Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Rent the Runway is gaining speed to take on industry competitors from Amazon to Zara.

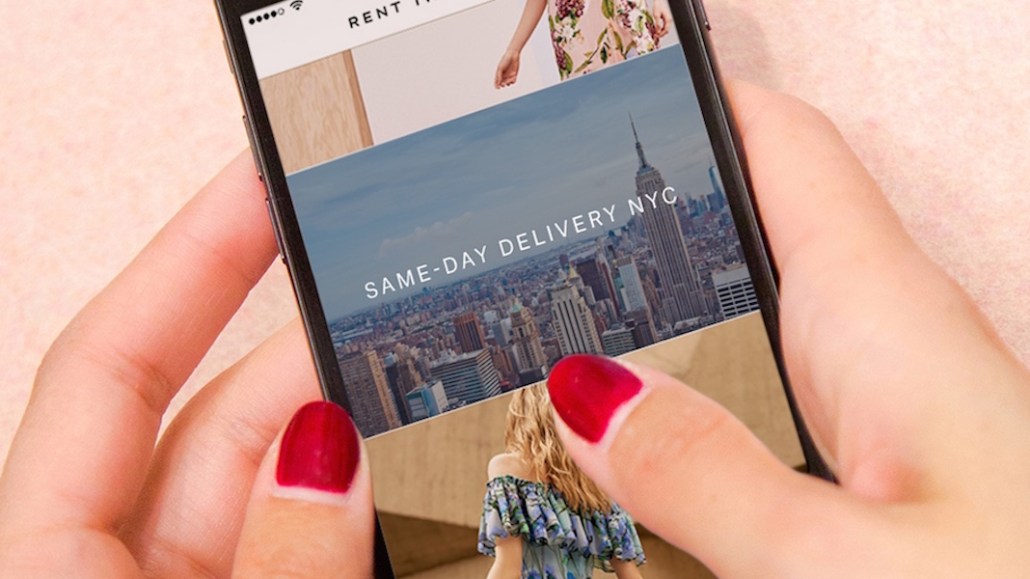

The company, which rents one-time occasion wear as well as everyday items by subscription, rolled out a same-day delivery service last week that guarantees orders placed by noon will arrive by 5 p.m. The service is currently available only in New York City, but Rent the Runway plans to expand it to new cities based on demand.

“We can’t scale if we’re not meeting the customer where she is,” said Rent the Runway CEO and co-founder Jennifer Hyman. “And when customer expectation has now moved to on-demand, we have to expand our logistics to cater to that. The idea of planning in advance doesn’t really exist for our customers.”

Rent the Runway isn’t about to become the next Amazon. But in order to grow its customer base, and particularly, its Unlimited subscription service, it has to maintain a similar breakneck speed to the retail giant. Amazon has conditioned its Prime customers to receive online shipments in two days or less. Rent the Runway doesn’t disclose its number of Unlimited subscribers, but in 2016, it hit $100 million in revenue reportedly thanks to its launch of the membership model, according to company figures, and Unlimited generates Rent the Runway $1,700 a year per member.

“This isn’t Rent the Runway comparing itself to Amazon out of the blue,” said Nicole Ferry, the executive director of strategy at the marketing agency Sullivan. “They’re responding to a clear shift in customer behavior and expectations, and to grow, they need to be more relevant.”

Rent the Runway saw in its internal data that the window between when customers booked orders and when they wanted them delivered was narrowing. In Rent the Runway’s five retail stores, customers are taking advantage of last-minute orders already: according to the company, 30 percent of store orders are made to be worn that day.

Hyman hopes that the convenience of same-day delivery could replace a trip to Zara or one of its fast-fashion counterpoints, where customers flock for quick, trendy closet pick-me-ups.

“We’re aiming to pull off what we consider to be the ‘ultimate convenience’: Designer clothing at the same price as something from Zara, on demand. It’s essentially a never-ending closet,” said Hyman. “We want women to think about Rent the Runway in the same way you think about going to Zara or H&M for a new piece.”

To be able to guarantee same-day deliveries in New York, Rent the Runway’s biggest market, it had to consolidate the in-house technology that processes typical rentals and returns. Hyman said that right now, Rent the Runway can turn around more than 100,000 items a day, a process that involves taking a returned dress or clothing item, dry cleaning it, taking care of any repairs, and then shipping it out to the next renter. However, the deadline for those orders was 8 or 9 p.m. To ensure that orders would arrive before 5 p.m., the company hired a special same-day operations team of five people who crunch the logistics into a smaller timeframe. The company is using RFID tagging to get clarity on where inventory was within its system, making it easier to source items from the New York Rent the Runway store, warehouse or showroom and get it out the door faster.

The service will also increase the amount of information it’s able to share with its brands, particularly around what styles are moving faster thanks to same-day shipping. In the past, designers have used Rent the Runway customer insight to inform design decisions, particularly with the company’s millennial demographic in mind.

“We encourage our designers to come in to a store at 6 p.m. on a weeknight and see the inventory that people are demanding same day,” said Hyman. “It’s a fascinating experience to see that physical retail isn’t dead — if you’re giving the customer the immediate experience for the price that she wants, she’ll show up.”

If same-day delivery takes off in New York, Hyman said that the company would also consider expanding its retail store network in order to support the service. Rent the Runway is also moving into traditional retail with a new “Keep It Forever” model that sells pieces that are about to be pulled off the site to customers at a discounted price.

“Right now, we continue to see the decline of the department store and full-price retail alongside the growth of those off-price stores like T.J. Maxx and fast fashion brands,” said Hyman. “What the customer is indicating is that she wants trends and variety at a cheap price, and she wants it on demand.”

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.