Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Ad Tech Briefing: Can The Trade Desk turn walled gardens’ retreat into open web gains?

This Ad Tech Briefing covers the latest in ad tech and platforms for Digiday+ members and is distributed over email every Tuesday at 10 a.m. ET. More from the series →

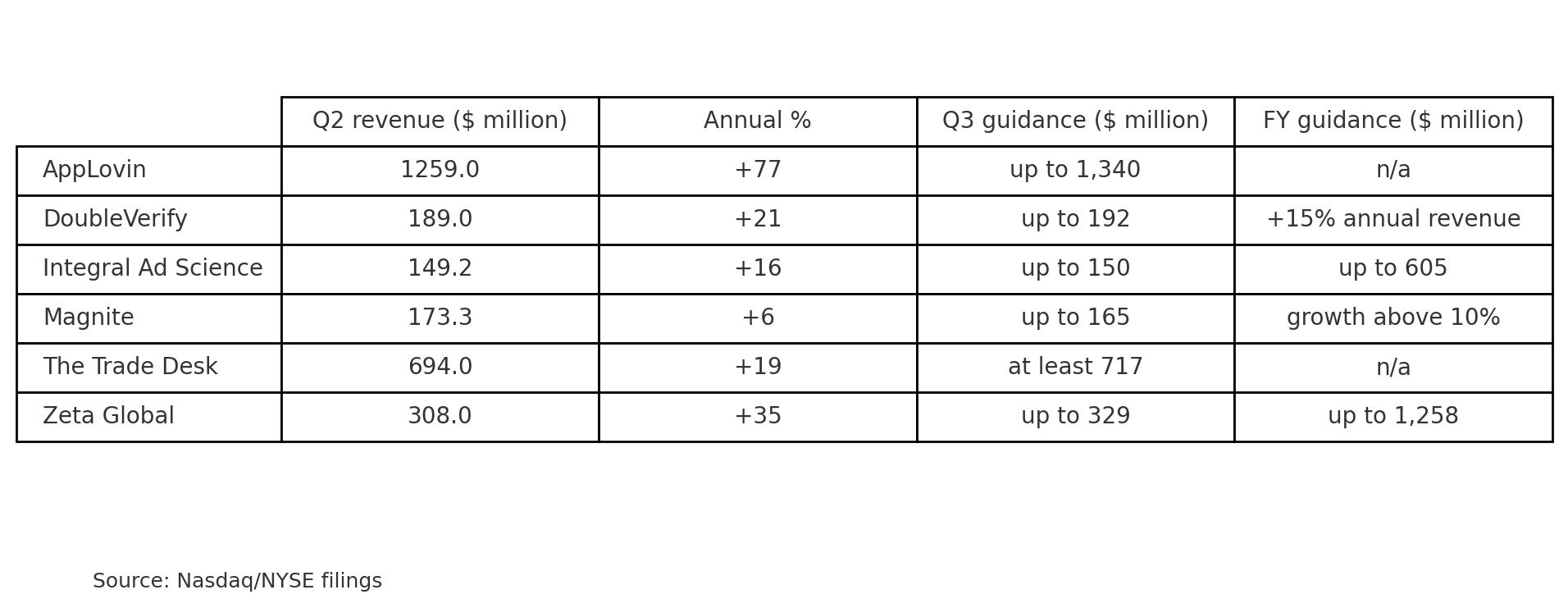

If you’re reading this, you’ll likely have seen at least some of the latest financial results posted by the ad tech sector’s coterie of publicly listed companies, with AppLovin and The Trade Desk leading the pack in earnings (see below).

Both companies, talismans of independent ad tech, saw their stock prices dip in early hours after issuing Q2 earnings — despite reporting a 77% and 19% annual increase in revenues, respectively.

In The Trade Desk’s case, this included an immediate 30% plunge. The declines were tied to “the narrative,” with analysts deeming guidance remarks underwhelming.

AppLovin retained its lead as top earner, with The Trade Desk, now in the S&P 500, nearing $700 million in revenue for the period.

Indies eye gains from Google’s troubles and walled garden retreat

A common thread across several earnings was the potential to benefit from Google’s mounting legal troubles with the Justice Department.

