Last chance to save on Digiday Publishing Summit passes is February 9

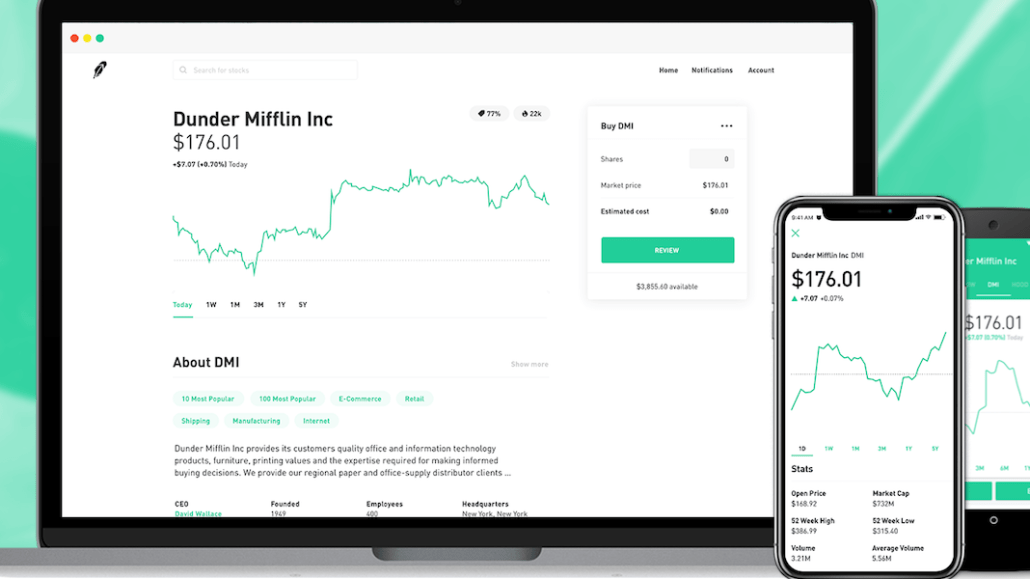

Robinhood is bringing investing under the social finance umbrella.

The company behind the popular trading app launched a web platform Wednesday to help to deliver the second part of its mission to make stock trading accessible to everyday people: help them make more informed decisions. It’s adding tools, features and information on other users’ activity that makes the experience feel more like a social network.

Robinhood, which launched in 2013, says it has crossed 3 million users as of Wednesday and more than $100 billion in transaction volume with about 100 employees, according to co-CEO Baiju Bhatt. By comparison, the 42-year-old TD Ameritrade has 11 million funded accounts and more than 10,000 employees as of this September; E-Trade, 35 years old, reported 3.5 million accounts by the end of last year with some 3,600 employees. Robinhood users have saved more than $1 billion in commission fees (typically $7 per transaction) using the fee-free app, Bhatt said.

More in Marketing

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.

Programmatic is drawing more brands to this year’s Winter Olympics

Widening programmatic access to streaming coverage of the Milan-Cortina Games is enabling smaller advertisers to get their feet in the door.