Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: How ad spending is changing in the coronavirus era

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

The vast majority of ad campaigns are on hold or canceled — 73 percent of buyers said brands are now “pausing” campaigns while they assess their next moves.

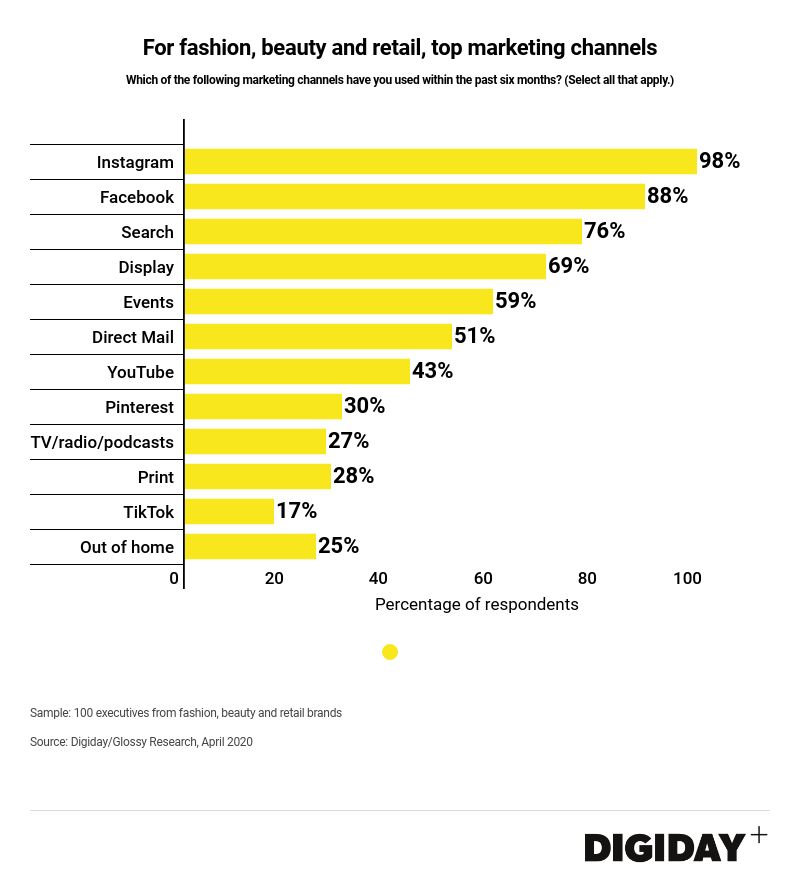

A new survey from Digiday/Glossy that asked 100 brands in the retail, fashion and beauty industries about changes they’ve made to their marketing strategies.

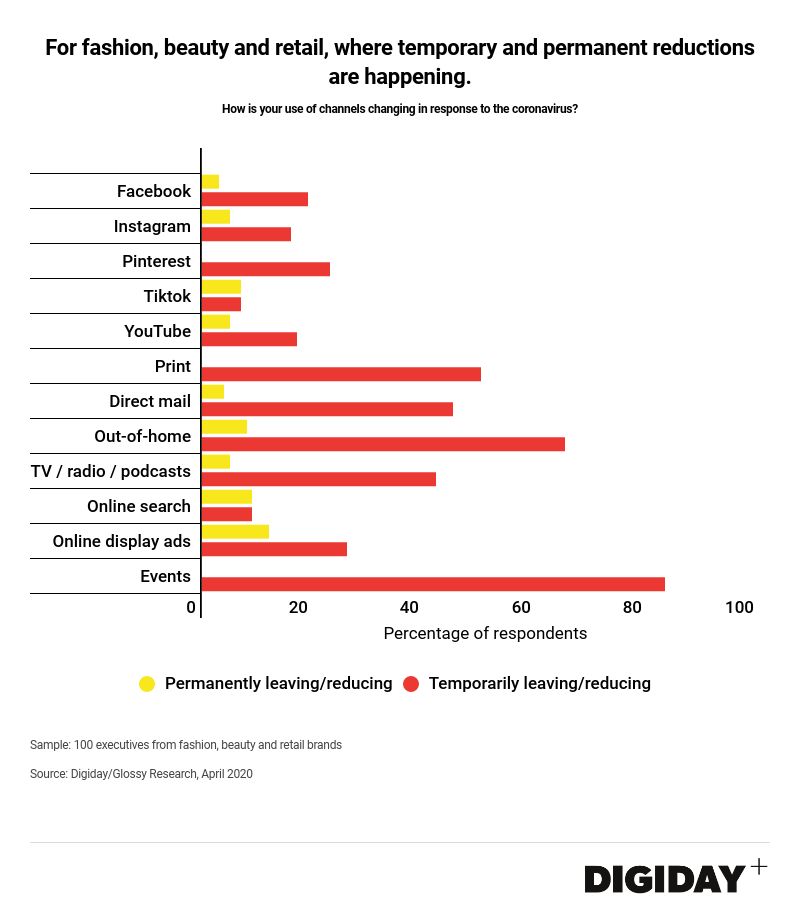

The top five channels brands were either temporarily reducing or temporarily leaving were in print advertising, direct mail, out of home ads, TV/radio and podcasts, and of course, events. The top channels brands planned to permanently reduce or entirely eliminate advertising in were events, TV/radio and podcasts, and online display.

The largely unscathed channels were Facebook, Instagram, TikTok and online search.

The data gives a snapshot of the marketing industry at a time where many are debating whether there are permanent, lasting effects of the current crisis.

