Secure your place at the Digiday Publishing Summit in Vail, March 23-25

‘Not a clear commitment’: European publishers see modest gains from platform subscription services

Facebook, Google and Apple now have more ways to drive subscriptions, but in Europe at least, the impact is still negligible.

In the last 12 months, platforms Facebook and Apple have released more subscription services, like Apple News+ and subscriber registration through Facebook’s fast-loading Instant Articles format, giving subscriber bumps to certain publishers.

But it’s still U.S. publishers reaping the benefit of these arrangements with platforms, according to Stefan Betzold, managing director at Axel Springer.

In the U.S., publisher relationships with platforms are naturally more evolved compared with Europe as new features launch earlier and engineering teams are closer at hand.

“[Platforms] have moved some steps forward, for instance in growing their news partnerships teams,” he said, “but it’s not in their DNA, there’s not a clear commitment.”

As subscription publisher businesses become more mature and forced to look beyond their loyal cohorts to drive new readers, platforms should become more important. This hasn’t been the case in Europe, according to research carried out by Axel Springer across 100 delegates at its paid content summit in Berlin, Germany, last week.

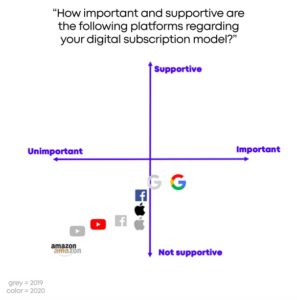

On a scale of one to 10, publishers scored Apple and Facebook higher than the previous year in how supportive they are to subscription publishers, based on the new services they have launched. Yet both Apple and Facebook score the same as previous years on how important they are for publishers in driving subscribers, that’s to say, they aren’t.

Google scored as more important for publishers but equally as supportive compared with previous years. The search engine scored higher than other platforms on both importance and supportiveness.

Platforms have always made a strong marketing channel for publishers driving subscriptions rather than distribution. For instance, Google’s Android store has been a successful seller of publisher apps and subscriptions, added Betzold.

“We see a marketing opportunity to use some of their tools, like Subscribe with Google, in order to help us reach our 2025 goal of 1 million digital subscribers,” said Lou Grasser, subscriptions director at Le Monde.

Apple News+ hasn’t arrived in Germany yet but Axel Springer is open to discussing terms, as it is with all platforms, as long as they meet the publisher’s requirements it set out when partnering with platforms. The publisher wants to be able to monetize its content, have access to its audience data — so it can learn how to improve its acquisition processes — and have the ability to sell its own advertising through the platform’s feature. Another crucial requirement: Making sure that free content is not given preferential treatment to paid content on algorithm-driven platforms, which favor stories with lower bounce and higher click-through rates.

“We need to work [so that] premium content is not discriminated against free content, that is the biggest barrier,” added Betzold. “It’s really hard to explain this to product people at newsfeed platforms, they don’t understand. It’s more of a European problem.”

“Our relationship [with platforms] has evolved tremendously over the past year,” said Katherine Bailey, general manager Wall Street Journal Platform and svp Wall Street Journal Digital. WSJ-parent News Corp and its execs have long leveled complaints at the platforms for not compensating publishers for displaying their content. Last year, Facebook started paying news publishers millions annually to license content via its News Tab.

“Facebook and Apple are realizing the value of news in driving habit and value and they are willing to make it work commercially for us,” she added. “This is made evident as both Apple and Facebook have dedicated newsrooms and editors, charged with curating our top stories and creating habit-building collections. The pitching process whereby we work with them in order to increase visibility and reach for our journalism is bearing fruit.”

Despite publisher’s relative ennui with platforms, the mood about growing reader-revenue is buoyant, he added.

“Reader-revenue models are the new normal,” he said. “Publishers are seeing double-digit growth in revenue and subscription numbers, there’s good growth in the market. Five years ago that was completely different.”

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.