Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

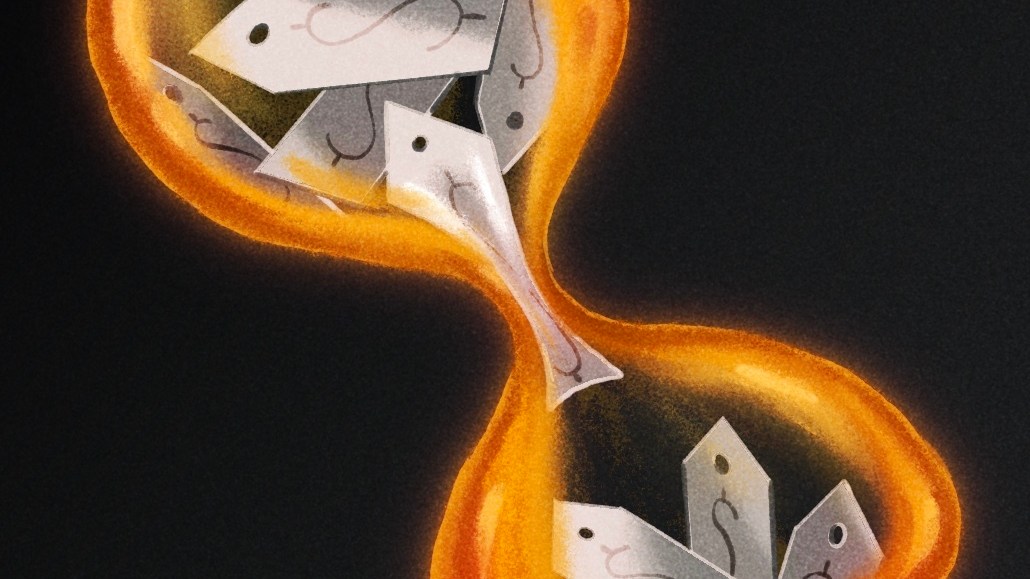

The Home Depot rebrands its retail media network in pitch for ad dollars

Retail media networks are increasingly taking a page out of major media players’ playbook, hosting upfront-style pitches to advertisers, looking to locking in ad dollars sooner rather than later.

On Thursday, The Home Depot hosted its inaugural InFront, a play on upfront negotiations or digital media’s affair the NewFronts, to tout its retail media offering.

Hosted at its Atlanta headquarters, The Home Depot pitched a rebrand to its retail media network from Retail Media+ to Orange Apron Media, a new partnership with Univision to open up more media placement opportunities and a new in-store advertising offering. The retailer brought executives, including Ted Decker, chair, president and CEO of The Home Depot along with Melanie Babcock, vp of Orange Apron Media (formerly Retail Media+) and monetization team, Molly Battin, svp and CMO onstage.

Even before the doors to the event opened, Babcock told Digiday anecdotally that she’d been in talks with media buyers and suppliers looking to ink deals with the retailer’s revamped offering. (She did not disclose said media buyers nor suppliers.)

“It’s very important for our supplier, marketing teams and agencies to meet our marketing leaders,” Babcock told Digiday. “If you’re a retail media network and you don’t think that that piece is important to your supplier, you’re missing the boat.”

The home improvement store has been banking on its specialty retailer status to stand out in a crowded marketplace, but isn’t resting on its laurels. After nearly five years in business, it’s a chance to show that retail media is growing up and out, and The Home Depot intends to position itself as a top contender in for a bigger share of ad dollars.

“For me, what it says very loudly is that this is an important product and an important platform and an important revenue stream for Home Depot,” said Jennifer Kohl, chief media officer at VML ad agency, ahead of the event. “The whole idea of upfronts way back when was really to get advertisers to commit money in advance of the new seasons and then NewFronts came into play.”

To agency executives, it’s a case of history repeating itself. Recall the early days of Google, Meta, Hulu, Spotify and others starting NewFronts a decade ago to get in front of CMOs, media buyers and other marketing execs before budgets are finalized for the fiscal year. Of course, retailers like Amazon, Walmart and Kroger have a similar playbook, either hosting invite-only summits or aligning themselves with traditional upfronts.

“It’s less about creating an upfront marketplace and more about capturing the mindshare of CMOs at the right time of the year and being seen as a strategic growth platform versus one of many experimental vendors,” Craig Atkinson, CEO at Code3 digital agency, said in an email.

To Kohl, it makes sense that retailers are starting to carve out space for themselves as momentum (and spend) around retail media grows. Retail media is expected to make up one-fifth of the world’s digital ad spend this year, reaching more than $140 billion, per eMarketer. That figure is significantly higher than the $115 billion forecasted last year.

There’s an influx of retail media networks, with everyone from Walmart Connect to Wawa convenience store throwing their hat in the ring. Notably, these players are moving to take in brand dollars, opening up media placements in brand marketing channels like streaming. Hence, Orange Apron Media’s partnership with Univision, its in-store display ads, even or Walmart’s acquisition of Vizio.

During the event, Decker said The Home Depot wasn’t after trade dollars, or spend dedicated to supply chain partners. Instead, the retailer is going after brand dollars, or marketing spend. “This business is being built for your marketing dollars,” he told the audience.

All of the growth has made for a fragmented marketplace, leaving brands and their agency partners grappling with where to best invest their ad dollars.

By hosting an InFront, as The Home Depot calls it, the retailer tried to drum up earned media and press buzz. But perhaps more importantly, it sets the retailer up to be top of mind for media buyers when it’s time to divvy up ad dollars around upfront negotiations, digital media players at NewFronts or PlayFronts in the gaming space.

The retailer also touted new influencer partnerships and Studio Orange, an 18-acre production facility for content creation.

Agency execs say they expect more pitching events like this to continue as retail media networks grow and mature. Given it’s a subset of digital, it’s unclear if it’ll create a wholly new category of advertising outside of digital, said Atkinson. Still, it’s no doubt retail media is growing and standardized industry events speak to said growth.

“If you have the show, they’ll get some of this attention,” said Kohl. “They want more impressions out there about their offering so that planners and buyers and brands are sitting up and taking notice, so that when the ad dollars are being distributed, that this is at least a place where it would make sense.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.