Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Ad industry split on whether a divestiture of Google’s sell-side ad tech will change anything

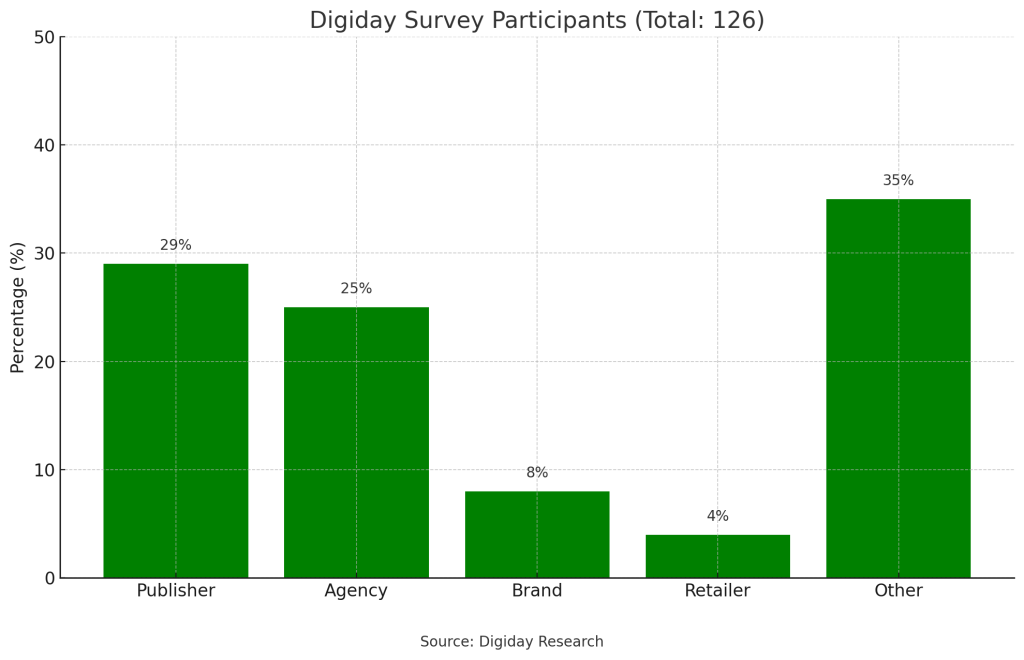

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

The largest company in online advertising is in the dock on several fronts. The Department of Justice’s latest antitrust case, which targets Google’s ad tech suite, has many thinking substantial changes are on the horizon.

But, then again, some are a bit more hard-bitten, believing little will change despite the forensic efforts to shine a light on the inner workings of Google’s labyrinth-like ad tech empire from governments across the globe.

These are just some of the insights gleaned from the latest Digiday+ Research survey into readers’ attitudes.

The DOJ’s antitrust case against Google focuses on its tech operations, alleging monopolistic practices that harm competition in the $600 billion online digital advertising sector. Should the government prove successful in court, it will request the divestiture of some, if not all, of such assets.

However, in the run-up to the latest case, which formally began Sept. 9 and is set to run for four to six weeks, Google has proposed moving some key functionalities of its ad tech stack via Privacy Sandbox APIs.

Such proposals include moving its ad server and supply-side platform directly into the Chrome browser, claiming it would enhance user privacy while maintaining effective ad targeting and monetization capabilities.

However, some suspect an ulterior motive, and Digiday+ Research tested such notions in an online survey of its readers conducted from Sept. 4 to 13, asking if the DOJ’s request is now moot.

Participants were sourced from across the breadth of the digital media industry, with nearly three-quarters of respondents self-identifying as ad tech, agency and publisher professionals.

