Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Why executives at Esports Business Summit are (still) bullish on competitive gaming

At this week’s Esports Business and Gaming Summit, executives at some of the industry’s leading companies remain confident about the future of competitive gaming — perhaps surprisingly so.

Today, October 24, marks the third and final day of the annual Las Vegas conference. This year’s event comes at a particularly fraught time for the esports industry. Investors are growing wary of the industry’s ability to turn a profit; brands are cutting ties with esports in favor of outreach to the broader casual gaming audience; and esports organizations are shutting their doors and snapping each other up as the industry gradually contracts.

In the lead-up to this year’s Esports Business and Gaming Summit, the event’s organizers polled 112 North American gaming and esports executives about their thoughts on the industry’s current trajectory, representing a cross-section of executives in sectors including broadcasting and media, scholastic esports, agencies, consultancies, game developers, hardware manufacturers and the esports organizations themselves.

Digiday has the exclusive on the survey data — and here are some of the most interesting findings.

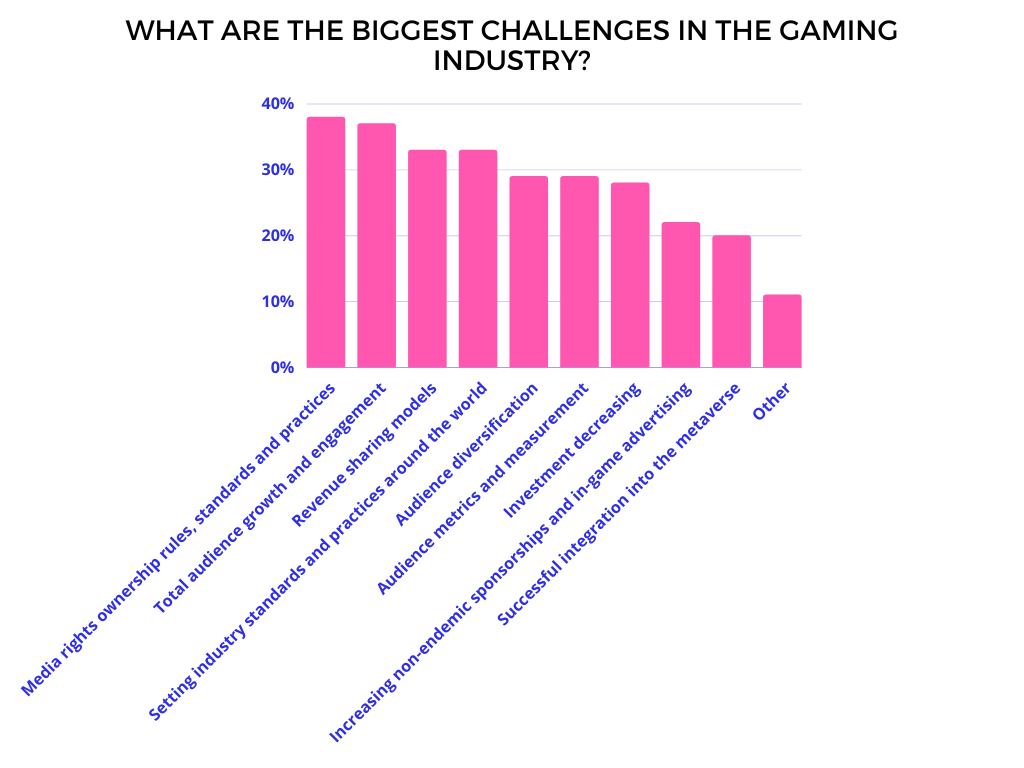

Esports executives believe broadcast rights are the industry’s biggest challenge

38 percent of survey respondents told Esports Business Summit that they believed media rights ownership rules, standards and practices represented the industry’s biggest challenge. This is not particularly surprising. Early investors in esports believed they were getting in on the sports of the future — but traditional sports leagues maintain lucrative rights deals with broadcasters that are simply unattainable for esports leagues, whose users are accustomed to watching livestreams for free on Twitch and YouTube.

Some of the industry’s leading companies seem to have given up on the potential revenue stream that is broadcast rights — at least for now. In April, Riot Games president of esports John Needham told Digiday that his company was “not focused” on monetizing its livestreams, believing that exclusive broadcasts are not fan-friendly.

