Secure your place at the Digiday Publishing Summit in Vail, March 23-25

How AI’s hit to publisher traffic is quietly rewiring media M&A

Publishers’ traffic has dipped since AI tools arrived — and the fallout isn’t limited to audience or ad revenue. It’s now weighing on the media mergers and acquisitions (M&A) market, making deals harder to price during a time of disruption, according to investors and analysts.

Higher interest rates, economic tariffs, and a soft ad market haven’t helped, either.

“You can’t buy a business easily in this state of disruption, and you don’t know who’s going to be the winner versus the loser,” said Amir Malik, managing director of advisory firm Alvarez and Marsal.

There has been movement, though. After an “abysmal” 2023, the market started to warm up a little in 2023 and last year, according to Sam Thompson, senior director at M&A advisory firm Progress Partners.

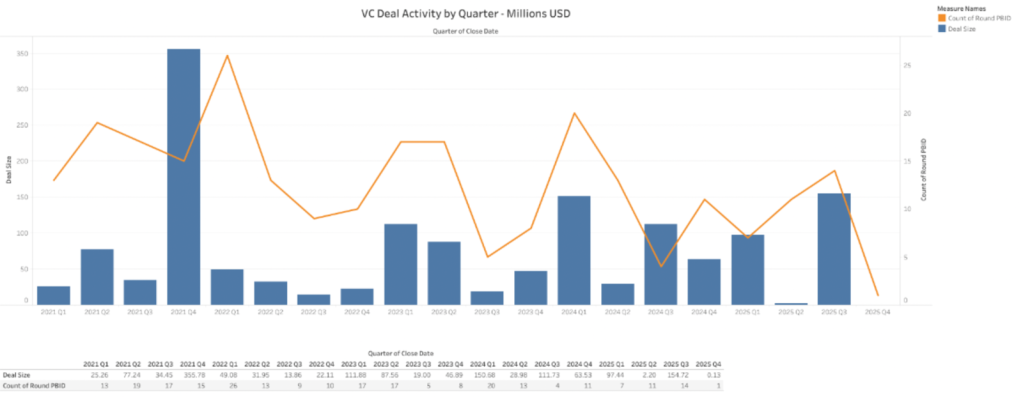

U.S. venture capital deal activity started off slow this year, but has picked up. There were just seven deals in Q1 2025, but that increased to 14 in Q3 2025, according to data from capital market research firm PitchBook, which measured VC deal activity in “publishing” companies (defined as providers of print and internet publishing services, such as newspapers, magazines and books.)

Overall, there were 32 VC deals in publishing from Q1 to Q3 2025, compared to 37 in the same time period in 2024. Notably, overall VC deal size has been larger this year, coming in at $353.9 million from Q1 to Q3 2025, compared to $291.4 million in the same time period last year. This October, Paramount Skydance bought Bari Weiss’ independent digital media company The Free Press for $150 million.

Q2 2025 was particularly quiet — 11 deals worth $2.2 million collectively, compared to Q2 2024 of 13 deals worth $29 million.

But the decline in publishers’ site traffic from AI summaries in search and elsewhere has made it harder for some companies to scale, leaving them less attractive to potential acquirers.

“Deals are being paused because of AI Overviews,” Malik said. Many publishers lost a third or more of their traffic since the launch of Google’s AI summaries in search, which led to buyers and investors turning away from deals, as well as pausing M&A activity, he said, adding, “It will not stop M&A. It will change M&A, and unfortunately the valuations of these businesses will decrease but they’ll need to sell now if they’re uncertain about their future.”

Publishers have seen everything from 15 to 40 percent referral traffic declines in the past year. Forbes had a 40% year-over-year decline in search referral traffic. Most of Digital Content Next’s 40 member sites — which includes The New York Times, Condé Nast and Vox Media — experienced traffic losses from Google search between 1% and 25%.

Andrew Perlman, co-founder and CEO of media operating company Recurrent Ventures, said unstable traffic has meant investors are “sitting back or making very low offers.” He described the market as feeling “stuck.”

But, that may be changing. Perlman said there has been an uptick in both inbound buyers reaching out and outbound conversations Recurrent Ventures is kicking off themselves.

“People are now starting to wake up, where it does feel like sellers are starting to be a little bit more rational,” he said.

It may be the right time to exit or buy right now for some, but for those selling — don’t expect a high price like the early 2020s. (Who can forget the 2022 deal when Cox Enterprises bought Axios in a cash deal valuing the company at $525 million — roughly five times its projected 2022 revenue of over $100 million?).

