Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Media buyers crave more programmatic direct deals with publishers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

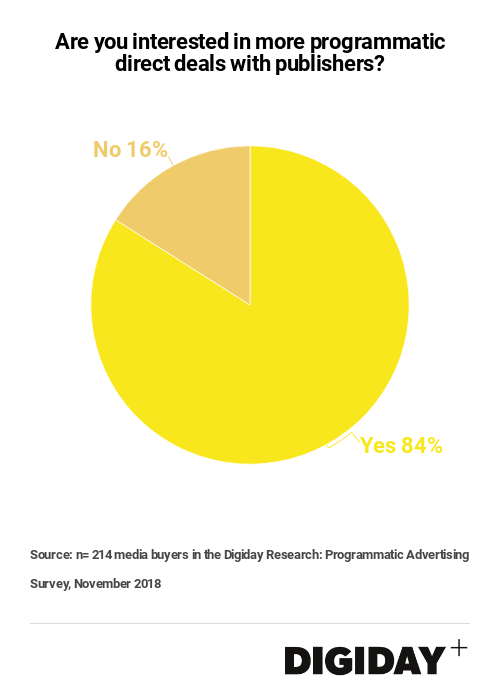

Media buyers are increasingly gravitating to programmatic direct deals. Eighty-four percent of the 214 media buyers polled by Digiday this November said they intend to direct more of their budgets to the channel in 2019.

Programmatic direct deals, while more costly than open exchange buying, appeal to buyers because it enables them guaranteed access to publishers’ premium inventory at fixed prices. Many advertisers believe this inventory performs better and is more brand-safe than what they might buy through open exchanges.

One key driver for the uptick in interest in programmatic guaranteed deals is clients. Those with sophisticated knowledge of the programmatic marketplace often push their agencies to buy on a direct basis, agency media buyers say.

But agencies aren’t eschewing open auctions altogether. Buyers recognize that there needs to be a specific reason for programmatic direct deals, otherwise buying in open exchanges can be a better option, assuming proper safeguards and targeting parameters are in place. “I do like PMPs and programmatic guaranteed, but there’s a time and place,” said Sarah North, senior programmatic specialist at Empower. “

Rather than being viewed as the cure-all to the safety and fraud risks of open exchanges, buyers say they’re more interested in programmatic direct deals as a way to fill the gaps of exchange-first strategies.

“We definitely prefer open exchange versus programmatic direct,” said Monica Capelan, vice president of sales planning at Horizon. However, she acknowledged that programmatic direct, particularly programmatic guaranteed deals, had specific use cases that made them valuable. She noted that programmatic-guaranteed deals can be useful to ensure a certain number of impressions with a publisher for campaigns that have a shorter cycle, like movie premiers.

Programmatic direct deals can also be a useful tool to lock in results for certain spending habits. For buyers that consistently spend with a certain publisher in open exchanges, “It definitely makes sense to enter into a private programmatic deal, said North. “Doing so guarantees the performance and it also saves you time from an optimization perspective.”

Following the General Data Protection Regulation, there has been reinvigorated interest in programmatic guaranteed deals because buyers saw them as a way to leverage publishers’ first-party data. However, buyers are unlikely to dive into programmatic guaranteed deals en mass. Instead, buyers, while certainly interested in such deals, are taking more measured approaches.

Because programmatic guaranteed deals often require higher minimum commitments from buyers with less flexibility, buyers could instead run a PMP deal with a publisher first before deciding to commit to a programmatic guaranteed deal. “I would not enter a programmatic guaranteed deal with a publisher without having first done a PMP deal so I can be sure of the quality of inventory that they’re going to pass me and the overall performance,” said North.

While the root attraction of PMPs and programmatic guaranteed was that it guaranteed that the advertisers’ ads would appear in a certain environment, earlier Digiday research found that brand-safety fears were not a primary factor driving spending on PMPs.

Buyers now have more tools at their disposal to fight against ad fraud and low-quality ads like ads.txt, a cottage industry of ad verification vendors and in-house technologies, meaning they don’t necessarily need to jump straight to PMPs and programmatic direct deals.

Media buyers will redirect more spend to programmatic direct deals in the coming year, but it won’t be a massive realignment of current spending. There are still several problems with programmatic direct deals that can turn buyers off. One anonymous buyer complained of the “lack of inventory, lag time with generating deal IDs, outrageous spend commitments and limited flexibility.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.