Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: What if streamers adopted an ad revenue-sharing model for original programming?

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing explores the idea of top-tier ad-supported streaming services adopting revenue-sharing models for producers.

- Show me the money

- Streaming viewership overtakes cable TV

- Netflix’s ad product, TikTok’s shoppable ads and more

Show me the money

What if the rise of premium ad-supported streaming were to meet with the entertainment industry’s current era of austerity to spark a new financial model for original programming? And what if that financial model wasn’t actually all that new, but mirrored the model of theatrical movies met with YouTube?

What if Netflix and the like decided to split ad revenue with the companies they pay to produce original shows and movies?

Ugh, groan, right? Digital video producers grouse about how YouTube’s, Facebook’s and Snapchat’s ad revenue-sharing programs can be unreliable revenue streams, and thereby compromise how much money the producers are willing to invest in videos. That’s a reason why these producers try to pitch projects to the big leagues of Netflix, Hulu and HBO Max that the streamers will cover with big checks paid upfront.

But those big upfront paychecks are under threat. Warner Bros. Discovery is trying to cut $3 billion in costs, leading to a development freeze and layoffs at HBO. Disney’s new activist investor Third Point is pressing the company to similarly cut costs. And even smaller original programming distributors are doing cost-benefit analyses. Roku, for example, has started to look at the programming costs for its free, ad-supported streaming TV service The Roku Channel, and Charter has opted to exit the original programming business as production costs have increased.

And that’s another thing: Production costs have increased with rising inflation, rising interest rates, supply-chain constraints and the continuation of Covid-19-related costs.

These financial factors have already opened up the likes of Netflix and CNN Films to co-financing projects. However, the co-financing model can result in some rights to a project reverting to the producers of that project, which can inhibit the streaming distributor from capitalizing on the intellectual property rights to sell merchandise and create theme park attractions based on a movie or show.

“Companies that have a 360 [degree] view of content, they’re going to be fundamentally less interested in co-financing because they want all the rights,” said one entertainment executive.

Why not broaden the economic model a bit more by co-opting the rev-share model for original programming as digital video platforms have done? The streamers would pay a certain amount of money upfront to help pay for a project’s production, the producing company would cover the remainder, and then both sides would make back their money by splitting the revenue from ads running against the show or movie.

While inspired by the digital video platforms, the model also mimics movies where producers can receive a percentage of theatrical ticket sales revenue in exchange for taking lower upfront payments.

“The model should really be: Take the pool of revenue that comes in, allow all the costs of production to be recouped, allow whatever advertising [costs] to be recouped and then share there — almost like the old theatrical model,” said a second entertainment executive.

The risk, of course, is that there won’t be enough ad revenue for producers and streamers to reap, let alone recoup. Facebook and YouTube have already proven how financially feeble ad-supported original programming can be. Another risk would be that a rev-share model introduces the wrong incentives — an overload of ads and mass-appeal projects that lack any real appeal — scuttling the streamers’ ad-supported viewership and potentially turning off ad-free subscribers subjected to the same fare sans ads.

Then again, the top-tier streamers like Netflix could have some hope of succeeding in co-opting the rev-share model for original programming. For starters, major ad-supported streamers like Hulu and Peacock already charge at least three times as much per thousand ad impressions as digital video platforms, so there would stand to be more revenue to split per ad.

Then again again, if there’s more money to be made from advertising — including from product placement deals — and if the streaming owners are trying to cut costs to protect profits, a scenario in which they hoard that money for themselves seems much less iffy.

What we’ve heard

“I’m not surprised at all that [Netflix has] taken this long [to formulate its advertising pitch]. We all kinda knew that a million things could go sideways. I was surprised the timeline was so aggressive to begin with. They were trying to keep up with Disney+, but Disney has an ad sales team and built the platform knowing they want to allow advertising one day, and a lot of their content is their own, so they have more control over everything.”

