Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: Media and entertainment matchmakers, 2024 edition

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the potential tie-ups that the media and entertainment could see as the M&A market appears set to heat up.

- Match game

- CTV’s children’s privacy conundrum

- TV watch time ends 2023 on a high

- ESPN’s NFL deal talks, entertainment unions’ next AI negotiations, VideoAmp’s currency costs and more

- Twitch has undergone a series of layoffs in recent years.

- Its total employee headcount has halved since 2022.

- Telly debuted a voice AI assistant built with OpenAI’s large language model.

- Samsung, LG and Hisense are incorporating AI technologies into their TVs to improve picture and sound quality.

- CES provides a backdrop for celebrities and creators to get in front of potential brand sponsors.

- Robert Downey Jr., Will.i.am and Paris Hilton were among the celebrities in attendance.

Match game

Paramount’s parent company, National Amusements, is reportedly on the verge of a sale. Whether the media conglomerate ends up in the hands of Skydance Media or Warner Bros. Discovery, such a deal could kickstart yet another wave of merger and acquisition activity in the media and entertainment industry.

So let’s speculate on which companies could pair up and why. To assist in the matchmaking undertaking, I called up Paul Greenberg, a veteran of A+E Networks, MTV Networks and Time Inc., who put a helpful caveat on any potential Paramount deal that will also serve as a blanket disclaimer for the hypothetical hitches below.

“It is a crapshoot because higher interest rates and regulatory scrutiny could make bigger deals difficult,” Greenberg said.

Another disclaimer: The rationale for the pairings are strictly strategic and take little account of the companies’ respective financial situations. Considering WBD’s candidacy for acquiring Paramount despite its debt load, fiscal concerns seem fine to set somewhat aside. With that out of the way, let’s make up some matches.

Warner Bros. Discovery + NBCUniversal

As mentioned above, WBD is reportedly in the running for Paramount. But with The Wall Street Journal reporting last week that Skydance is working to put together an all-cash offer for National Amusements, let’s — for the sake of making this exercise more interesting — say WBD loses out on Paramount.

Considering WBD’s debt load, it could just as well opt not to go deeper into the hole to buy another massive media company. But considering the state of the cable TV network business and WBD’s moves to stream sports on Max, a big reason why WBD would likely want Paramount is for its rights to air NFL games, which are far and away TV’s most premium programming.

In lieu of Paramount, WBD could make a run for Fox, which would also give it Tubi and a foothold in the free, ad-supported streaming TV market. But the Murdochs may be unwilling to part with their broadcast TV network — or WBD may be uninterested in taking on another cable TV news network.

That leaves NBCUniversal. Since the Warner Bros. Discovery merger, the Comcast-owned media company has been in a similar position to Paramount of being big but possibly not big enough. Comcast could continue to hang on to NBCUniversal, but it’s been pushing into the CTV platform arena through its Xumo joint venture with fellow pay-TV provider Charter. In light of streaming entering into rebundling era, maybe Comcast would want to sell off NBCUniversal to raise some money to reinvest in building the streaming equivalent of its legacy platform business.

Netflix + Roku

The name of the game in streaming advertising is scale. While Netflix’s ad-supported tier is growing, Amazon Prime Video’s entry stands to raise the bar, leaving Netflix in need of additional inventory and fast — or FAST.

Acquiring Roku would give Netflix a FAST service in The Roku Channel that could help to supplement the streamer’s ad supply. It would also help to up Netflix’s offering for ad-supported subscribers and create a potential on-ramp for future subscribers as well as a way to stay in the mix for customers who churn until they renew their subscriptions.

“They’ve got some good channels there. And some momentum. I know they’ve had some layoffs, but on balance, I think they could be a really interesting match for somebody like Netflix,” Greenberg said.

