Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Despite industry initiatives to address it, ad fraud is still a massive issue.

Juniper Research estimates that advertisers will lose $51 million (£36.5 million) per day on ad fraud in 2018, totaling $19 billion (£13.6 billion) over the year. Publishers like News UK and the Financial Times have cracked down on fraud after investigations into their ad tech stacks revealed they were losing revenue to the tune of millions a month. Meanwhile, marketers like Procter & Gamble, Unilever and the Royal Bank of Scotland have been paying more attention to how their budgets are spent, bringing more marketing in-house.

Here are four charts that illustrate the state of ad fraud.

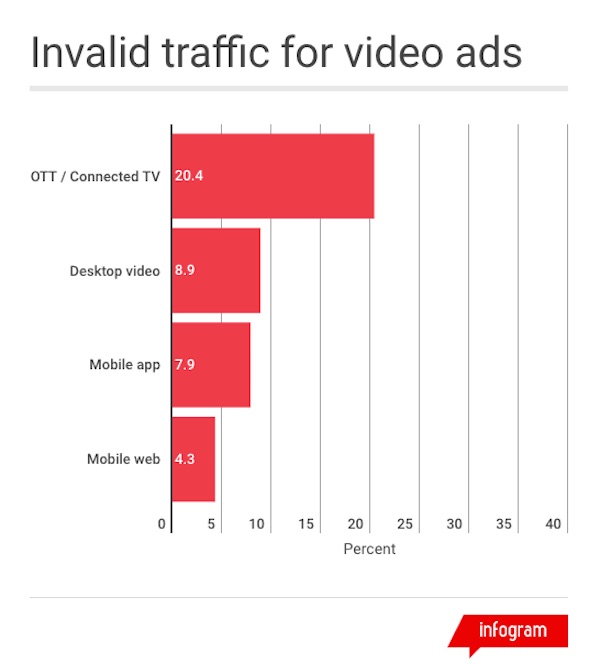

OTT has a big ad fraud problem

As Digiday has reported, video is where the money is, so it’s the most attractive for fraudsters. OTT — the environment set for the largest increase in video ad spend over the next five years — is a hotbed for nonhuman or invalid traffic, according to fraud prevention ad tech firm Pixalate. More than one in five (20.4 percent) of programmatically sold connected TV or OTT video ads were measured as invalid during October 2017.

As reported by BuzzFeed News, platforms like LinkedIn and YouTube can be used to “scrub” traffic, using pop-under ads and redirects on invalid traffic to make it look more legitimate, adding to the long list of ad fraud tactics that platforms have to take responsibility for.

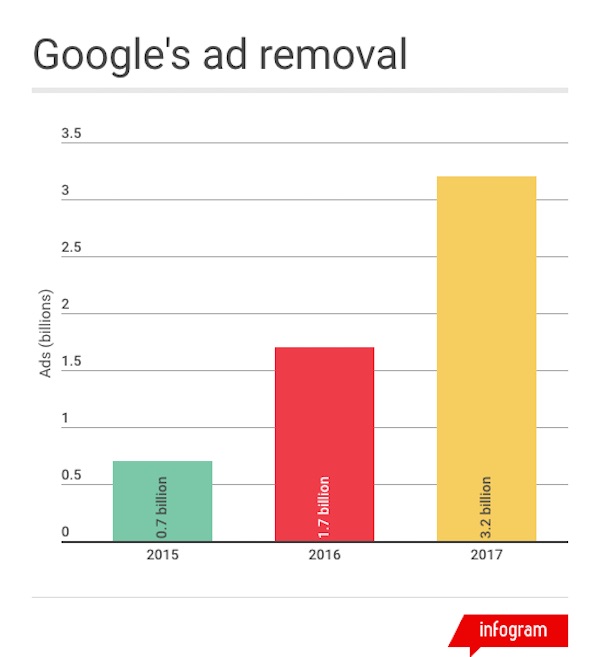

Google is on the defensive

Facing mounting pressure, Google has directed more resources into tackling what it calls “bad” ads: ads that violate its policies. The platform has introduced new technology like page-level enforcement, which helps prevent publishers from losing revenue due to bad ads, and it has added 28 new advertiser policies and 20 new publisher policies to better reflect the digital ad ecosystem and protect against fraud. Google has also dedicated thousands of people to work on removing bad ads, leading the platform to remove or block 3.2 billion ads in 2017, up from 700 million in 2015. This June Google plans to ban any advertising about cryptocurrency-related content.