Generative AI is hurting M&A

Generative AI hasn’t been good for the M&A media market. The economy may have been anything but stable the last year or so, but AI is the icing on top.

According to Pitchbook’s data, the most VC activity this year was around newsletter-focused media businesses, as well as emerging tech media orgs. Three deals closed in August, from RTB Digital (for $31.85 million), The Argument (for $4 million) and 831 Stories (also for $4 million). The largest VC deal this year was Substack in July, which closed at $100 million.

Publishers have been working hard to try to shift the narrative away from AI-driven SEO declines, highlighting diversification, first-party data strategies, subscriptions and more resilient direct revenue. And while those efforts may be stabilizing parts of the business, they haven’t yet convinced the investor market. For some buyers, it’s still too early to see that activity meaningfully move the needle, leaving a gap between publishers’ optimism and how their businesses are being valued.

“These companies are struggling to continue to maintain their audience and attract new audiences,” said Yale Yee, founding partner and co-founder of investment bank and M&A advisory Telos Advisors. “AI has destroyed the SEO, SEM model… The rules have completely changed now. How do you get your content found through agentic AI, because the Google Search model is gone? How do you monetize that?”

The unpredictability of how AI will continue to transform publishing businesses also isn’t helping, according to Malik. Publishers are increasingly getting paid by AI companies in exchange for content licensing. OpenAI, for example, has licensing deals with over a dozen major publishers. But the longevity of these monetization opportunities are unclear, he noted. AI engines are also changing how users request information online, but it remains to be seen whether more people will use AI search experiences that don’t drive referral traffic to sites, Malik said.

“This is a bullet wound into a major organ at a publisher. This is not like a flesh wound or something you can stitch,” Malik said.

Publishers need to “take control of their audiences,” and monetize them in other ways beyond search to look attractive in the current market, Thompson said. The less reliant on search traffic, the better, he said. AI is “accelerating and creating more immediacy to solve for this” — especially given venture investments in traditional content businesses have “dried up,” he added.

Where investors are looking now

Most of the investment interest is going toward social and creator economy-focused businesses, investors and analysts told Digiday. That means publishers can tap into that by expanding their initiatives in podcasts and video, and try to attract and retain creators to sell ads against their content, they said.

Publishers have invested more resources into these areas this year. Companies like Yahoo, The Independent, Fast Company, Inc. and Morning Brew are among those that have recently launched creator programs and creator-led initiatives to produce more talent-led and personality-driven content.

All the analysts and investors that Digiday spoke to for this article said the market was starting to pick up again following a quiet few years, albeit slowly.

“Companies that want to restructure might divest assets, and so that will drive appetite,” Malik said. “If someone’s underperforming but a household brand name, that can drive transactions as well.”

Yee believes the market will become more active with bigger deals next year.

He started hearing from media companies in April that they were getting pinged by buyers, and asking his team if it was the right time to sell. And it might be, if a company doubts it can survive the next three to four years as AI integrates itself more deeply into the digital ecosystem. “If you can get a good exit now, you should probably take it,” Yee said.

But don’t expect to get a high price

Spotify bought the Ringer in 2020 for $250 million, almost 10 times the company’s revenue, according to Yee. Those days are behind us for now, analysts told Digiday.

“That is not where the market is now. Those businesses would be four to six times [the] revenue range today. So not quite half but close to half — but still by any measure healthy multiples,” Yee said.

One of the biggest changes since those days is that companies either need to be profitable or near-term profitability, Yee said. “Back in [2020 and 2021], they didn’t care. Frankly, they were just looking for growth… Now the companies are more mature… The valuations are attractive but rational right now.”

But Malik was a bit more reserved in his vision of 2026, especially for the publishing industry, which he felt was “about to hit a distress curve.”

“I see deals happening, but I don’t think they’re happening because these are great businesses in great shape. I think they will be restructured by PE. It’s not a positive image, [even if it’s positive] in terms of deal flow,” Malik said.

Despite the hesitancy in the market and the traffic challenges publishers are facing that has led to a quiet M&A period, now might be the right time to buy or sell — because of the uncertainty of the future.

“Get your return now if you’re a shareholder or media company because your revenue might decline over the next few years, which means you have to change the shape of the business,” Malik said.

But for some, it may not be the right time for all that.

“It’s a little bit too early. I think it’s going to take another couple quarters to really get a sense of where the market stands and what the outlook looks like,” Perlman said. “We’ve seen a lot of people that are willing sellers, but I haven’t seen anything where I’ve wanted to jump up and down and pound the table and said ‘yes, we need to do this.’”

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.