Roku would also give Netflix an opportunity to sell ads across other streaming services through Roku’s CTV platform business and OneView programmatic ad buying platform. And perhaps as importantly, Roku’s CTV platform business would put Netflix in position to be among the streaming bundlers, replicating the aggregator approach that it originally used to ascend to become the predominant streaming service.

As for Roku, the CTV company has been struggling to turn a profit, and its hardware business has been stagnant. Netflix’s profitability could offset those challenges, and the streamer could adapt its fledgling gaming business to the TV screen by working with Roku to make the next generations of its own fledgling smart TVs into pseudo gaming consoles.

Hearst + A+E Networks

Any mid-sized cable TV network business is an easy mark for M&A. What makes this imaginary marriage worth mentioning is that the two companies are already effectively engaged: A+E Networks is a joint venture between Hearst and Disney.

There are reasons against such a deal happening. For starters, Hearst would need to get Disney to sell its stake. But consider that Disney CEO Bob Iger has expressed an openness to selling the company’s non-core assets and, more to the point, has reportedly explored spinning off some of its TV networks into A+E Networks.

Additionally, the joint venture arrangement could be a case against any such acquisition by Hearst. Why would Hearst buy out the cow if it already owns much of its milk? Moreover, why would Hearst — a company already in the local TV and magazine publishing business — want to get in on the cable TV network business?

“I don’t know that somebody from the outside would say, ‘Hey, I really want to be in the cable network business right now,’” Greenberg said.

Fair enough. But for one thing, it feels weird to me that traditional publishers like Hearst and Condé Nast haven’t made more aggressive runs at building streaming businesses. I’d considered trying to make a case for some sort of Condé + AMC Networks match, but the effective elimination of Condé Nast Entertainment last year made such speculation seem especially misguided. So considering the existing corporate relationship between Hearst and A+E Networks, this is the pair I picked. Plus, in building up a streaming business, Hearst could use A+E Networks’ library of owned shows to augment its own intellectual property.

Greenberg entertained my imaginings and ended up doing me one better by making this match into a thruple.

“If Hearst wants to try to expand that footprint, maybe they bring in A+E Networks and bring AMC [Networks] together,” he said. The latter cable TV network owner has also been struggling, and its strength in scripted programming could complement A+E Networks’ unscripted arsenal.

Okay, maybe it’s not the most attractive match. But it’s fun to think about.

The New York Times + CNN

Speaking of fun matches to think about and traditional publishers getting in on streaming, what if The New York Times were to expand its subscription-based bundle ambitions to include a streaming service? And what if WBD were to find a buyer for CNN to bring in some funds to go after NBCUniversal (or pay down its debts)?

The New York Times has dabbled in TV and streaming, such as through its show on FX and Hulu “The Weekly.” And it continues to produce videos, including Oscar-winning long-form documentaries, for its YouTube channel. Meanwhile, CNN has had a hard time since being subsumed into the WBD maw.

Admittedly, those aren’t exactly the makings of a heaven-sent match. And Greenberg wasn’t exactly sold on the combination.

“I don’t know if they’d want to spend that much money, but it could be really interesting to do that. That could be an interesting pair-up; I wonder if there’s a licensing deal there too,” he said.

Nonetheless, this pairing seems as much a merger of complementary equals as any in this lineup. The New York Times seems set on selling subscriptions to the news in any format. CNN had rallied around building a subscription-based streaming service before its new corporate overlords immediately scuttled it. The New York Times gives CNN a new source of original reporting, and CNN gives The Times a new outlet for that reporting — and vice versa.

What makes this match especially fun for an outside observer is trying to imagine who would be the CEO of the combined company: Times CEO Meredith Kopit Levien or CNN CEO Mark Thompson, who happens to be the Times’ old CEO?

YouTube + Runway

If I had to pick any deal in this list to put somebody else’s money on happening, this would be the one. For starters, Google is already an investor in generative AI video startup Runway. Secondly, Google-owned YouTube has already been working on rolling out generative AI video tools for creators.