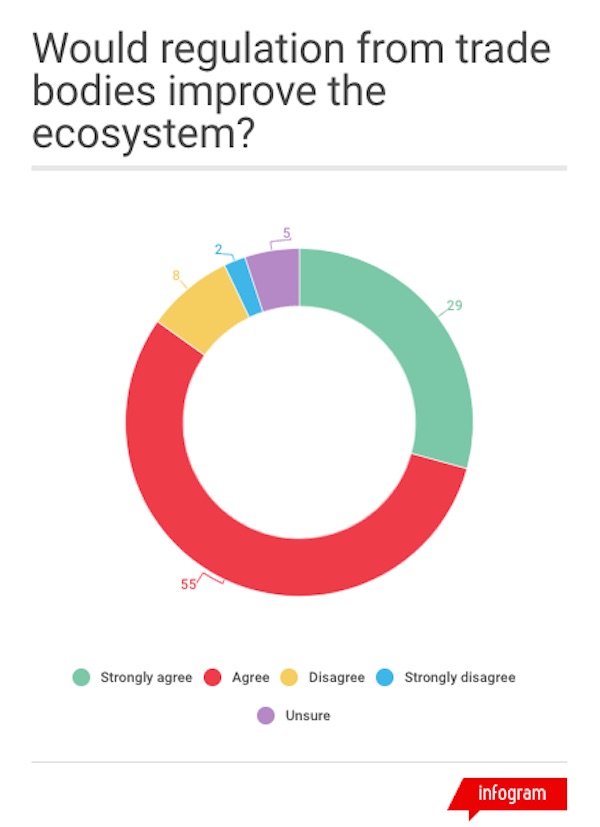

Trade bodies step up

Who’s to blame for ad fraud is up for debate, but brands and publishers want trade organizations to take more action. Eighty-five percent of brands surveyed by performance marketing agency QueryClick said it would be beneficial for trade bodies such as the Interactive Advertising Bureau to have more authority to punish bad actors.

Trade bodies have made positive moves, with the IAB’s ads.txt initiative being widely adopted, although it has its limits. In January, the U.K. and Ireland’s Joint Industry Committee for Web Standards and U.S. body Trustworthy Accountability Group announced they are merging their strategies to help clean up digital advertising.

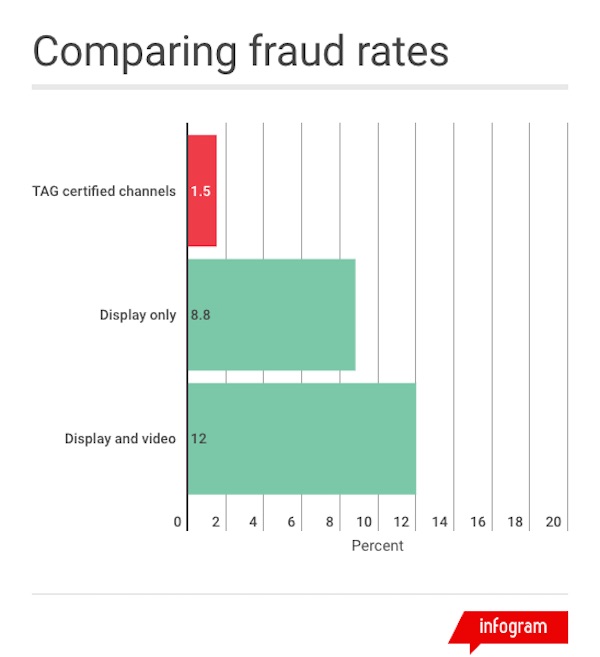

Early signs are encouraging. In December, a study conducted by The 614 Group on behalf of TAG found that TAG Certified channels — used by companies that abide by TAG’s guidelines to combat fraud — had a measured invalid traffic rate of 1.48 percent across video and display inventory, an 83 percent reduction in invalid traffic compared to general industry fraud rates.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.