Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Pitch deck: Amazon instructs advertisers to spend amid Trump’s tariff turmoil

This article is part of an ongoing series for Digiday+ members to gain access to how platforms and brands are pitching advertisers. More from the series →

When the economy wobbles, most marketers ease off the gas. Amazon is telling them to floor it — on its ads, naturally.

It’s a predictable pitch from a media owner. But Amazon isn’t just any seller of ad space. It can draw a straight line from impression to impact — be it a sale or a sentiment shift. That’s compelling in any climate but especially when every marketing dollar has to prove its worth.

“The depth of Amazon’s customer data and its massive scale and reach are substantial advantages in this environment,” said Sky Canaves, principal analyst, retail and e-commerce at eMarketer.

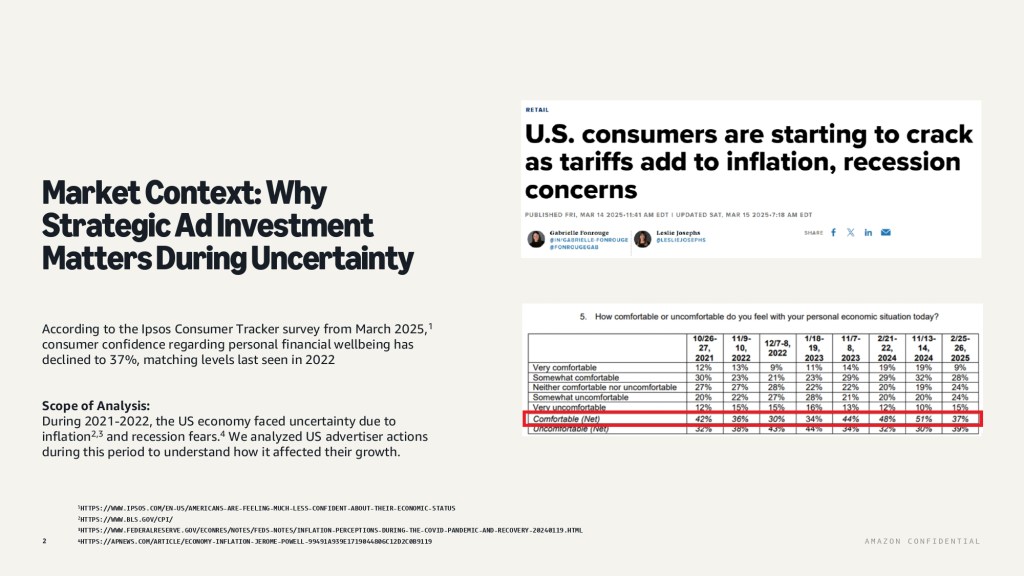

Amazon execs have been reiterating that message in recent meetings with marketers, armed with fresh data from Ipsos’ March Consumer Tracker, according to an April 2025 pitch deck shared with Digiday. According to the survey, consumer confidence in their financial wellbeing has dipped to 37% — right where it was in 2022, when inflation and recession fears were peaking.

Marketers then faced the same fork in the road they’re at now: pull back on brand-building and invest in short-term performance plays like discounts. Many did, and in hindsight, many lost. There’s now plenty of data showing that staying the course through the chaos paid off.

Amazon’s betting that marketers remember the lesson. But just in case they don’t, its execs are more than happy to jog their memory. The pitch deck lays it out plainly: brands that cut upper and mid-funnel ad spend in 2022 saw customer growth drop 5% year over year, whereas those that increased it grew by 14%. The contrast is ever sharper when it comes to those brands that went completely dark on upper and mid-funnel advertising — they saw sales slump 9% while those that stayed the course saw growth surge 10%.

It might sound counterintuitive for a company built on performance dollars to push brand-building. But in Amazon’s playbook, it’s perfectly on message. The idea that ads don’t just convert — they compound — has been a central part of its pitch since it launched ads on its streaming service over a year ago.

No surprise then, that Amazon’s putting serious muscle behind touting the value of streaming TV. When the stakes are high and the purse strings are tight, it’s not just about clicks for marketers — it’s about staying relevant.

When trying to acquire new customers during a period of uncertainty, the deck states that brands that didn’t use upper funnel video ads only saw 6% year-over-year new-to-brand customer growth in 2022, compared to the 17% year-over-year increase seen by those that did use upper funnel video ads.

Amazon emphasized the message by using automotive brands that had invested in Fire TV.

In 2022, auto brands that only combined display and fire tablet relative to those that only used display ads saw 1.3 times higher click-through rates. But even better were those brands that combined display, fire and video ads, as they saw 12 times higher click-through rates.

Amazon is trying to emphasize that brand and performance shouldn’t be treated as rival strategies, but complementary forces. When calibrated correctly, they don’t compete, but compound.

Brands that invested in both ads and retail promotions saw 1.3 times higher lift in purchase compared to those that relied only on retail promos, according to the deck. Amazon’s clarity — and its ability to tie it all back to results — may be its sharpest tool as it angles to grab a bigger slice of the full-funnel pie.

These examples are likely even more relevant now given the global tariff situation, which will likely pave the way for sales and ad spend to shift between markets, while Amazon remains a steady destination. And that’s because ad buyers on Amazon are roughly split 50:50 between Chinese and non-Chinese sellers.

“Other direct-from-China platforms will be impacted more than Amazon from the dual impact of tariffs and the end of the de minimis exemption,” said Claire Holubowskyj, senior research analyst at Enders Analysis. “This advantages Amazon by leveling out the other platforms’ price advantage, and shifting the momentum back towards Amazon’s USPs of fast delivery and enormously sticky Prime membership.”

And unsurprisingly, Amazon’s DSP — which is overseen by the same team driving this pitch — is key to those efforts.

“Amazon’s investments in expanding and streamlining its DSP have been paying off and it’s poised to capture more interest from advertisers looking to run targeted campaigns across channels,” Canaves said.

Still, the key factor isn’t so much that Amazon can sell ads through their DSP, but rather that they have designed their platform to make advertising a necessary cost of doing business, added Holubowskyj.

“The commodified nature of goods on the platform make advertising essential for visibility: pulling back on spend due to broader uncertainty simply isn’t an option for sellers that want to continue selling on Amazon,” she explained. “And selling elsewhere is a difficult proposition as most sellers have optimised for the platform and lack brand recognition.”

To view the full pitch deck, click below:

Amazon didn’t immediately return Digiday’s request for comment.

More in Marketing

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.