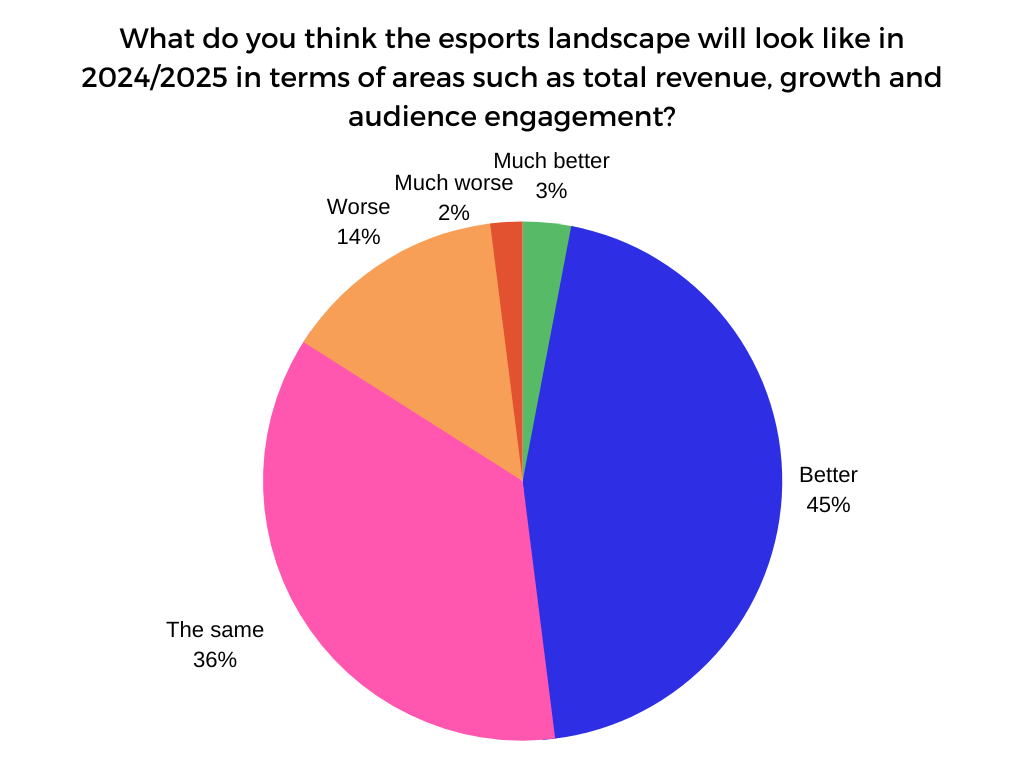

Most esports executives remain neutral-to-positive on the industry’s future

For better or worse, esports executives still have a rosy view of the industry’s future. 48 percent of survey respondents said they believed the esports landscape would look better or much better in 2024 and 2025, while 36 percent said they thought things would remain the same.

Esports Business and Gaming Summit organizer Robbie Caploe told Digiday that she was surprised by the positive response to this question, pointing out the many aforementioned challenges currently facing the industry — but speculated that pragmatic esports execs view the current contraction of the industry as a much-needed change.

“I am going to give them the benefit of the doubt, and say it’s not just because they want to make it a self-fulfilling prophecy, but that they think that what’s happening is really a long-overdue correction in the marketplace,” Caploe said. “So people are being more serious; they’re being more focused on the bottom line and they think that they’re positioning themselves in a smarter and more businesslike way that’s going to set them up for success.”

