Secure your place at the Digiday Publishing Summit in Vail, March 23-25

As Amazon continues to build its retail empire, it is reportedly considering a partnership with Violet Grey, an effort to both expand its beauty product roster and develop an editorial point of view.

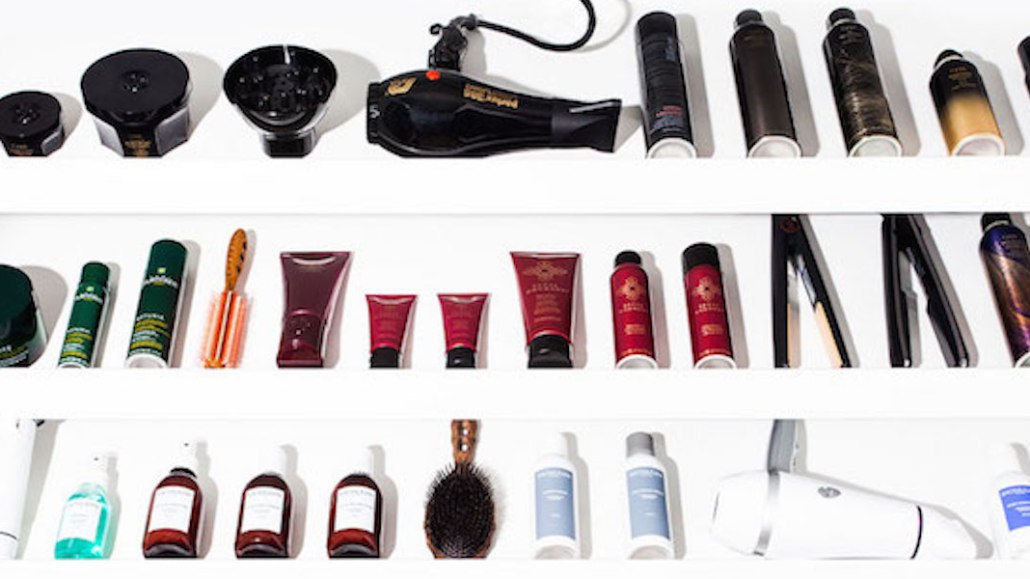

Violet Grey operates as an e-commerce site featuring a wide swath of beauty products, but asserts it is first and foremost an “editorial endeavor, exclusively.” Since its inception, Violet Grey has published product reviews from editors and written features on beauty routines and trends, including recent pieces on Rosie Huntington-Whiteley and January Jones. Products mentioned in these articles and throughout the site are marked with the “Violet Code,” similar to how publications like Allure endorse editor-tested products in its stories, along with information on how to buy them.

Though Amazon has not verified if the potential partnership is indeed in motion, it could indicate a larger effort to cultivate an editorial point of view the juggernaut currently lacks, said Melinda Sanna, founder and CEO of consumer insight consultancy Spark. The report also comes on the heels of the launch of Amazon Spark, a mobile feed of shoppable photos for Prime members that mirrors Instagram’s product tags designed for product discovery.

“For [Amazon] to really shift the paradigm and go beyond being a delivery company, they have to create their own voice, which they’ve never tried to do,” Sanna said. “Even their advertising for Amazon Fashion feels generic. Until they have a point of view on curating, they’re never going to go beyond being a shipping company. It’s hard for me to see the value of acquiring such a specialist unique point of view.”

Sanna said Amazon will, however, benefit from the expanded product selection that a site like Violet Grey allows. While consumers may not go to Amazon to find a Tom Ford eyeshadow palette or La Mer face cream, they may opt to refill it using Amazon once they’ve initially discovered it elsewhere.

“Amazon is a warehouse shipping company, which is nothing to sneeze at. They do it better than anyone else,” she said. “When you’re out of a product and you want to replenish it, you want it immediately and there’s a lot of value in that. Sales will come their way because they’re good at shipping, but people don’t see them as a vehicle for discovery, not as a curator.”

Though the partnership isn’t likely to put Amazon on the map as a beauty authority, Amazon could gain increased credibility from partnering with a consumer-trusted site like Violet Grey, said Elaine Kwon, founder of e-commerce management firm Kwontified and former vendor manager of the luxury division at Amazon Fashion.

“A potential partnership with Violet Grey, that’s famous for its empowered, feminine aesthetic and selection, brings the industry credibility element and possible collaboration of curation to the forefront,” Kwon said. “To this point, one might assume Amazon is not only trying to drive highly sought after editorial content, but also establish Amazon as a trusted place to purchase beauty and fashion products across various brands, genres, styles and price points.”

Kwon said this is yet another method for Amazon to experiment in new categories and expand its reach, following the announcement of Spark as well as Amazon Prime Wardrobe, a try-before-you-buy service launched last month.

“It’s a healthy cycle of powerful decisions that will enable customers to explore, engage, and ultimately buy more of Amazon’s beauty product,” she said.

Image courtesy of Violet Grey

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.