The week began with news that OpenX is seeking compensation for Google’s anticompetitive actions as part of an ongoing ad tech antitrust case. Meanwhile, Magnite leadership expressed similar concerns during their Q2 earnings call (see above).

In a Q&A after The Trade Desk’s August 7 earnings call, CEO Jeff Green said these trials are creating opportunity for independent ad tech as marketers grow wary of Google and other Big Tech platforms.

Green noted “the supply-side demand imbalance” favoring “the open internet” over walled gardens like Amazon, Google, and Meta. “Consumers spend more of their time in the premium open internet than they do inside of walled gardens,” he said, adding that walled gardens have an inherent conflict of interest.

“I believe TTD and the open internet have a bigger TAM than Facebook has… Our goal is to buy the entire open Internet objectively for buyers.”

He also claimed, “As Google and Facebook have largely abandoned the open internet, The Trade Desk is the largest source of third-party demand for many publishers around the world.”

Profit trumps transparency in adland and finance

While investors punished perceived weak growth forecasts, they appeared forgiving of structural flaws in the ecosystem. Several high-profile criticisms of the cohort barely registered in analyst questioning across calls.

The last 12 months have been turbulent for the sector, with short-sellers targeting multiple companies, including AppLovin and Zeta Global, causing stock price volatility. Yet Q2 results suggest advertisers largely ignored these claims.

In Q1, AppLovin’s stock fell 20% after Muddy Waters alleged unethical data use, prompting a rare off-calendar defense from leadership. In Q2 disclosures, executives emphasized plans to drive advertiser growth via AI and greater adoption of its self-serve platform, reducing reliance on sales or product teams. It also aims to expand internationally so its customer base is evenly split between the U.S. and global markets.

With a Q4 rollout, AppLovin is targeting SMBs, expanding beyond in-app into broader web and e-commerce. CEO Adam Foroughi said testing has brought in hundreds of advertisers, “The new type of platform that comes to our platform is extremely incremental to our business… We expect that will increase the advertiser count quite quickly, and also allow us to go through live examples of advertisers coming in self-service [and then] all the way to scale on our product.”

Despite revenues of $1.2 billion, up 77% year-over-year and beating expectations, AppLovin’s stock still fell 7% after the announcement — a sign of investors’ counterintuitive moves.

Earlier in the week, Zeta Global, which faced short-seller reports late last year, posted similarly strong results. Earnings rose 35% year-over-year to exceed $300 million, signaling client confidence despite prior allegations. Analysts focused more on Zeta’s competitive positioning, particularly with agencies under pressure to develop high-margin software tools.

Also under scrutiny in 2025 have been ad measurement and brand safety giants DoubleVerify and Integral Ad Science. Both reported Q2 growth: DoubleVerify at $198 million, up 21% year-over-year, and IAS at $149.2 million, up 16%. These gains came despite reports highlighting brand safety shortcomings.

In March, Adalytics alleged DoubleVerify and IAS failed to block ads to declared bots despite advertisers paying for pre-bid bot filtration, and routinely allowed general invalid traffic, implying advertisers were misled about protection levels. This followed an earlier report claiming both allowed ads on sites with child abuse content, triggering a class-action suit against DoubleVerify. The company has responded with its own defamation case against Adalytics.

Despite the controversy, revenue momentum and advertiser contracts appear to be sustaining both companies.

On DoubleVerify’s August 5 call, leadership highlighted rising activity in social and CTV — up 14% and 45% annually, respectively — while fielding questions about relevance as the open web wanes. CEO Mark Zargorski, discussing AI’s rise, said, “So many of the AI solutions don’t include a lot of transparency on what’s going on… That’s part of our role, to drive transparency and open up that black box a bit.” He added that value remains strong among customers on Meta and other platforms using AI tools “without a lot of transparency or clarity on how we’re getting there.”

LiveRamp also posted results for the quarter ending June 30 — “Q1 2026” in its reporting. Revenue rose 11% year-over-year to $195 million. Guidance for the next quarter was $197 million, with a full-year forecast of up to $818 million.

