Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

With the rise of retail media networks, marketers continue to grapple with lack of standardization

This article is part of a series covering our Programmatic Marketing Summit. More from the series →

The rapid growth of retail media networks in recent years has certainly created more competition for marketers’ retail media ad dollars.

And that growth isn’t yet slowing down anytime soon, according to Kelly Leger, managing director, advertising, marketing and commerce for Deloitte Digital, who said on stage at the Digiday Programmatic Marketing Summit in New Orleans this week that the firm is tracking roughly 45 retail media ad networks based in the U.S. and approximately 80 globally with more to come.

That’s not to say there will be an endless number of retail media networks in the near future. While others are expected to launch new networks, industry experts expect that there will be some form of consolidation in the future.

“There’s not enough money to support 100 U.S.-based retail media networks,” said Leger, on stage during the DPMS summit. “The reality is that brands on shelves will double down on the five to 10 who move the needle.”

That will likely be with the big players in the space that have already launched and been in the market for a few years. While smaller, more regional-based stores may be interested in their own properties, it’s likely that they will do so by combining with firms that are controlled by their private equity or holding company owners or work with cooperative retail media networks.

Regardless of potential consolidation, marketers are dealing with more and more retail media networks now. That’s meant that marketers for major CPG brands in particular have been managing a trickier relationship with those retailers. Those marketers are not only looking to negotiate for shelf space but are also feeling a sense that how much they spend on retail media networks has an impact on their shelf placement.

“It complicates the relationship,” said Lauren Lavin, executive director, commerce practice lead at Group M during another panel at DPMS in New Orleans, of the relationship between retailers and CPG brands given the growth of retail media networks.

That’s not the only pain point for marketers when it comes to retail media networks. As retail media networks have grown their capabilities, they’re selling off site display advertising. “When they move off site, they haven’t stood up the capability of having it be self-serve programmatic,” said Lavin. “We don’t have the ability to optimize it. A lot of it is still – probably more than you think – direct IO buying.”

Lavin continued: “That is a pain point, making sure that we as an agency and our brands can run that display media programmatically in a self-serve fashion so we can have control, making optimizations, making sure that we’re hitting those business objectives that our clients are looking for. We’re trying to have that feedback with retail media networks – that everything needs to be self-service buying.”

Another issue for marketers when it comes to retail media networks is the lack of clear standardization when running media as each one is operating under its own rules. That means that some retail media networks will tell marketers how they are measuring what’s working and what’s not. For example, they may say they are using a percentage calculation for return on ad spend or a 60-day attribution window or whatever it may be and those can be different with each retail media network.

“They sort of write their own rules as far as how they’re going to run their media,” said Lavin. “And then they grade their own homework and hand it back to you as performance metrics.”

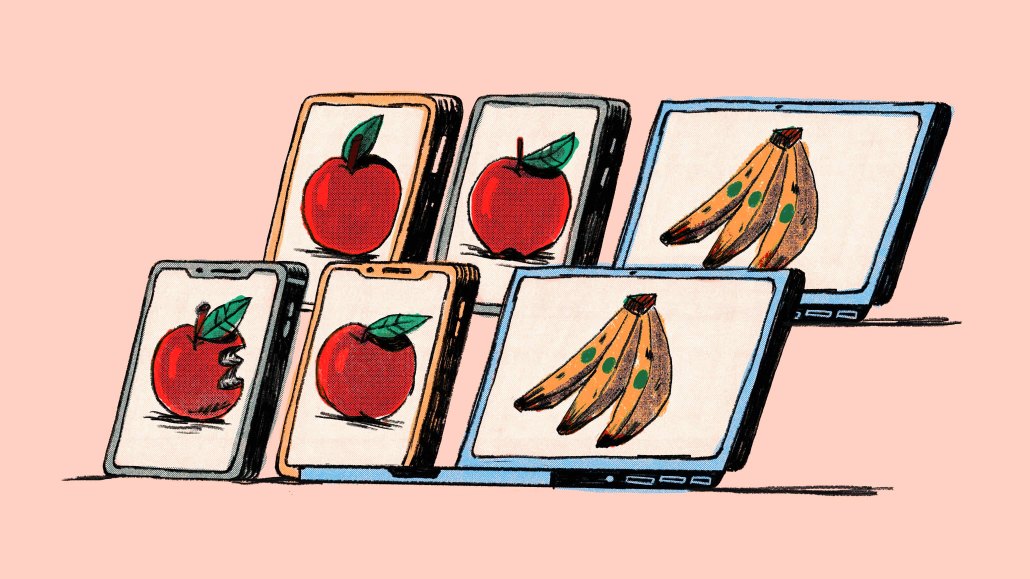

That means that when marketers are trying to decide where to spend dollars and which networks are working for them, they’re “looking at an array of apples and oranges to choose between,” said Lavin, making it all the more difficult to decide where to spend.

Marketers and agency execs hope that there will be standardization coming to the space – the IAB took a first pass on media measurement guidelines and asked for public comment earlier this year – but when that will happen is not yet clear.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.