Secure your place at the Digiday Publishing Summit in Vail, March 23-25

‘You’re seeing the lightbulb go off’: Amazon’s ad business is appealing to more buyers

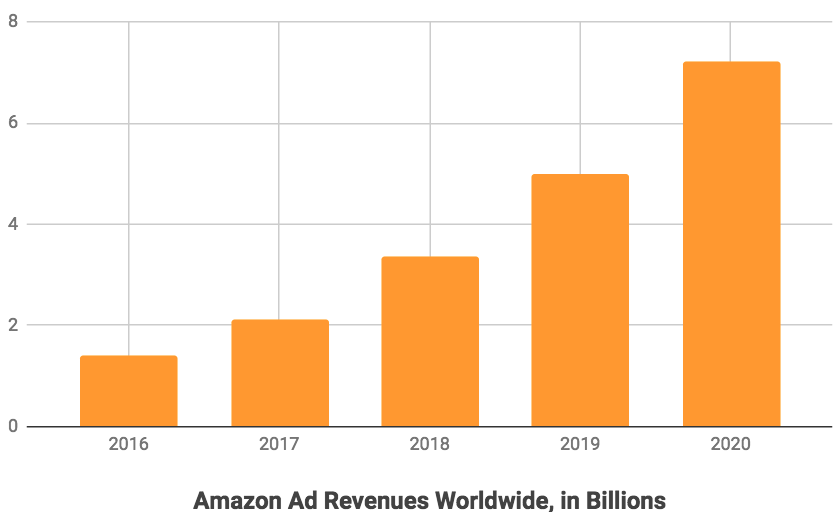

Amazon’s advertising business may have been absent from the company’s annual shareholder letter last week, but ad revenue continues to grow quietly behind the scenes, with particular growth in sponsored products and headline search ads, according to recent reports and ad buyers. It’s a sign of the sheer girth of Amazon that Bezos didn’t rate the $3 billion ad business a bullet point in his letter.

Amazon has also been beefing up its offerings. The company is making more products available and easier to use, buyers said. And conveniently, the fastest-growing ad format, headline search ads, appeal to buyers since many of them are already experts in the search business, given their work with Google.

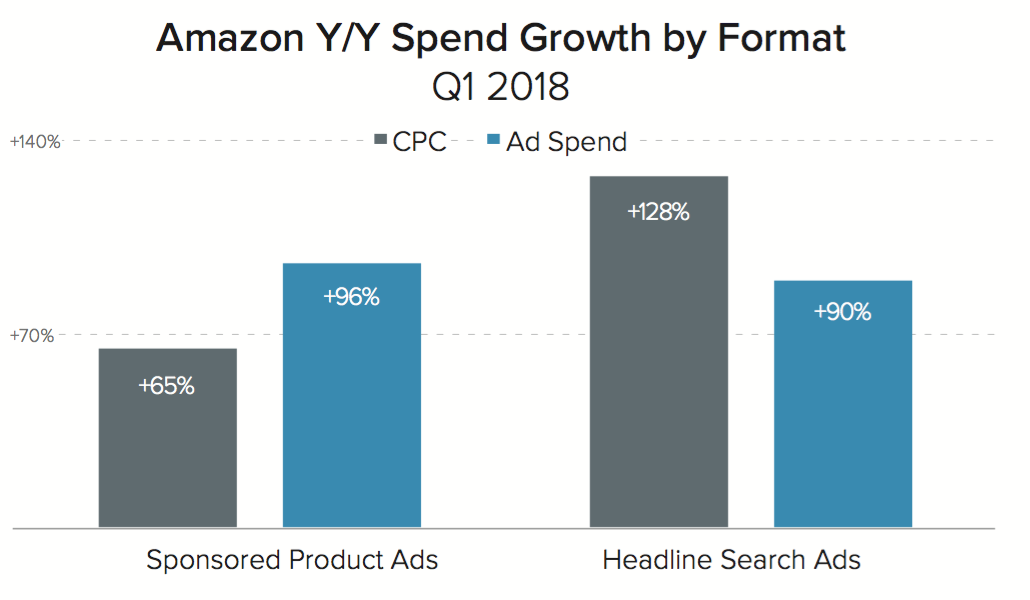

Increased interest from brands has resulted in Amazon ads becoming pricier, with Merkle’s digital marketing report saying cost per click for sponsored product ads is up 65 percent year over year and up 128 percent year over year for headline search ads. Buyers agreed to those estimates.