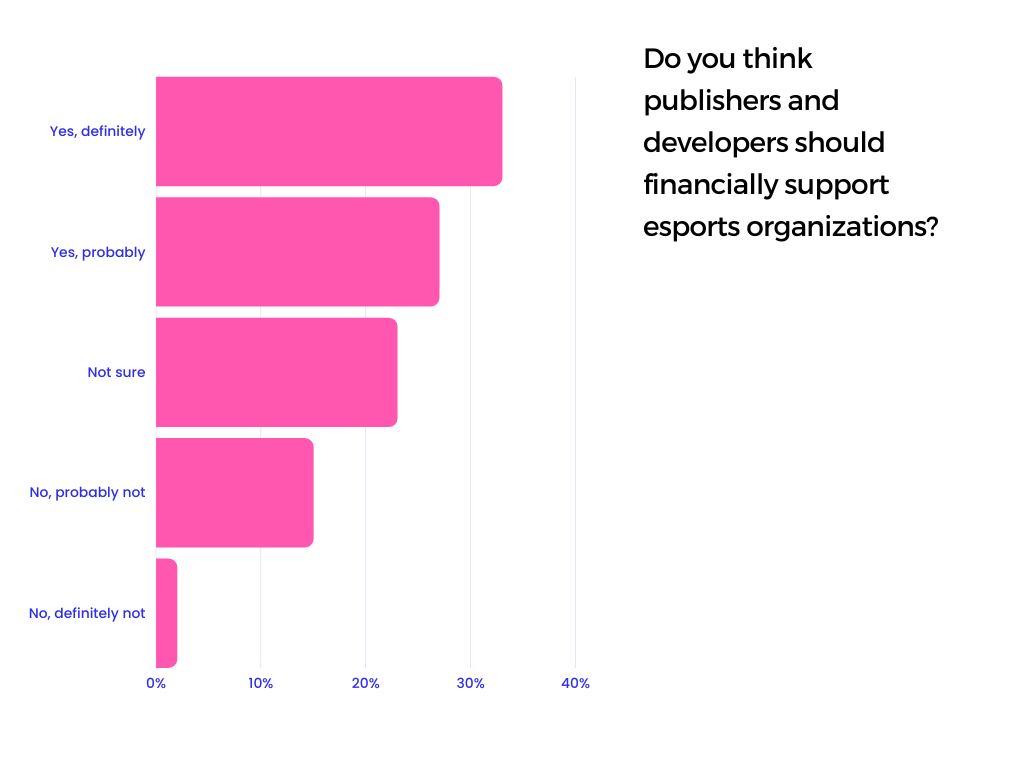

Most esports industry leaders think publishers should financially support teams

60 percent of respondents said they believed esports game publishers should financially support esports organizations — and they have ample reason to believe so. Over the past few years, as major esports game developers such as Activision Blizzard, Riot Games and Valve continue to churn out the profits, it’s become clear that the primary value of competitive gaming is to generate interest in premium game sales and in-game purchases, making esports essentially a very effective marketing tool for game developers.

In 2023, esports organization leaders have wised up to this dynamic, and they no longer want to help provide the industry’s core product — high-level competitive gaming — without getting a cut of the proceeds, too. In conversations with Digiday and other publications this year, the need for publishers to more thoroughly share their esports profits with the teams has consistently been a major talking point among the leaders of esports teams.

“The feeling about esports right now has certainly been that it’s kind of a loss-leader for larger organizations,” Caploe said. “So perhaps there’s a sentiment running through that it still serves a function, but maybe not the function we thought — and, frankly, maybe not yet.”

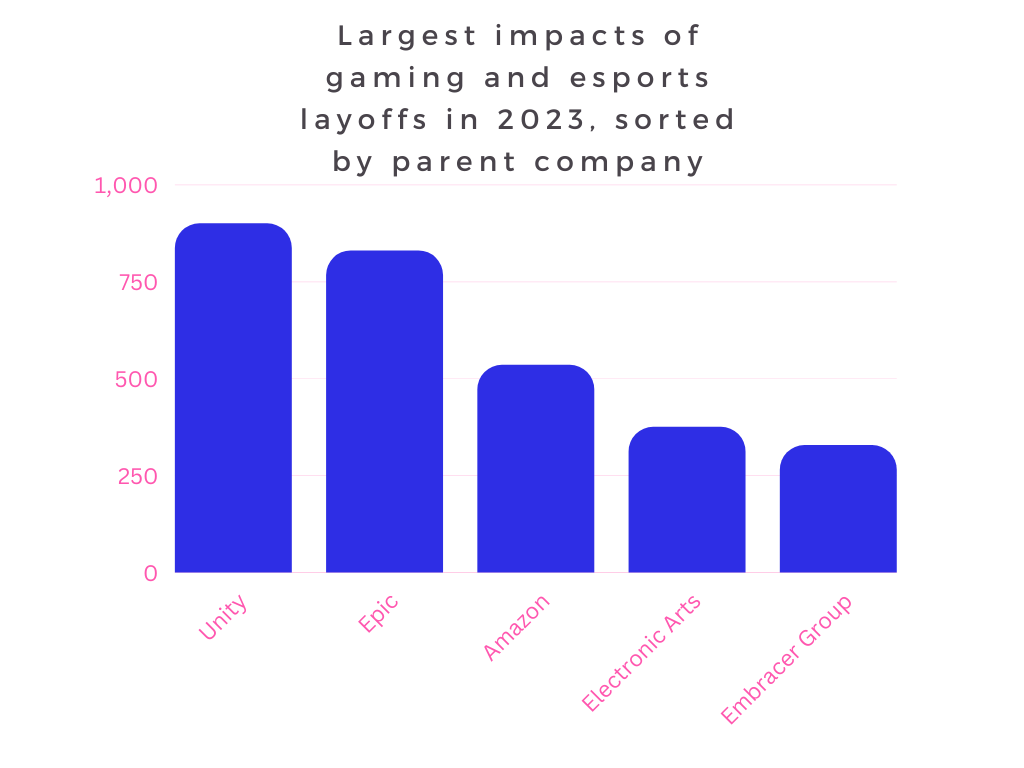

Bonus data: Layoffs have gutted the gaming and esports industries in 2023

Executives and business leaders within the esports space might still be feeling optimistic, but there’s no denying that the past 12 months have been brutal for rank-and-file workers in the industry. Data from videogamelayoffs.com shows that an estimated total of 6,400 workers in the gaming and esports industries have lost their jobs over the past year, with the bulk of those coming from major corporate game developers such as Unity and Epic Games. It’s possible that the future is still bright for the esports industry — but actually working in the industry in 2023 can still feel like a gamble, executives’ positive outlook notwithstanding.

More in Marketing

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.

Yahoo pauses IAB membership amid a series of quiet cost-saving measures

Yahoo pulls IAB board memberships, following job cuts as PE-owner reportedly reconsiders ad tech investments.

Target looks to e-commerce, advertising investments to help grow the business

Technology is one of the most important areas in which Target will invest with the hopes of returning to profit growth.