Why publishers are testing an old Facebook tool originally designed for brands

With more publishers trying to prove their worth as commerce and affiliate partners, a growing number of them have dusted off an old Facebook feature. In the past couple months, several publishers have quietly begun testing Facebook Shop, which the platform first rolled out to Facebook pages in 2015.

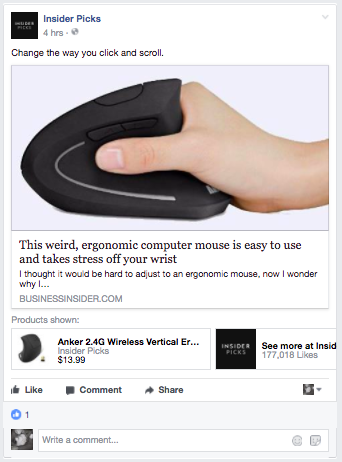

Instead of simply trying to drive readers to commerce-focused content outside Facebook with text posts or videos, numerous publishers, including the Axel Springer’s Bild and Insider Picks and Hearst Magazines’ Best Products, are now attaching separate product listings to posts that are driving readers directly to storefronts from the platform.

Theoretically, this new approach shortens the distance between a publisher showing a reader a product and that reader buying said product based on that recommendation. It’s also publishers’ latest bid to show they can drive revenue for brands using their audience, one of the key motivations for many publishers investigating e-commerce.

“I think publishers are responding [to Facebook Shop] because delivering ROI on advertising is about delivering revenue, and commerce does just that,” James Kim, the chief strategy officer of the commerce strategy consultancy Smith, wrote in an email.

All but one of the publishers using Facebook Shop declined comment for this story, saying only that they were in an early testing phase.

An examination of their efforts so far bears that out: The items on display inside these publisher-run Shops run the gamut, from antimicrobial toothbrushes to dress shirts to a chocolate fountain that costs $110. They drive readers to a host of different sites, from e-commerce mainstays like Amazon, Walmart and Etsy to independent individual brand storefronts. They also use a number of different affiliate partners, including Skimlinks and Pepperjam.

“They’re clearly in testing mode right now,” said Bart Mroz, the CEO of e-commerce consultancy Sumo Heavy. “I think they’re trying to figure out what brands want to do with it.”

What they’re all looking for is a way to fit Facebook into their commerce strategies. While affiliate commerce has become a sizable source of revenue for some publishers, search traffic, rather than social, has powered most of that revenue growth. Publishers have tried to change that balance in several ways, including content about products that Facebook’s users might share with their friends or making video content about products they sell on their sites.

But Facebook hasn’t given much priority to commerce-related posts so far. While it will still give priority to video content or content uploaded directly to its platform, Facebook would prefer brands to pay for the privilege of hawking products directly to its audience.

And so even though a large number of brands – 3 million, according to a Facebook spokesperson –adopted Shops after its rollout, brands have changed their Facebook strategies accordingly; the same spokesperson declined to share information about how many of them were in use. “I think most brands still think of Facebook as a social marketing channel,” Mroz said. “I don’t think they’ve fully figured out how to sell to audiences on there.”

That’s not going to dissuade publishers from trying, in large part because their brand partners are curious. “We have certainly seen interest in the market to find ways to include this and other commerce-driven products into our 360 branded content programs across Hearst titles,” Kelly Hushin, the director of content marketing for Hearst Magazines Digital Media, wrote in an email.

But even if brand interest keeps growing, publishers are likely going to run into the same structural challenges brands face on the platform. “This is e-commerce,”Kim wrote. “Attention spans are short, unless people are in search mode and are seeking out a specific product or are willing to try a new product. Facebook is going to need to beat out the convenience, simplicity and speed that Amazon has trained us to expect.”

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.