Google would likely want to own Runway as much to enhance the visual capabilities of its ChatGPT rival Bard as to bolster YouTube’s creation tools. But Runway would seem to bolster YouTube’s creation tools at an important time. Consider that TikTok already features generative AI features in its video editing app CapCut, and so YouTube could use Runway to catch up to the competition.

Having used Runway’s image-to-video and text-to-video AI generation tools, its capabilities would definitely benefit from being able to be trained on YouTube’s video corpus as well as Google’s image library (a minefield of copyright concerns, notwithstanding). And then YouTube would be in position to pitch Runway as not only a visual aid to video creators but also as a creative option for advertisers to pair with Google’s “let the computers do it” ad management tool Performance Max.

What we’ve heard

“There is a misunderstanding in the industry today that — just because the household is consuming content on the big screen, on the TV, and you could have parents present in the room — it may be okay to target the parents because, as an advertiser, you may be going after the parents and not the kids.”

— Future Today co-founder Vikrant Mathur on CTV’s children’s privacy conundrum

CTV’s children’s privacy conundrum

The connected TV ad industry continues to rely on the IP address for tracking viewers and connecting CTV audiences with other devices in the household. However, this type of household-level tracking appears to fall into a legal gray area when it comes to children’s privacy law.

In this video essay, I spoke with experts in privacy law, ad tech, children’s media and CTV to understand why complying with children’s privacy law on CTV can be so complicated.

Numbers to know

>23 million: Number of monthly active users — not subscribers — that Netflix’s ad-supported tier has.

27.6 million: Number of viewers that streamed the NFL’s Wild Card game on NBCUniversal’s Peacock.

-36%: Percentage year-over-year decline in TV-and-film shooting days in Los Angeles in the strike-affected fourth quarter.

>500: Number of employees that Twitch is laying off as part of a broader round of layoffs at Amazon.

17.9 million: Average number of viewers that NFL games attracted during the most recent regular season.

$80: New monthly subscription price for Fubo’s streaming pay TV service.

