Secure your place at the Digiday Publishing Summit in Vail, March 23-25

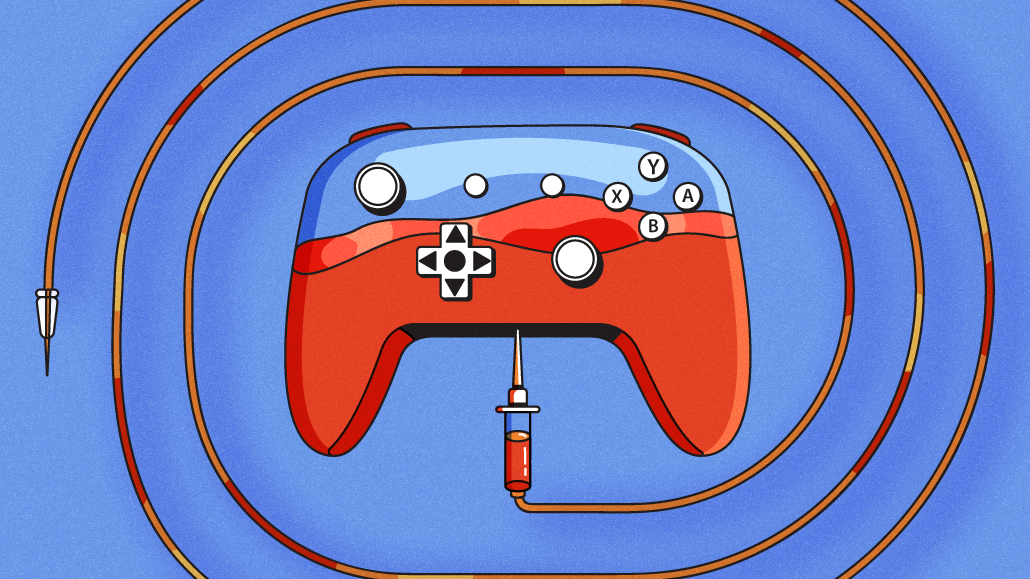

It’s becoming impossible for game publishers to avoid the question of advertising inside premium titles

As a Digiday+ member, you were able to access this article early through the Digiday+ Story Preview email. See other exclusives or manage your account.This article was provided as an exclusive preview for Digiday+ members, who were able to access it early. Check out the other features included with Digiday+ to help you stay ahead

Major game publishers’ flirtation with in-game ads has yet to blossom into a full romance in 2024 — but the question of advertising has become nearly impossible for them to avoid, as shown by Electronic Arts CEO Andrew Wilson’s endorsement of the revenue stream during the company’s earnings call earlier this month.

“Our expectation is that advertising has an opportunity to be a meaningful driver of growth for us,” Wilson said during the call. “We’ll be very thoughtful as we move into that, but we have teams internally in the company right now looking at how we do thoughtful implementations inside of our game experiences.”

His comment on in-game advertising during EA’s May 8 Q4 2024 earnings call was an off-the-cuff response to a question from Goldman Sachs analyst Eric Sheridan, not a prepared remark outlining a detailed strategy for the future. As such, it’s not surprising that an EA representative declined to speak further on the matter when reached for comment. Still, Wilson’s answer provided key insight into the growing urgency of standing up in-game ad offerings as the gaming industry’s traditional business models falter.

Wilson’s professed interest in in-game ads does not mean that Electronic Arts is going full-steam-ahead into in-game advertising. At the moment, EA’s advertising inventory is primarily located inside its sports titles, such as the popular football game EA FC, as well as its mobile games. The earnings call sparked widespread speculation that EA would be expanding its advertising offerings into more premium console titles, but EA has not confirmed this.

“It’s maybe, or maybe not, a bit unfortunate that Andrew’s and EA’s comments created so much commentary, as without further context it is really hard to know what Andrew meant by ‘very thoughtful implementations inside of our game experiences,’” said Kristan Rivers, CEO of the in-game advertising company AdInMo. “Free-to-play games, regardless of platform, are the sweet spot, as the ad-supported model is already there, and the value proposition of trading some time and/or attention in return for a free game experience is understood by players.”

But both Sheridan’s question and the excitement generated by Wilson’s answer to it are signs that EA’s entry into the premium in-game advertising market is more a matter of when than a matter of if. After laying off 6 percent of its staff in March, EA is in the process of pivoting its core business, and expanding its advertising products is one relatively simple way to make the business less dependent on premium game sales as games flock to free-to-play titles. As profit margins get thinner across the gaming industry, the relatively low overhead costs of an advertising business make it a potentially crucial revenue opportunity for beleaguered game publishers.

Standing up a bigger advertising business could also make EA more attractive to potential acquisition partners as the company explores its options for the future. In recent years, tech and entertainment giants such as Microsoft and Disney have shown an interest in acquiring or investing in game publishers, and EA flirted with its own deal with NBCUniversal in 2022.

“Any commentary on advertising by EA ultimately remains a reflection of its desire to be acquired by another major media and entertainment company, specifically by demonstrating its flexibility in generating revenue from a passionate fanbase,” said Gareth Sutcliffe, the head analyst covering the games industry for market research service Enders Analysis. “While any advertising option is unlikely to provide a material uptick in revenue, EA’s audience remains valuable and it assists in its positioning as a full-stack operation across all development platforms and nearly every conceivable revenue model.”

Should it push further into advertising, EA arguably has a head start over other major game publishers thanks to its wealth of experience placing programmatic ads inside its portfolio of sports games.

But EA will have to walk a fine line as it looks to expand these offerings into its other premium console titles, whose virtual worlds are largely devoid of natural advertising locations such as billboards and field-side banners. Serving ads inside these worlds could open up a promising new revenue stream for EA — but it could also risk alienating the company’s core gamer audience.

“If you’re interrupting the gameplay, that tends not to be ‘pro-gamer’ — and because it’s not pro-gamer, then you get this backlash,” said Dentsu evp and global gaming lead Brent Koning. “As we know with the gaming community, we are loud, we are vocal and we are right. So if you start to interrupt those experiences, I think that’s actually not good for brands, and I would advise our clients against things like that.”

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.