“I don’t know if Amazon is going to be building that themselves, or encouraging agencies and brands and third-party tools to develop,” said Will Margaritis, vp of e-commerce at 360i.

Amazon’s ad business grew to about $1.7 billion in the fourth quarter of 2017, up from $1.12 billion in the previous quarter, according to the reported “other” revenue. The entire business could bring in more than $3 billion this year, according to eMarketer. Spending on sponsored products and headline search ads increased 96 percent and 90 percent, respectively, year over year.

In the shareholder letter, Amazon CEO Jeff Bezos went as far as to tout the success of the Treasure Truck, its fleet of vehicles offering daily deals. While he did not mention the ad business, Amazon is top of mind in the ad industry. A big shift is how brands perceive the tech giant’s value. Amazon advertising works when it is done in conjunction with a larger Amazon strategy, including retail, review policing and even supply logistics.

Advertisers’ perspective is “shifting to see Amazon as more of a wholesale customer and realize it’s also an ad platform. What they’re putting onto Amazon works with what they’re spending on Facebook and Google, and even TV, and it’s even closer to conversion. You’re seeing the lightbulb go off,” Margaritis said.

Agencies are gung-ho. Martin Sorrell, former CEO of WPP, told CNBC in January the firm was spending $300 million on Amazon ads this year, up from $200 million in 2017.

George Manas, president of Omnicom-owned Resolution Media, said Merkle’s numbers were not surprising and perhaps “a little bit conservative. There could be more spend.”

While the shareholder letter didn’t reveal any new statistics on Amazon’s ad business, other numbers Bezos shared do provide some insight into its growth. More than half of products sold on Amazon globally came from third-party sellers, and Amazon Prime now has 100 million subscribers. The former means more potential advertisers, while the latter implies more valuable customer insights, said Monica Peart, forecasting analyst at eMarketer.

And given the state of brand safety across Facebook and Google and the government regulation on data privacy, Amazon is looking even more appealing to advertisers.

“With a company like Facebook, ads could be even interruptive to your experience, where Amazon almost seems like they’re not advertising. To the consumer, it’s, ‘Oh, I searched for this, and you’re trying to be helpful by showing me other options,’” Peart said.

Facebook, Google and Amazon each own massive data sets. But Amazon is unique in its commerce focus. Google knows intent, Facebook owns social, and Amazon wants purchases. Yet Amazon also has a much bigger business than just e-commerce.

“People use the phrase ‘walled garden’ to describe Facebook and Google. Amazon is a walled jungle. They have such a breadth of services. They have Prime Video, groceries, payments, Web Services. They operate a multidimensional business that in a lot of ways has become the personal microeconomy for people,” said Manas.

Amazon also has more potential inventory, such as through Prime Video or Fire TV, Manas added. Peart said she’s keeping an eye on Amazon Echo and the future of audio ads.

And Amazon, which has been hiring people in New York City to focus on advertising, also understands this is a relationship business. “They’ve realized the value of relationships instead of just data,” Margaritis said. “They understand that this industry operates via people.”

Subscribe to the Digiday Retail Briefing: A weekly email with news, analysis, interviews and more covering the modernization of retail and e-commerce.

More in Marketing

TikTok after the legal fight and why it’s coming for Meta’s ad dollars

With legal issues behind it, TikTok is stepping up marketing and making a stronger play for Meta’s ad budgets.

Ad Tech Briefing: Embattled, embittered and determined

Company executives come out swinging as the markets issue their judgements on Wall Street pitches.

Target CEO says ‘busy families’ will be company’s focus as it seeks growth

The company is making tweaks to departments like food and baby, as well as services like same-day delivery.