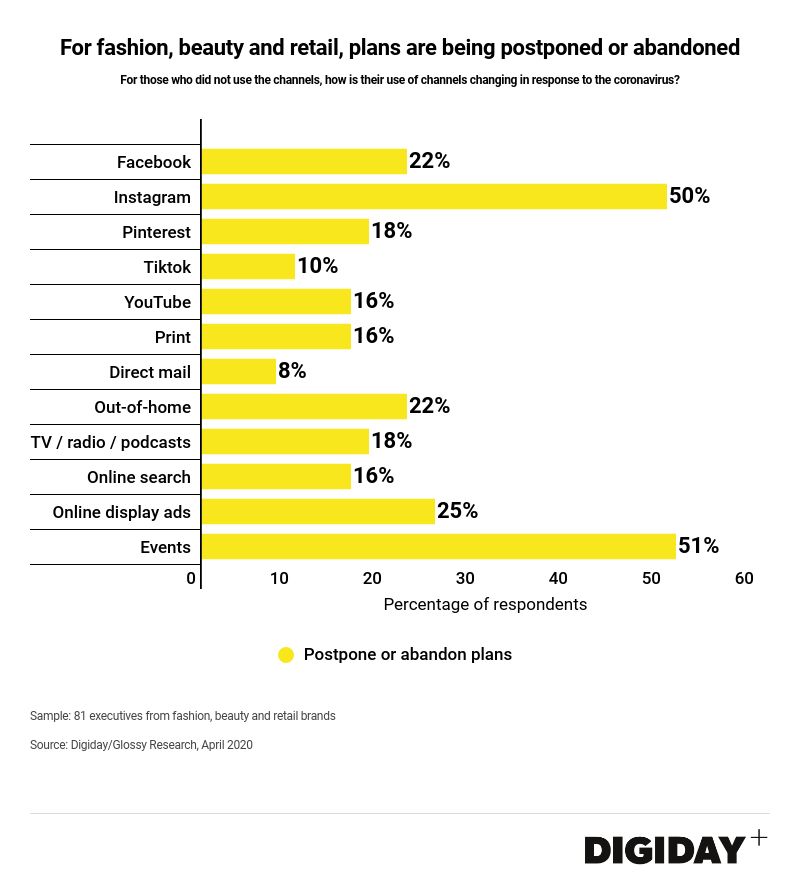

The survey also asked those who had plans to grow expenditure in certain channels and if the crisis has made them rethink those plans.

About 22% of respondents said they would postpone plans to spend money on out-of-home ads, while 48% said they would postpone plans to do any new marketing events.

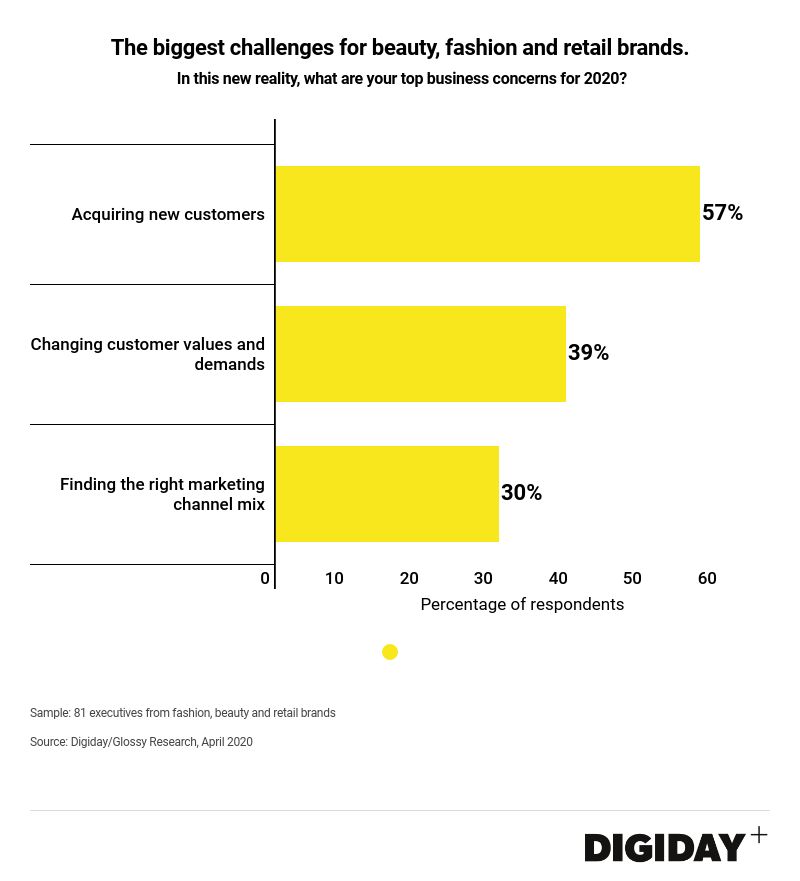

The survey also asked about the top business concerns for 2020 in light of the coronavirus. Finding the right marketing channel mix was the top concern for 30% of participants, while 58% of brands said its acquiring new customers.

The impact of this on the industry is stark. While most of the data so far has focused on the expenditures falling, the fact is that ad impact is relatively diverse depending on category. The IAB found in an earlier study that among those adjusting spend, there was a 33 percent drop in spend on digital media, and a 39 percent drop in spend in traditional media. The biggest impacts there were on print and linear TV, as well as display, in line with Digiday’s results.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.