- Elsewhere, publicly listed ad tech companies PubMatic and Viant reported their earnings after the bell on August 11. This was past the press time for this article. Meanwhile, Nexxen is due to make its earnings disclosure on August 13.

- Separately, MNTN, a new addition to this cohort following its NYSE debut within the last 90 days, reported Q2 revenue of $67.8 million, representing a 35% year-over-year increase. The company expects revenues in the range of $70 million for the following quarter, even without the contribution of Maximum Effort, the agency founded by Hollywood star Ryan Reynolds, which it recently sold.

What we’ve heard

“Google went from organizing the world’s information to stealing it, taking a sledgehammer to the implied contract the open web has relied on for so long.”

–Odysseas Papadimitriou, WalletHub CEO, in a blog post explaining how his company has removed 40,000 pages of its financial content from the reach of Google and other AI search engines. Instead, this content will now be exclusively available to logged-in WalletHub users.

Numbers to know

- $465 million: Taboola’s Q2 revenue, which equated to an 8.7% year-on-year revenue growth.

- $1.9 billion: Taboola’s forecasted FY 2025 revenue guidance.

- $343million: Teads’ Q2 revenue, which equated to a 60% year-on-year revenue growth – this number reflects its post-merger earnings, for the company formerly known as Outbrain.

- $143 million: Teads’ (upper end) forecasted Q3 gross profit guidance.

What we’ve covered

Future of TV Briefing: 5 reasons CTV’s ROI comes up short for advertisers

Despite the hype, CTV is still not the miracle media channel for advertisers. The reason? It’s still impossible to justify the costs, according to UM Worldwide chief investment officer Marcy Greenberger.

After filing legal papers citing Google’s alleged misdeeds to subvert and dominate the online display ad ecosystem, notably in the Eastern District of Virginia, the same jurisdiction where the biggest company in advertising is doing battle with the Justice Department, seeking damages, and adding to calls for a structural remedy.

What we’re reading

Omnicom’s Samardzija To Join Stagwell In The Fall

After Digiday first covered news of a pending leadership shakeup at Omnicom Media Group, with the pending exit of Annalect CEO Slavi Samardzija, it has subsequently been announced that he will join independent media agency Stagwell, with precise details of his role yet to be confirmed.

The State of Digital, 2025, by LUMA Partners

The macroeconomic environment improved throughout 2024, but uncertainty over the tariff policies to be enacted by the current U.S. administration caused market instability. Despite this, digital ad spend has rebounded, and AI is now considered a fundamental requirement for marketers, with the amount of mergers and acquisitions in the space experiencing a notable uptick in the opening quarter of 2025.

More Like No Yield: A New Book Explores How Google Soaked Up The Web’s Ad Profits

AdExchanger’s James Hercher sums up Ari Paparo’s book, “Yield: how Google bought, built and bullied its way to advertising dominance.” It features a host of familiar names such as Stephanie Layser, Jana Meron, Brian O’Kelley, Michael Barrett, Michael Rubenstein and many other industry leaders play prominent roles, all of whom help chronicle how Google ingested DoubleClick, and later went on to cross almost every tier of the market with a series of rollouts such as Project Poirot, Project Bell, Project Bernanke, Project Jedi Blue, Project Liberty, Project Wolf and Project Centillion.

This Ad Tech OG’s AI-Powered Analytics Startup Just Raised $9M In Series A Funding

Newton Research, a company led by ex-Data Plus Math exec John Hoctor has raised $9 million two years after it was founded, taking its total funding to $14 million. Contributors to the latest Series A round include Greycroft and Bessemer Partners, along with S4S Ventures, Aperiam Ventures, plus LiveRamp’s investment arm.

More in Media Buying

The Rundown: Ad tech’s performance in 2025 was overshadowed by AI concerns and Big Tech

Despite revenue increases, the markets were brutal but reports over talks with OpenAI proved later upside.

As brands respond to AI search, walls crumble between paid and organic

Agencies are knitting SEO and PPC teams closer together as they adapt to the new rules of search that are driven by the use of generative AI.

Future of Marketing Briefing: Epsilon’s quiet bet against the LLM gold rush

In advertising’s AI race, Epsilon says the winners won’t pick one mode. They’ll orchestrate many.