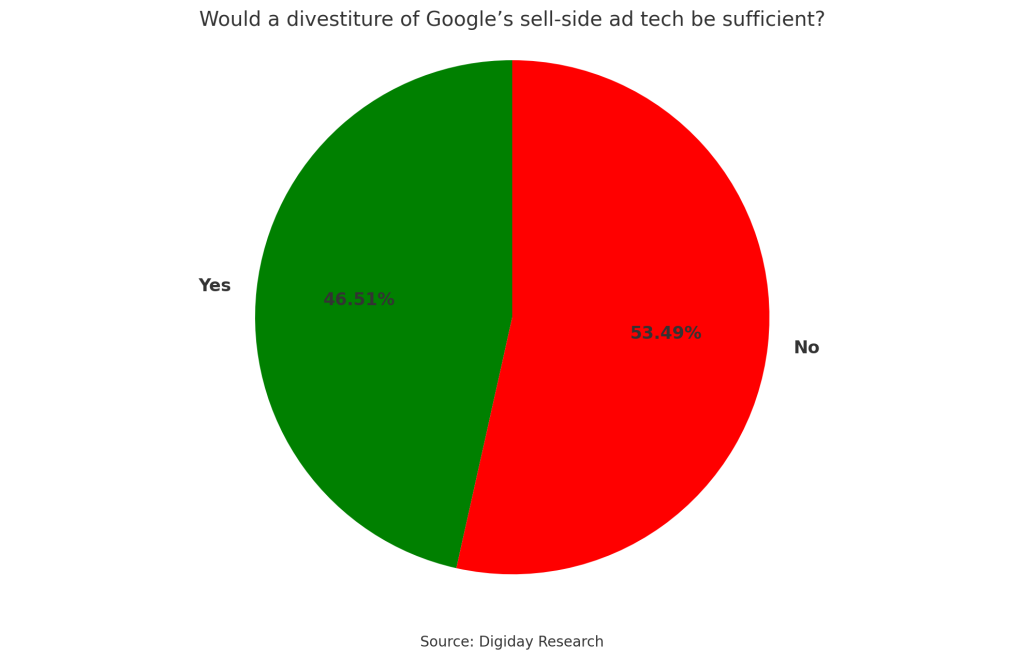

The survey’s 126 respondents were asked, “Would a divestiture of Google’s sell-side ad tech — one of the remedies requested by the Justice Department — be sufficient given Google’s maneuvers in recent years?” The results suggest opinions are almost even.

Survey respondents were offered the resource to (anonymously) explain their reasoning, and approximately a third took advantage of the opportunity. Some of the highlights can be seen below:

“Google doesn’t need to stop Google Ad Manager (GAM), but they should stop buying from publishers within GAM,” wrote one respondent in the most detailed response recorded in Digiday’s research. “They should participate in header bidding auctions like other companies such as Magnite, OpenX, AppNexus, etc.”

“Currently, Google seems to be leveraging its dominant position to buy priority inventory without truly participating in header bidding. They claim they are, but that’s not the reality. If they truly wanted to participate, they could create their own pre-bid adapter for header bidding,” the respondent continued.

“However, they prefer to buy more valuable impressions within GAM without competing in the header bidding auction with others. Why would you? You are controlling publisher placement and buying it when you want faster than any other demand partner of a publisher. Solution? Well, they have to be equal with everyone so they need to stop buying in GAM directly and become a bidder in pre-bid auction,” the respondent concluded.

Most survey respondents who offered commentary advocated divestiture, with many noting that Google’s efforts to shift the ad server and ad auction function into the Chrome browser could effectively circumvent the remedy requested by the DOJ.

Albeit a notable minority thought it best to “leave Google alone,” as one respondent put it.

A similarly-voiced response separately added, “With all of the new AI products/tools coming, I think the anti-trust trial is misguided, and there’s a lot of competition and change coming in both search and ad tech.”

More in Media Buying

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Canadian indie Salt XC expands its U.S. presence with purchase of Craft & Commerce

Less than a year after buying Nectar First, an AI-driven specialist, Salt XC has expanded its full-service media offerings with the purchase of Craft and Commerce.

Ad Tech Briefing: Publishers are turning to AI-powered mathmen, but can it trump political machinations?

New ad verification and measurement techniques will have to turnover the ‘i just don’t want to get fired’ mindset.