TV watch time ends 2023 on a high

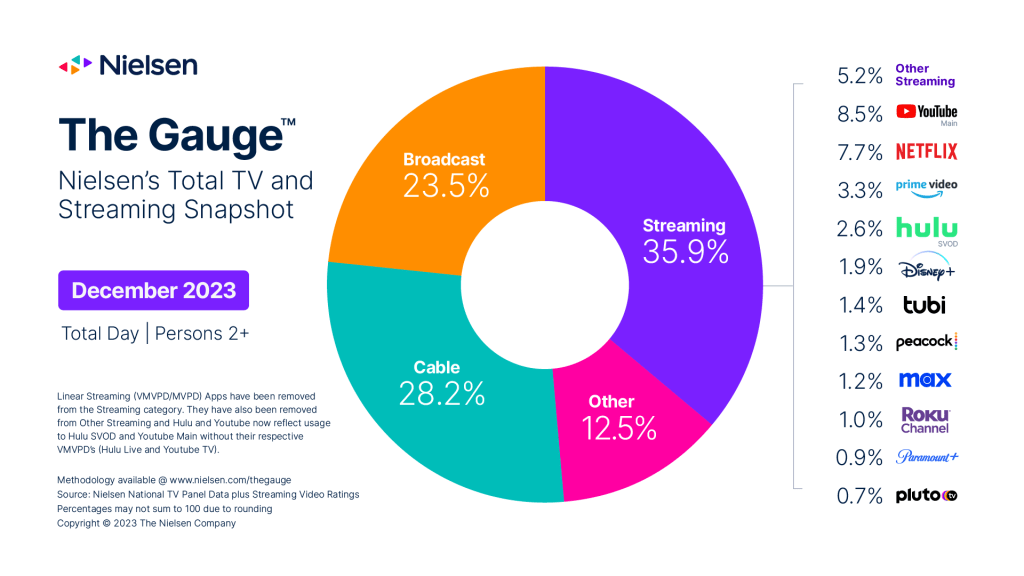

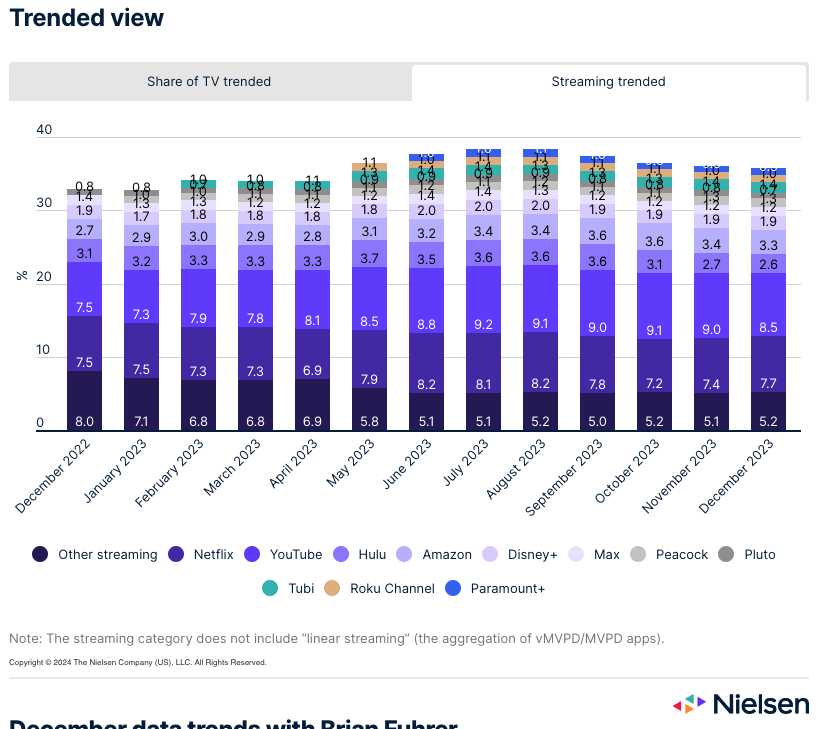

In December, people in the U.S. spent the most time in front of their TV screens since January 2023, according to Nielsen’s latest The Gauge viewership report.

While people increased their time watching streaming services and cable TV networks in December compared to November, both categories’ respective watch time shares dipped. So did broadcast TV networks’, and this category also saw its viewership decrease month over month.

YouTube also surrendered some of its watch time share, though it maintained its lead over Netflix as the most-watched streamer by share of watch time.

Netflix did creep up on the Google-owned video platform by 0.3 percentage points. The rest of the streaming category largely stayed the same, including Paramount’s Pluto TV staying under a full percentage point of watch time share.

What we’ve covered

Digging into the numbers around Twitch’s 35% layoff:

Read more about Twitch here.

At CES, new AI tools for TVs offer new features for both content and commerce:

Read more about AI-powered TVs here.

Celebrities, influencers descend on Vegas as creator space continues to evolve:

Read more about CES’s creator happenings here.

What we’re reading

The media company and sports league are discussing a deal that would give ESPN control of the NFL’s media arm and the NFL an equity stake in the Disney-owned TV network, according to the New York Post.

Entertainment unions keep a wary eye on AI:

The writers’ and actors’ guilds may have reached new agreements that govern TV-and-film studios’ use of AI, but they’re already considering how to tackle the topic in their next negotiations, according to Puck.

VideoAmp’s currency gambit isn’t exactly paying off:

In its bid to unseat Nielsen, the measurement provider has been overspending and has had to cut its revenue projections, according to AdExchanger.

The descriptors the streamer has appended to shows and movies — like “swoonworthy” and “cerebral” — have helped to get people to stream titles in a similar way to tags on print magazine covers, according to The New York Times.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.