Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The holiday shopping season is on and Bustle Digital Group is setting up shop virtually

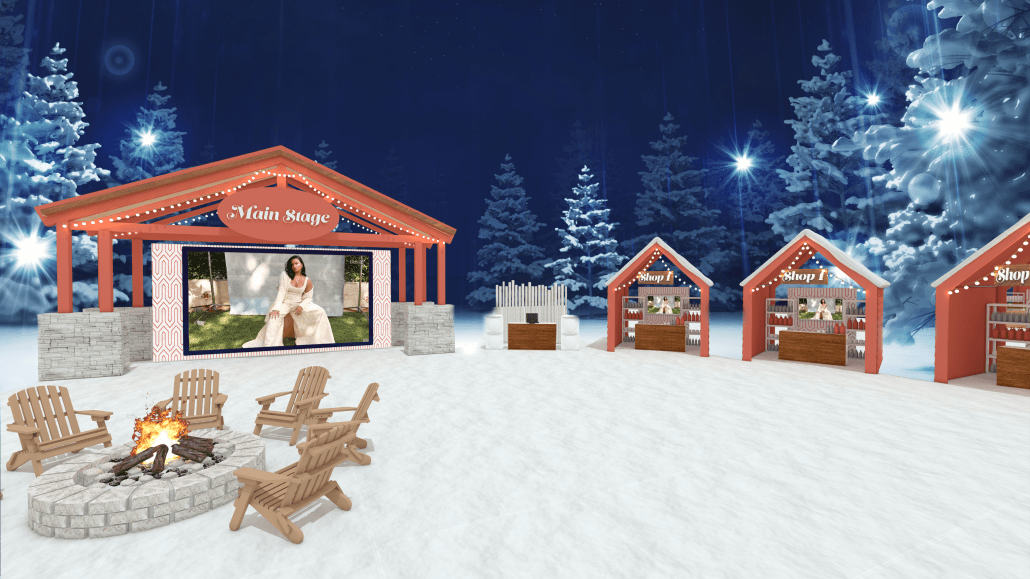

Bustle Digital Group is trying to recreate the holiday shopping experience online this year with its three-week-long Shop Holiday virtual bazaar.

Launching on Black Friday and running through Dec. 18, the online market will feature ski chalet-style booths where seven event sponsors — including Samsung, Kohl’s, Intimissimi and Gap — are able to show off their products. The booths will also incorporate editorially created content like quizzes, stories and videos, meant to keep viewers engaged with the brands to help with both top- and bottom-of-the-funnel interactions — including the ability to purchase those products right in the event itself.

“We’re trying to bring the excitement and energy of the good old fashion American mall into 2020,” said Jason Wagenheim CRO and president of Bustle Digital Group.

To do that, each of the publisher’s brands, including Romper, Nylon, Inverse and Elite Daily, will host an entertainment element like Nylon’s DJ booth, Romper’s photo booth and gifting videos from Bustle, Elite Daily and Inverse on the main stage. These elements will be playing 24/7 throughout the event so that people are able to join and explore at any point. There will also be one giveaway per day to keep people returning.

Being 21-days long, this will be the publisher’s longest-running activation for the holiday season, compared to its Let it Zoe influencer shopping event that has taken place in Los Angeles during past years. Those events were only able to last a few days at most because the costs of operating the in- person event was high, according to Wagenheim.

What’s more, Shop Holiday is expected to draw in more than 10,000 attendees over the three weeks, he said, which on average will spend about 20 minutes on the site. He added it would cost millions of dollars to pull off an in-person event of this size and while he would not disclose the cost of putting on the virtual experience, he said the bulk of the cost is tied to the technology and using Mark Stephen experiential agency.

Despite those costs, Shop Holiday is bringing in mid-seven-figures of revenue for its direct sold advertising business, which will account for 15% of the company’s overall fourth-quarter revenue. And this year, the fourth quarter is projecting to be up 25% year over year.

Publishers are beginning to figure out how to transition their experiential holiday pop-up shops and events to virtual activations in order to keep both sponsorship and commerce revenue strong in the fourth quarter.

While BDG is not using their Shop Holiday experience as an commerce revenue driver for its own business, it’s a goal for its sponsors that are looking to get a larger share of the e-commerce market that has skyrocketed since the beginning of the pandemic.

Wagenheim would not disclose how high the expected click-through and conversion rates will be for the activation, but said that so long as it is on par with the publisher’s other commerce-focused branded content initiatives, this event will be seen as a success.

Eric Fleming, executive producer of experiential agency Makeout, said that another cost that publishers have to keep in mind for their virtual holiday markets is user acquisition.

That’s because with the boom of e-commerce, there are multiple publishers, retailers and online marketplaces that are competing for customers’ attention, especially as the holiday shopping season begins to pick up earlier than usual this year.

It follows, Fleming said, that marketing around virtual events like BDG’s activation will be a necessary cost to bare as well. But they cannot solely rely on marketing — the value proposition has to be appealing as well.

“The competition is fierce for people’s attention,” said Fleming. “If [publishers] are just doing commerce for commerce’s sake, that’s illogical. Amazon does that all day long. But finding the right mix of editorial [with] virtual experience with the opportunity to purchase things throughout that experience makes sense.”

Aside from the branded content, giveaways and interactives that are scattered throughout the event, Fleming said another way for publishers to drive eyeballs to the site is to use the “drop” method of releasing limited edition items or short-term deals on products during the event.

“It comes down to creating something interesting to the audience,” said Fleming.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.