing platform fees and working media more closely and exploring alternatives like direct-to-publisher and IO-based buys that bypass demand-side platforms,” he said.

“At the same time, they’re leaning further into curation, which, despite higher fees tends to deliver better outcomes,” added MacDonald, noting how companies are sharpening their focus. “Where they once had a ‘top five’ list of priorities, they are now betting on a ‘top three’ or even one big swing, whether it’s a product, partnership or market expansion.”

More in Media Buying

Omnicom Media North America CEO Ralph Pardo on integration and disintermediation

Ralph Pardo, CEO of Omnicom Media North America, explained how far along the holding company is in absorbing IPG’s agency brands, as well as why they were kept alive.

Ad Tech Briefing: Criteo named first ad tech partner to OpenAI’s ChatGPT ad pilot

This Ad Tech Briefing covers the latest in ad tech and platforms for Digiday+ members and is distributed over email every Tuesday at 10 a.m. ET. More from the series → Earlier this week, Criteo confirmed it is the first ad tech partner to integrate with OpenAI’s advertising pilot in the U.S., available in ChatGPT’s […]

The agency holdcos have an AI story, but not an AI business model

The holdco platforms need to deliver on the promises made — and so far, clients aren’t seeing it.