— Agency executive

Streaming viewership overtakes cable TV

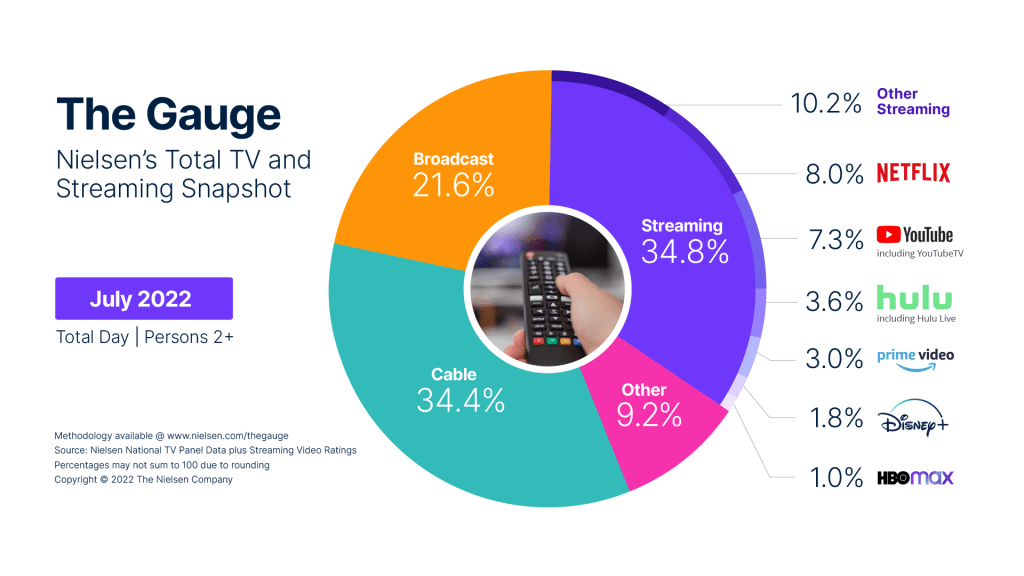

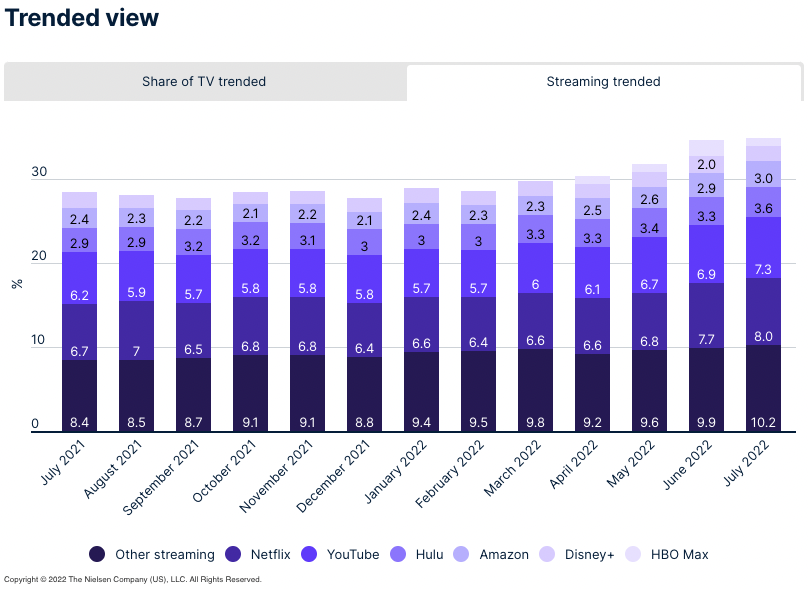

The amount of time that people spend streaming shows and movies on TV has finally surpassed that of traditional cable TV, according to Nielsen’s The Gauge TV viewership report for July 2022.

To be clear, traditional TV still accounted for a majority of the time (56%) people spent watching TV in July. And July is typically one of the weaker months for traditional TV programming with broadcast primetime shows and major sports leagues like the NFL and NBA being between seasons. Nonetheless, streaming overtaking cable TV’s share — and having surpassed broadcast TV’s share since Nielsen began publishing The Gauge last summer — marks a milestone.

However, while streaming’s share of TV viewership overall increased, not all major streamers saw upticks in July compared to June.

YouTube recorded the biggest month-over-month increase at 0.4 percentage points, followed by Netflix and Hulu with 0.3 percentage point rises each. And Amazon Prime Video’s share inched up by 0.1 percentage points.

By contrast, HBO Max’s share of TV watch time stagnated at 1.0%, while Disney+’s actually dipped from 2.0% in June to 1.8% in July.

Numbers to know

350,000: Number of U.K. households that stopped subscribing to any streaming service in the second quarter of 2022.

-1%: Percentage decline in linear TV ad spending in the second quarter of 2022.

$28 million: How much money Swiss Beatz and Timbaland claim Triller has yet to pay for acquiring Versus.

58%: Percentage share of survey respondents who said they’d rather pay a lower monthly subscription price for an ad-supported tier than a pricier, ad-free option.

1.9 million: Number of subscribers that top pay-TV services lost in the second quarter of 2022.

What we’re reading

Netflix’s ad product takes shape:

While Netflix has kept mum when talking with agency executives about its planned ad product, the streamer’s iPhone app spilled the beans on Netflix blocking ad-supported subscribers from downloading programs and skipping ads, according to Bloomberg.

Vice takes to Twitch:

Vice World News has debuted an original show on Twitch, making it the latest news outlet after The Washington Post and The Recount to adopt the Amazon-owned live-streaming platform, according to Adweek.

TikTok adds shoppable ads:

The digital video platform is still trying to make shoppable video a thing by introducing features for people to purchase products through advertisers’ videos as well as live streams, according to Ad Age.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.